Just weeks ago, gold just hit a new record high above $4,381.

All thanks to geopolitical and economic uncertainty, the government shutdown, expectations for more interest rate cuts, and central bank buying.

Now back to $4,001, gold’s pullback may be another buy opportunity.

Granted, the trade war is cooling. The US dollar is firming. And geopolitical issues are cooling off, at least for now. But there are still plenty of issues that could send investors right back into the safe havens of gold, including boiling, explosive tensions with Russia and Ukraine. Plus, central banks are still buying. There’s still plenty of geopolitical and economic uncertainty.

In addition, according to Morgan Stanley, central bank demand and lingering uncertainties could send gold to $4,500 by mid-2026. JPMorgan says gold could rally to $5,055 by the fourth quarter of 2026. Goldman Sachs believes gold could rally to $4,044 by the first quarter of 2026, and possibly to a high of $5,055 by late next year.

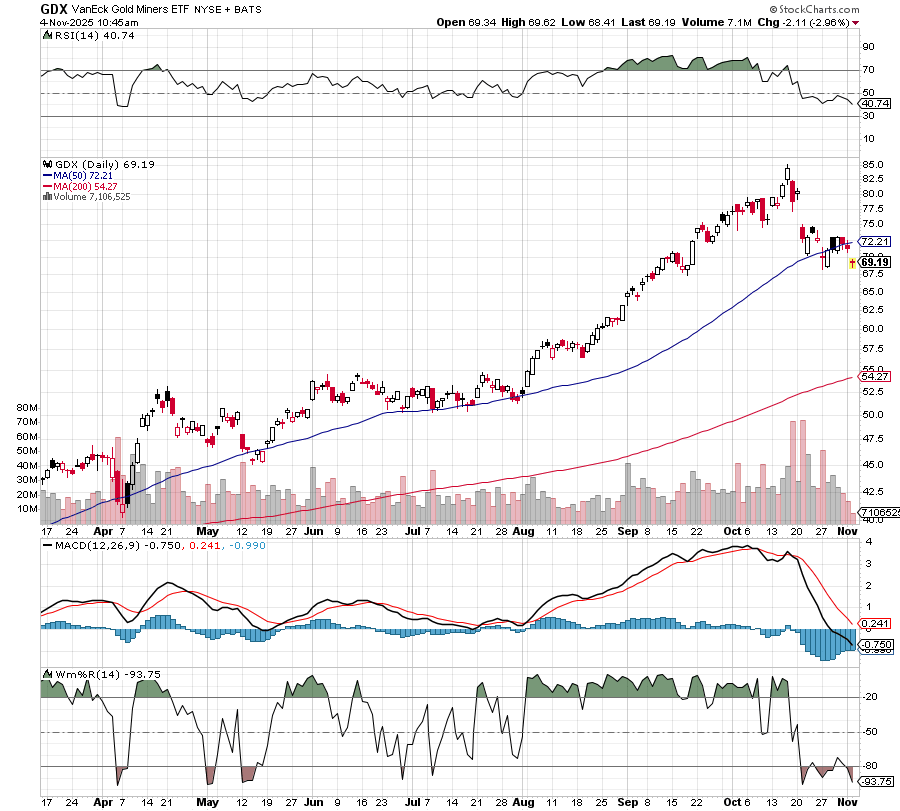

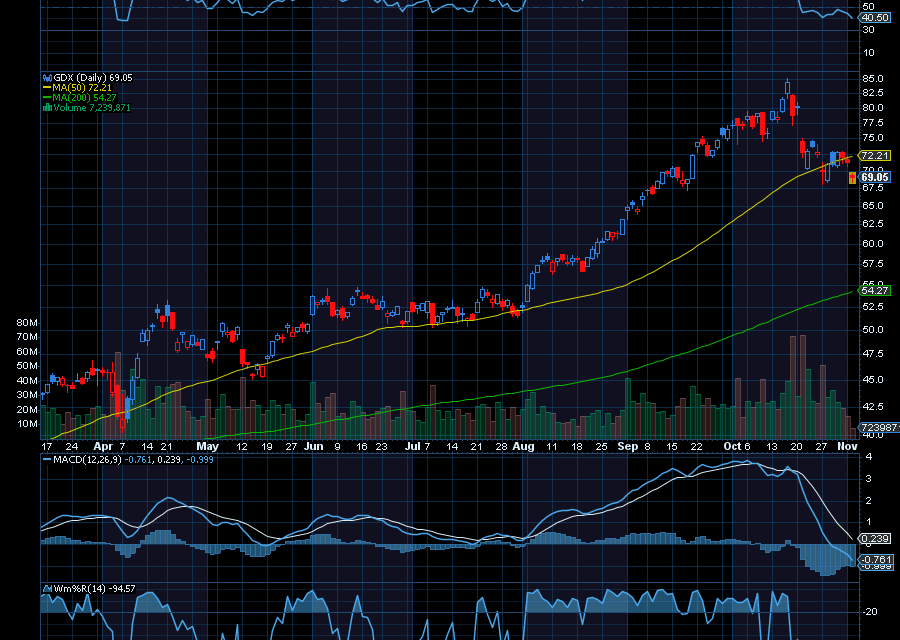

That being said, use weakness as an opportunity with the VanEck Vectors Gold Miners ETF

One of the best ways to diversify at less cost is with an ETF, such as the VanEck Vectors Gold Miners ETF (GDX). Not only can you gain access to some of the biggest gold stocks in the world, you can do so at less cost.

With an expense ratio of 0.51%, the ETF holds positions in Newmont Corp., Barrick Gold, Franco-Nevada, Agnico Eagle Mines, Gold Fields, and Wheaton Precious Metals to name a few.

Even better, shares of mining stocks often outperform the price of gold. That’s because higher gold prices can result in increased profit margins and free cash flow for gold miners. In addition, top gold miners often have limited exposure to riskier mining projects.

Sincerely,

Ian Cooper

Recent Comments