Are we destined for a major problem in this market? With the government shutdown, the consistent narrative has been the negative impact on the economy while the investment community pushes the market to new highs. Something feels a bit off.

Maybe all this means is that the lack of economic data due to agencies like the Bureau of Labor Statistics being furloughed means we won’t give the reason for the FOMC to alter their course at the next meeting on October 29th. So, if they must cut rates, and money gets cheaper, then the market must go up.

Or maybe all of this is just noise amidst a market looking for long-term growth opportunities. Whatever the case may be, I need some answers, and the market behavior on Tuesday left more questions than answers after the morning turnaround in semi-conductors and broad tech stocks.

And if you know me, you know where I go when I’m looking for answers: the Forecast Toolbox!

I ran the screener. I looked for names with a strong forecasted price pattern. I checked the recent patterns and crossed out the setups that don’t fit my trading style. I narrowed the list down further to a handful of interesting names, and one in particular really stands out to me.

EQT Corporation is a vertically integrated natural gas company, and that’s an interesting sector concept for me. It also happens to be one of the lowest cost producers of natural gas in the United States. If you like the bull case for AI companies, you may be familiar with EQT already, not because it’s a big AI company on its own, but because AI needs power, and that means demand for natural gas. Let’s look at the chart for Natural Gas November 2025 futures:

It seems to me that a bottom is forming for Natural Gas futures here. That’s a good indication that there’s demand. And natural gas demand is good for EQT:

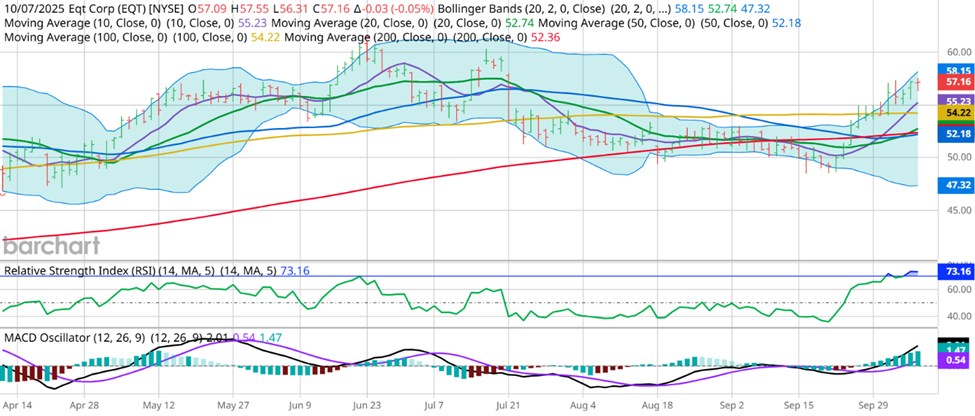

EQT is showing strength after bottoming out in mid-September, around the same time as the lows in Natural Gas.

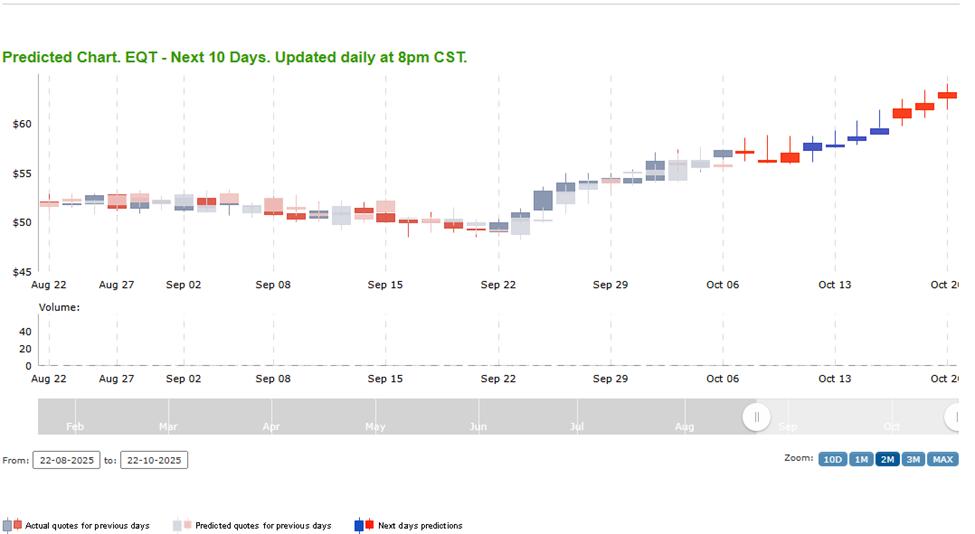

The correlation is there, and Natural Gas is recovering. The last confirming check for me is to see what the Forecast Toolbox thinks:

This looks like a winner to me. With earnings coming up on October 21st, I’ll focus on the options expiring on October 17th, and I’ll target a little less than the toolbox to be conservative. The toolbox prediction is $61.33, so I’ll go for a move to $60 or higher, and that lines up really nicely with a $57.50/$60 call spread, which is currently priced at $0.83. If EQT closes at $60 or higher on October 17th, that’ll achieve the max value of $2.50, so it gives me a nice potential 200% return on capital. That looks pretty solid to me in just under 2 weeks, and with the overall setup in Natural Gas, the bullish chart formation in EQT, and the confirming indicators from the toolbox, I see a lot of great potential here.

If you’d like to get your hands on the Stock Forecast Toolbox and see what it can do for you, you can access a free trial HERE.

And if you have any questions, never hesitate to reach out.

Keith Harwood

Keith@OptionHotline.com

Recent Comments