Markets got whipsawed by tariff news as the Greenland “conversation” escalates, and that’s causing great uncertainty for investors and traders alike.

In moments of uncertainty, I look for a signal from a reliable source that helps me filter through the noise. Trying to aggressively buy the dip might work, but it might not. I prefer something reliable and predictable in times like this, so I am looking for a potential trade in something stable and less impacted by the Greenland fundamental news.

For me, that means I look back at the Stock Forecast Toolbox to see what ideas look reasonable without feeling like I’m chasing or fighting the noise..

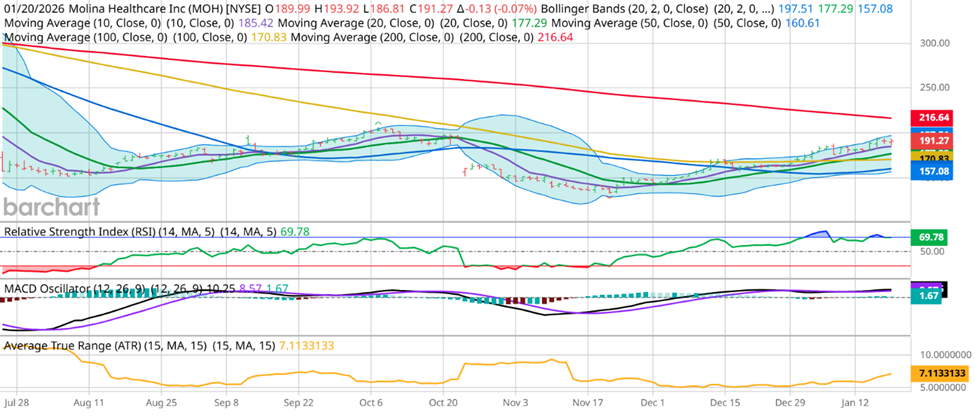

One name caught my eye because of its much more stable bullish behavior, and that’s MOH:

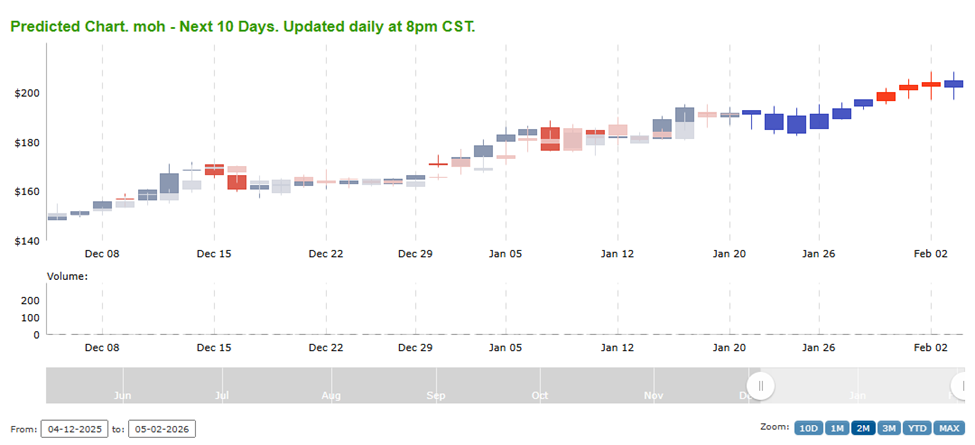

On top of a generally bullish chart, this stock in the healthcare sector had almost no impact from the Greenland geopolitical situation. I also like the way the forecast toolbox is projecting its behavior in the near term:

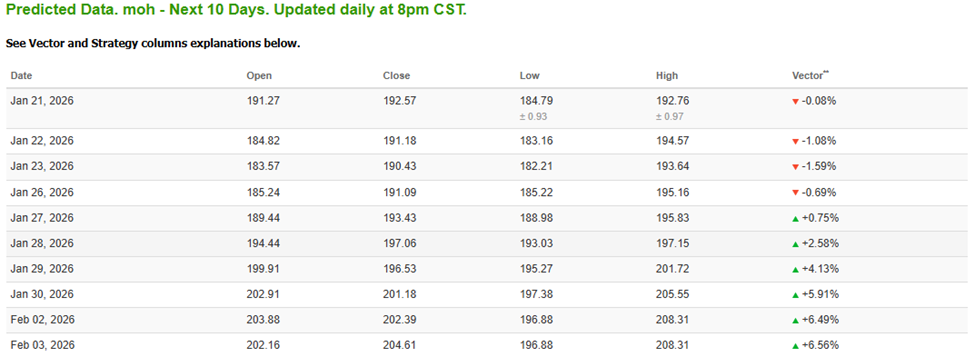

Looking at the AI projected move over the next 2 weeks, the model is projecting a target high of $208.31, with a rally to around $205. This sets up well for a call vertical that can ride with the trend and leverage the move. The February 20th, 2026 $195/$210 Call Vertical is currently valued at $5.40, and with a rally to $205, the projected value would be approximately $8.00. If this plays out the way the model expects, I would be looking at a nearly 50% return on an options trade with a nearly 7% move in the stock, which is an exciting, leveraged return, and that’s why I love using the forecast toolbox to help me identify these opportunities!

If you’d like to get your hands on the Stock Forecast Toolbox and see what it can do for you, you can access a free trial HERE.

And if you have any questions, never hesitate to reach out.

Keith Harwood

Keith@OptionHotline.com

Recent Comments