Macroeconomic news– like Unemployment, Gross Domestic Product, and the Balance of Trade — has a dramatic effect on the currency markets.

And the government reports this key data at regularly scheduled times, with news outlets like CNBC, Bloomberg, and Reuters making it immediately available to everyone at once.

Then, for the next thirty minutes the market bounces up and down like crazy while the world tries to sort out what the numbers mean.

There is an incredible amount of news from which to seek your fortune.

Starting from the Beginning…

When and Where Is The Next Big Report?

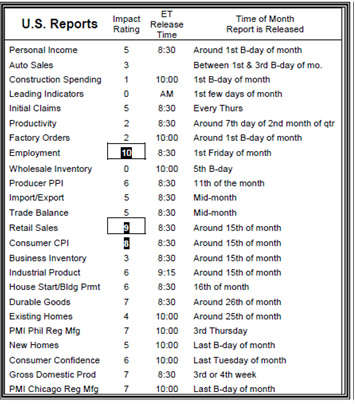

In the United States, there are twenty-four regularly scheduled economic reports released every month according to the following schedule….

Multiply the twenty-four reports listed above by eight currencies. Then add in the all-important interest rate announcements for each central bank. And you no longer wonder why the market gets so schizoid sometimes!

Relax. From a practical standpoint, only the highest rated reports are worth trading.

The most important announcements of all are monthly US Employment reports: Non-Farm Payroll and Unemployment.

Weekly Unemployment Claims, issued every Thursday, aren’t really very important… though some economic calendars rate them as high. But you can make a fortune off the monthly reports.

Interest rate announcements are also very critical. When the Fed talks, Forex shudders. In fact, all the Central Banks have a big influence on the currency markets.

The rest of the economic reports hold less or greater weight, depending on global circumstances at the time.

The Fundamental View

Now let’s take a closer look at a few of the more prominent reports and see how they affect the market.

It’s not hard to figure why Employment Reports are among the most important for every country. When more people have jobs, more money is spent in retail sales, which boosts corporate profits, so on and so forth.

In the US, the employment reports are prepared by the Bureau of Labor Statistics. And they are released on the first Friday of the month, at exactly 8:30am ET.

Non-Farm Payroll Up: Stock Market up, Dollar up

Non-Farm Payroll Down: Stock Market Down, Dollar down

Unemployment Rate Up: Stock market down, Dollar down

Unemployment Rate Down: Stock Market up, Dollar up

The quarterly Gross Domestic Product (GDP) provides the best overall view of economic activity. In the US, the GDP covering the previous quarter is released by the Commerce Department at 8:30am ET, on the last day of the quarter.

GDP Up: Stock Market up, Dollar up

GDP Down: Stock Market down, Dollar down

The Consumer Price Index (CPI) measures the retail price of a basket of goods and services, and indicates inflation. This report is released by the Bureau of Labor Statistics at 8:30am ET around the 15th of each month.

CPI Up: Stock Market Down, Dollar uncertain

CPI Down: Stock Market Up, Dollar uncertain

Prior to the release of every report, analysts from around the world publish a consensus of what they expect, and the market adjusts accordingly.

When the report is actually released, there is an immediate shock factor. And the market goes crazy.

Keep in mind, market reaction is entirely dependent on how the actual number compares with expectations. Even if the current report shows an improvement over the previous month, if it doesn’t meet expectations the market will react negatively. A better than expected number would cause a strengthening of the currency.

If the numbers come out exactly as expected, the market is likely to spike up and down, and then move sideways with a somewhat negative bias— adhering to the “buy the rumor, sell the news” phenomenon.

Recent Comments