After a slight pullback, gold prices are reversing course.

With investors running to the safe haven, coupled with global central bank buying, gold could test $4,500 shortly. At the moment, gold is back to $4,140.93, up about $90 on the day.

“The yellow metal’s underlying supply-and-demand dynamics remain solid — even at ‘significantly overbought’ levels in the short term, wrote analysts at Lombard Odier, a Swiss private bank,” as noted by Business Insider.

In addition, as reported by CNBC, “Industry experts say there is still room for gold to to run. ‘We are now aiming for $5,000 in 2026. If it continues on its current path, it could reach $10,000 before the end of the decade,’ Ed Yardeni, president of Yardeni Research said.”

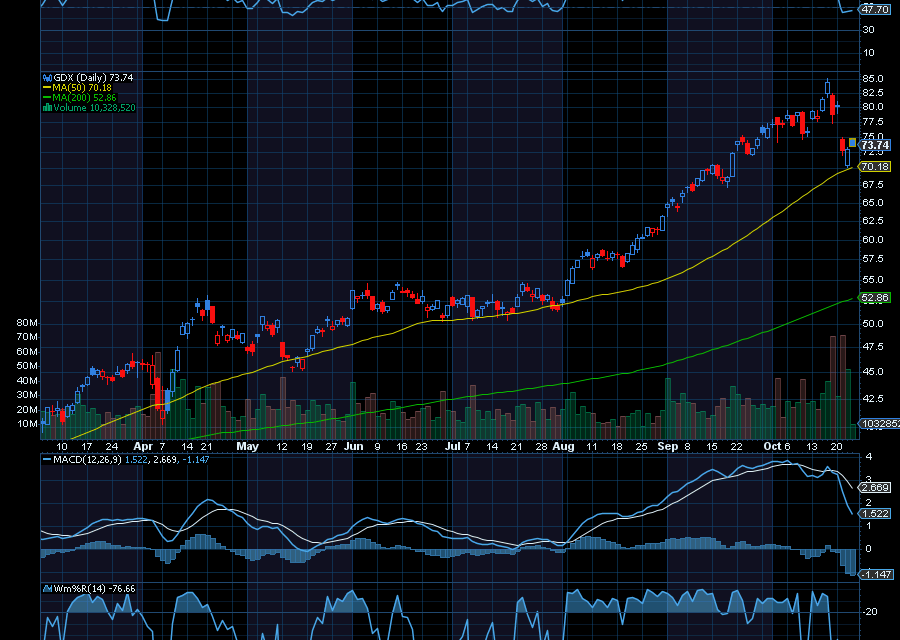

One way to trade the pivot higher in gold is by buying into a gold ETF, such as the VanEck Vectors Gold Miners ETF (GDX). With it, not only can you gain access to some of the biggest gold stocks in the world, you can do so at less cost.

With an expense ratio of 0.51%, the ETF holds positions in Newmont Corp., Barrick Gold, Franco-Nevada, Agnico Eagle Mines, Gold Fields, and Wheaton Precious Metals to name a few.

Even better, shares of mining stocks often outperform the price of gold. That’s because higher gold prices can result in increased profit margins and free cash flow for gold miners. In addition, top gold miners often have limited exposure to riskier mining projects.

Sincerely,

Ian Cooper

Recent Comments