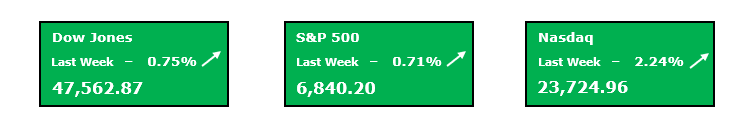

Just as we highlighted in last week’s edition, the major market drivers were the wave of mega-cap earnings and the much-anticipated Fed meeting. On the earnings front, results came in strong across the board, with the biggest tech names delivering “double beats” on both the top and bottom lines. Yet, stock reactions were far from uniform. Some companies faced investor pushback over rising expenses and accelerating capital spending, while others were rewarded for disciplined execution. Meanwhile, the Fed cut rates by 25 basis points — a widely expected move that had been priced in well ahead of the announcement. What truly moved markets, however, was Chair Powell’s notably hawkish tone during the press conference, where he cast doubt on whether another cut would come at the December meeting. The tone appeared intentional, aiming to temper market optimism after a strong summer rally. Despite a volatile week of back-and-forth trading, the S&P 500, Dow, and Nasdaq all finished higher, each closing at fresh all-time highs and extending their powerful multi-week run.

From a technical perspective, the S&P 500’s breakout to new all-time highs last week underscores the market’s ongoing strength. The index did become short-term overbought and saw a modest pullback into week’s end, but that type of consolidation is often healthy within a larger uptrend. The S&P remains well above its key medium- and long-term moving averages, confirming that the broader trend remains firmly intact. Importantly, last week marked the third consecutive weekly gain for the benchmark index — a bullish signal that reinforces positive momentum. Under the surface, market internals are showing a more nuanced picture. The S&P’s advance-decline line also reached a new high, indicating solid participation, but the percentage of components in long-term uptrends actually declined slightly. That tells us the latest surge has been more narrowly driven by the biggest names. In short: the technicals remain constructive, but a bit more breadth expansion would strengthen the foundation of this rally.

⚡ Special Promo: First Month Access for Only 1$⚡

Have you joined my Weekly Profit Opportunity newsletter yet? If not, then you just missed out on a recent trade alert I sent to members that has risen 153.4% in just a few weeks! While past results do not guarantee future returns, this newsletter features my top trade pick each week!

Key Events to Watch For

- Earnings season is now well past the halfway point, with roughly two-thirds of S&P 500 companies having reported — and the results have been impressive. So far, 83% of reporting firms have topped earnings expectations, marking one of the stronger seasons in recent quarters. This week, the focus shifts to a handful of high-profile names that could influence sector sentiment. Palantir kicks things off Monday, followed by AMD, Uber, and Arista Networks on Tuesday, and then McDonald’s midweek. Each of these reports will be closely watched, particularly for signs of spending trends, enterprise demand, and consumer strength heading into the final stretch of the year.

- Beyond earnings, investors will turn their attention to fresh labor market data. The JOLTS report should hit Tuesday morning, while Friday is scheduled to bring the all-important October nonfarm payrolls release. Both will offer critical insight into the Fed’s policy path — and traders will be parsing every detail for evidence that could support another rate cut in December. However, all of this hinges on whether the reports actually arrive on schedule, as the potential government shutdown still looms large. With Election Day on Tuesday, there’s growing hope that political pressure in Washington could finally spur progress on a funding resolution. Either way, this week’s data (or lack thereof) is poised to be a key catalyst for market direction.

Thank you for reading this week’s edition of the Weekly Market Periscope Newsletter, I hope you enjoyed it. Please lookout out for the next edition of the newsletter as we will give you a preview of the upcoming week’s important market events.

Thanks,

Blane Markham

Author, Weekly Market Periscope

Hughes Optioneering Team

Recent Comments