The market continues to chop, with a current setup back near the all-time highs.

With this, the market is setting up opportunities for a potential dip back to support or a breakout to highs, so it can be a bit tough to clearly see the best trading opportunities.

As always, especially when market behavior appears less certain, I use the AI-powered Forecast Toolbox!

Last week, it helped me identify an opportunity in UNH to sell a put credit spread, and that trade has worked well as the October 24th $350/$347.5 put credit spread dropped from $0.66 to $0.20. While there are still a few days left until that trade can achieve the full profit target, it’s time to find something new. And with UNH earnings next week that could cause large movement off a fundamental input, I’ll need to find a new stock.

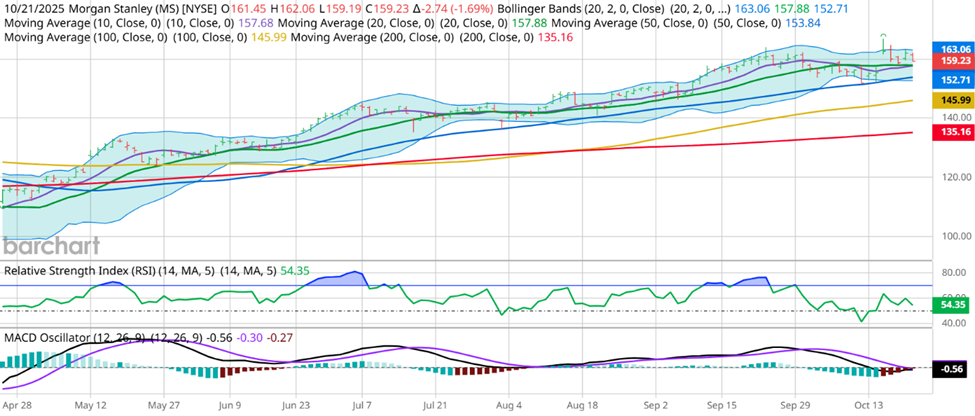

And with bullish earnings last week, it appears that Morgan Stanley (MS) has strong technical support with a possibility to grind higher:

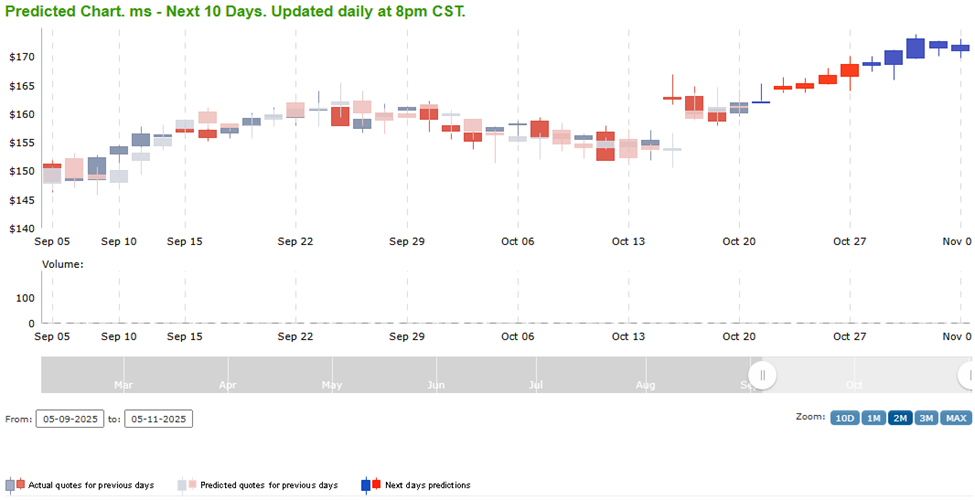

Along with this, MS has a strong forecast from the Forecast Toolbox, much like UNH did last week:

Once again, by combining the technical setup with the expectations from the Forecast Toolbox, I see a high probability of limited downside, and that is the type of setup that I continue to focus on put credit spreads, where I sell a put option and define my risk by simultaneously buying a lower strike put option with the same expiration date. In this case, $155 looks like a strong floor – it’s lower than the projected ranges for the next 2 weeks in the Toolbox and it’s below the 20-Day Moving Average.

In this case, I can execute a trade via the October 31st $155/$352.5 put credit spread, currently priced at $0.60. The max value of this spread is $2.50, so my risk in this case is $1.90. If the 20-Day Moving Average holds and the low of the expected range of the toolbox is right, that’s a potential 31.6% return on risk in 10 days. That’s another great return setup, and as a reminder these are the types of trades that compound and generate long-term success with a high win rate. Once again, I don’t need a rally, just limited downside for the next week and a half, and with strong earnings supporting Morgan Stanley, I feel good about this trade setup.

If you’d like to get your hands on the Stock Forecast Toolbox and see what it can do for you, you can access a free trial HERE.

And if you have any questions, never hesitate to reach out.

Keith Harwood

Keith@OptionHotline.com

Recent Comments