Over the last few days, the Volatility Index (VIX) spiked to a high of 60.13 on trade war concerns.

Since then, the VIX pulled back to 18.6 with tariff tensions cooling between the U.S. and China with a 90-day agreement in place. But it may be about to spike again on uncertainty.

What follows that 90 days is any one’s best guess.

And retailers like Walmart could be forced to raise prices.

In fact, Walmart can’t absorb all the pressure from tariffs, noting:

“We will do our best to keep our prices as low as possible but given the magnitude of the tariffs, even at the reduced levels announced this week, we aren’t able to absorb all the pressure given the reality of narrow retail margins,” Walmart CEO Doug McMillon said.

After all, about a third of Walmart’s spending goes into products made outside of the U.S., including China, which raises its cost. In addition to the potential for higher prices, we also have to consider that many Americans are starting to cut back on spending. All thanks to economic uncertainty and elevated inflation.

Walmart is the first major US retailer to report financial results this quarter. It’s also one of the first that can provide a hint as to the mood of consumers and the impact of tariffs.

If uncertainty persists after the 90-day agreement between the US and China, an intensifying trade war could have severe negative impacts on retailers and consumers.

All of which could send volatility screaming higher again.

One way to trade the potential for higher volatility is with ETFs such as:

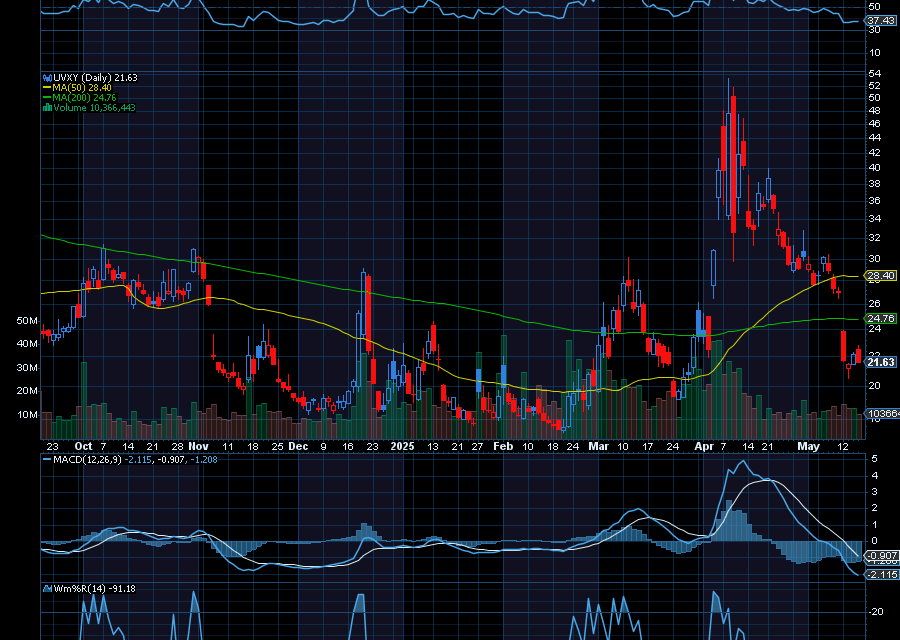

ProShares Ultra VIX Short-Term Futures ETF (UVXY) — The ETF was designed to match two times (2x) the daily performance of the S&P 500 VIX Short-Term Futures Index. When the VIX pops, the UVXY typically follows.

iPath S&P 500 VIX Short-Term Futures (VXX) — The VXX ETN provides exposure to the S&P 500 VIX Short-Term Futures Index.

ProShares VIX Short-Term Futures ETF (VIXY) — ProShares VIX Short-Term Futures ETF provides long exposure to the S&P 500 VIX Short-Term Futures Index, which measures the returns of a portfolio of monthly VIX futures contracts with a weighted average of one month to expiration

Sincerely,

Ian Cooper

Recent Comments