With the 2025 holiday season is just around the corner, investors may want to consider investing in Amazon (AMZN). That’s because, according to Adobe Analytics, online spending is expected to jump about 5.3% this year to $253.4 billion.

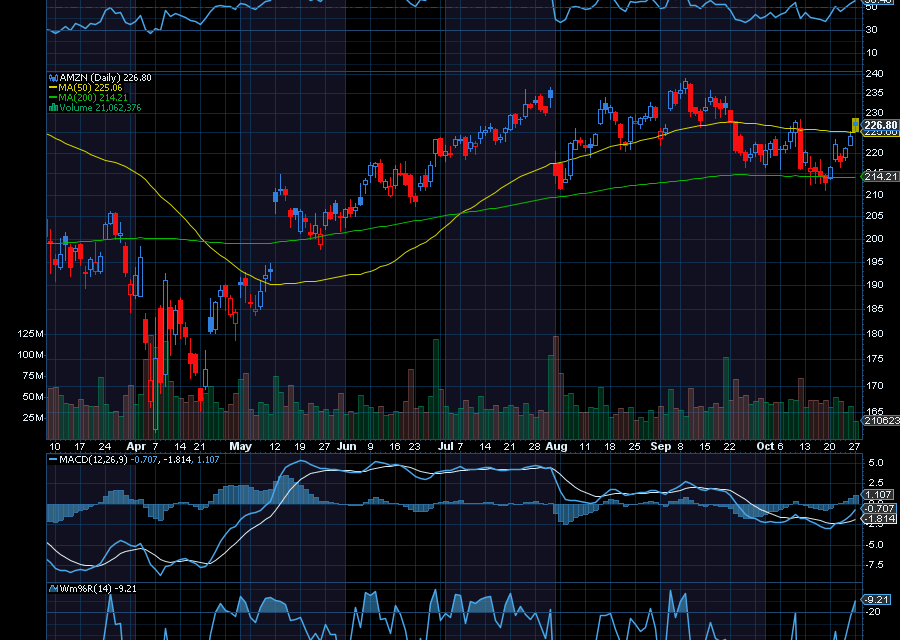

Amazon (AMZN)

In most years, Amazon is a no-brainer stock to buy and hold for the holiday rush. In fact, with the exception of 2022, the ecommerce giant has historically pushed higher heading into the holidays, which we expect to happen again this year.

After finding strong support at around $214, AMZN is now back to $227.51.

As we near the holidays, we’d like to see the ecommerce giant challenge its prior high at around $238.85 near term. Longer term, we’d like to see AMZN at $250 a share.

In addition, analysts at KeyBanc Capital say Amazon should benefit from the AI boom. The analysts say Amazon’s AWS is still growing strong. It also believes that the ramp of gigawatt data center clusters and customers like Anthropic are potential drivers of revenue acceleration into 2026. The analysts have an overweight rating on AMZN with a $300 price target.

Amplify Online Retail ETF (IBUY)

With an expense ratio of 0.65%, the Amplify Online Retail ETF should benefit from an expected surge in e-commerce spending, especially with holdings in Affirm Holdings (SYM: AFRM), Amazon, BigCommerce Holdings, Apple, and Netflix.

The ETF tracks the EQM Online Retail Index, whose holdings derive at least 70% of revenues, or a minimum of $100 billion in annual sales from online and/or virtual sales.

After finding strong support at around $72, the IBUY ETF is now back to $75.64. From here, we’d like to see it rally back to its prior high at about $79 a share.

Direxion Daily AMZN Bull 1.5x Shares (AMZU)

The Direxion Daily AMZN Bull 1.5x Shares is another interesting opportunity. With an expense ratio of 1.06%, this ETF offers single-stock exposure to Amazon. With this one, the fund seeks 150% daily leveraged investment results.

Since finding support at $32, the AMZU ETF rallied back to $36.84. From here, we’d like to see it rally back to $42 a share initially.

Sincerely,

Ian Cooper

Recent Comments