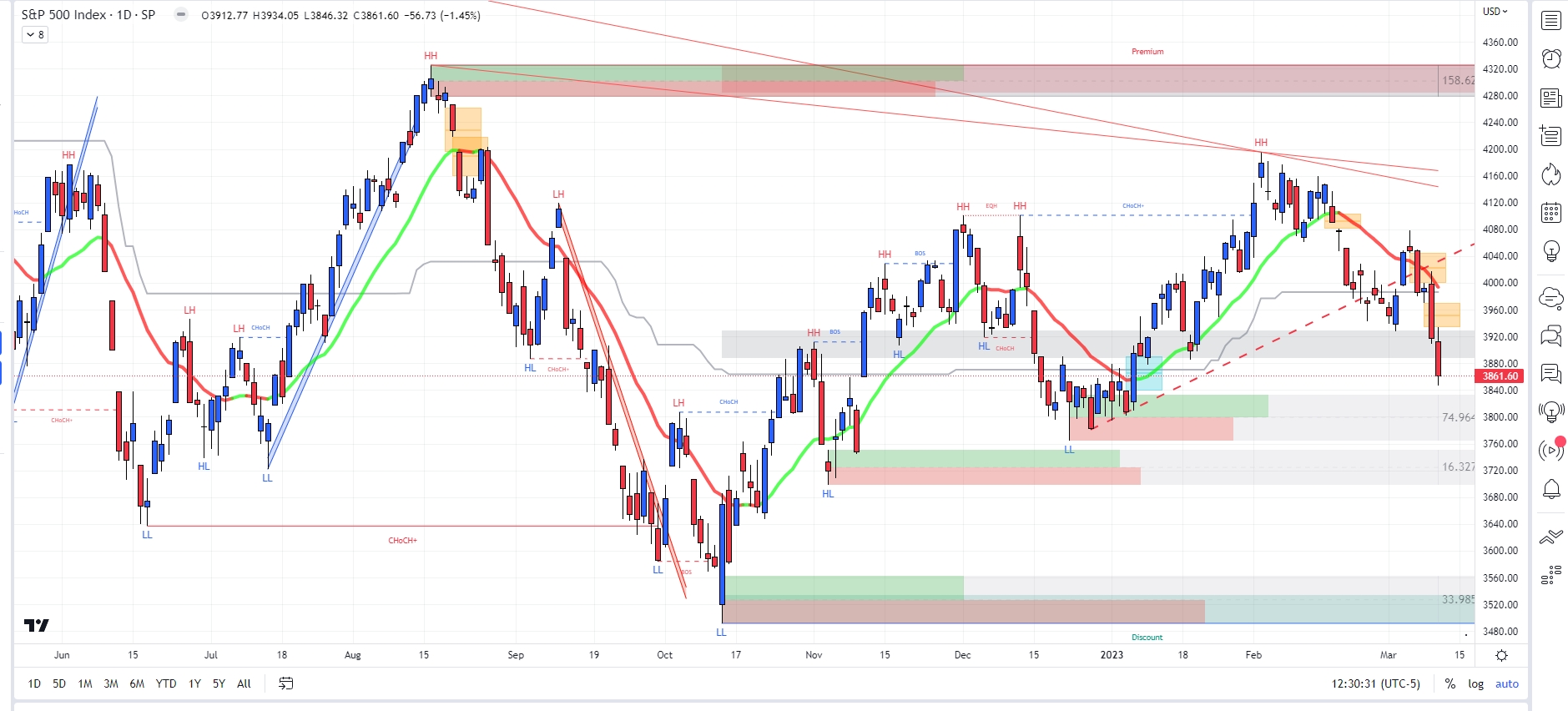

As discussed we were positioned for lower stock markets. The move down has thus far been swift. This means two things 1). a sharp short cover reversal is in sight 2) the amount of momentum generated to the downside means the bigger trend has strength, and except for aforementioned short cover rallies, it has established a solid down directional bias.

One way to take advantage of this is a spy calendar call spread. For example buy the May 19 370 call and sell the March 17 370 call against it. This is essentially a covered write with the May call taking the place of the stock.

Cover if the spy market moves to 370 as the spread will widen and you take profit. If the market doesn’t move toward 370 initially, then on expiry buy back the march 17 and sell another contract … say March 24 spy 370. You will sell the March 24 for more than you bought back the March 17 hence reducing the cost of the spread while you wait for the market to move lower and the spread to widen.

This is a more conservative strategy than straight puts, and much less dependent on exact timing, as a strategy to play for lower prices in the spy. We are using the strategy in Target Zone Trading.

Thanks,

Joe

Recent Comments