What to Watch for This Week

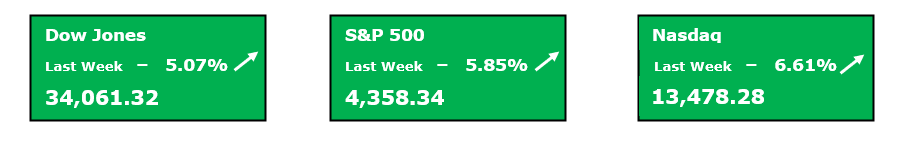

Last week’s explosive rally across the three major indices, was primarily spurred bya significant decline in U.S. treasury yields. This provided some much-needed relief for beaten down stocks. Should the pressure from high treasury yields continue to ease, expect this to be a boon for stocks. On Thursday morning we will get the weekly Initial Jobless Claims report. Additionally, this week the Fed’s latest Senior Loan Officer Survey will be made public.

- U.S. Treasury Yields – There were a number of factors that lead to last week’s major decline in U.S. Treasury Yields. The closely watched 10-Year U.S. Treasury experienced a 5.6% decline in it’s yield. This move placed the current yield at 4.57%, down from the mid-October highs of nearly 5%.

- Last week’s swing was an outsized move downward for typically less-volatile Treasury Yields. Should this be the beginning of a downward trend for Treasury Yields, it will likely provide a tailwind for stocks.

- Initial Jobless Claims – The Department of Labor provides a weekly report that records new Initial Jobless Claims in the U.S. Since peaking in mid-June, Initial Jobless Claims had been trending down until the Oct. 21st report, which signaled that jobless claims were beginning to tick back up. Last week’s Initial Jobless Claims came in 1.4% higher than expectations and 2.4% higher than the previous week. If Initial Jobless Claims continue to trend higher, this will put downward pressure on the U.S. Dollar & U.S. Treasury yields.

- Thursday’s report is expected to show 221,000 new jobless claims, a 1.8% increase week over week.

- Senior Loan Officer Survey (SLOOS)– Every quarter, the Federal Reserve surveys a large pool of Senior Loan Officers from large domestic & international banks. The purpose of the survey is to determine whether lending standards are generally loosening or tightening across a wide variety of the bank’s lending products. On Monday morning, the October SLOOS report will be revealed, showing investors where the bank’s current attitude is regarding lending.

- Given how dependent our economy is on credit, this survey can be a helpful tool in anticipating future economic activity based on the availability of credit.

Federal Reserve Watch

After last week’s FOMC meeting and policy decision, the Fed announced that they were maintaining the Fed Funds rate at its current target range between 5.25%-5.50%. They also communicated that they no longer have an additional hike penciled in for this year and for any future policy actions they will remain data dependent and make these decisions on a meeting-by-meeting basis. This week, we have a healthy dose of Fed speak queued up as there are numerous speaking engagements planned for various Fed members including Fed Chair Jerome Powell.

- This week’s Fed speak will allow the Fed members an opportunity to reiterate last week’s message. If they continue to cast doubt about future hikes, indicating that this hiking cycle is completed, this will be welcome news for the stock market. The next FOMC meeting is scheduled for December 13th, the last of the year.

- The CME Group now projects a 95.2% probability that at the next FOMC meeting the committee will opt to maintain the current target range between 5.25%-5.50%. Additionally, Fed Funds Futures indicate that investors believe that the Fed’s policy rate will remain paused through the end of the year, and they do not anticipate a rate cut until May or June of next year.

All About the Earnings

This week, the market will look to build off a mostly strong slate of earnings from the previous week. Investors will get the latest results from a group of large-cap drug-makers including VRTX & AZN. The Q3 earnings numbers for Walt Disney Corporation will be posted on Wednesday. Additionally, the markets will get to digest the most recent quarterly earnings results from a few newly public companies that had high-profile IPOs earlier this year.

- This week we will hear from more major pharmaceutical companies such as Vertex Pharmaceuticals Inc., AstraZeneca Plc, & Biogen Inc. are all due to report. Should VRTX report stronger than expected earnings and issue solid guidance for Q4, it is likely this stock will continue its strong YTD trend.

- VRTX earnings are expected to come in at $3.53 EPS.

- AZN earnings are expected to come in at $0.79 EPS.

- BIIB earnings are expected to come in at $3.97 EPS.

- After the bell on Wednesday, Walt Disney Company will report their Q3 earnings. The consensus estimates are that DIS will post their lowest quarterly earnings since Q3 of last year. Disney investors will be anxiously waiting to see if DIS can post an upside surprise and provide some clarity regarding the future of various segments of their business such as direct-to-consumer & media networks groups.

- DIS earnings are expected to come in at $0.68 EPS.

- A group of relative Wall St. newcomers are expected to report their third quarter earnings this week. In general, it has been a rocky start for this group of companies that earlier this year came public in notable IPOs. Investors in these various stocks will be keyed in to see if these companies can gain some traction in their post-earnings reaction.

- CAVA earnings are expected to come in at -$0.01 EPS.

- CART earnings are expected to come in at -$17.33 EPS.

- KVYO earnings are expected to come in at -$1.82 EPS.

Thank you for reading this week’s edition of the Weekly Market Periscope Newsletter, I hope you enjoyed it. Please lookout out for the next edition of the newsletter as we will give you a preview of the upcoming week’s important market events.

Thanks,

Blane Markham

Author, Weekly Market Periscope

Hughes Optioneering Team

Recent Comments