Dear Reader,

On Friday, we looked at a Daily Price Chart of Progressive Corp., noting that PGR stock has been making a series of higher highs and higher lows recently.

For today’s Trade of the Day e-letter we will be looking at a monthly chart for Textron, Inc. stock symbol: TXT.

Before breaking down TXT’s monthly chart let’s first review what products and services the company offers.

Textron Inc. operates in the aircraft, defense, industrial, and finance businesses worldwide. It operates through six segments: Textron Aviation, Bell, Textron Systems, Industrial, Textron eAviation, and Finance. The Textron Aviation segment manufactures, sells, and services business jets, turboprop and piston engine aircraft, and military trainer and defense aircraft; and offers maintenance, inspection, and repair services, as well as sells commercial parts. The Bell segment supplies military and commercial helicopters, tiltrotor aircrafts, and related spare parts and services.

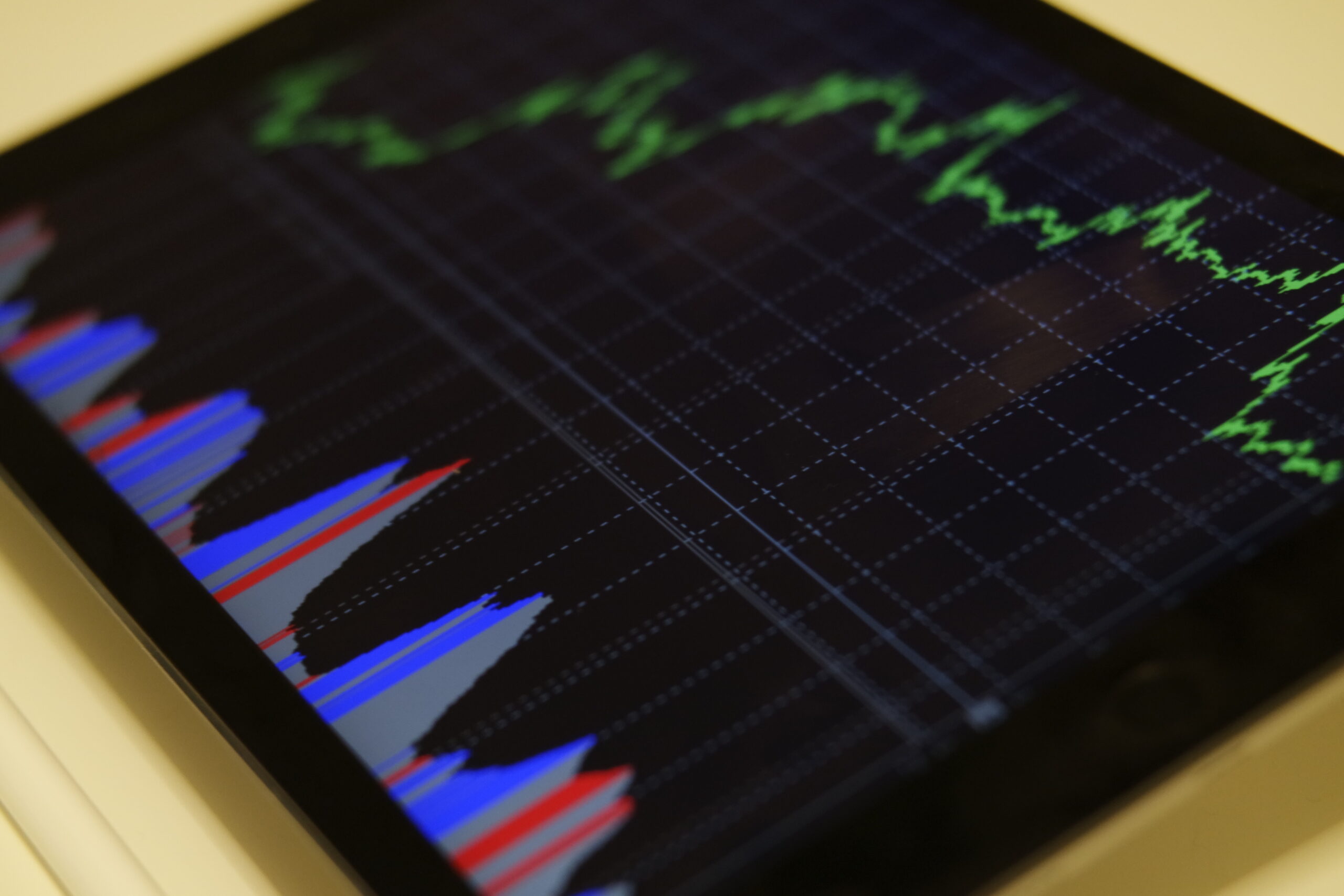

Now, let’s begin to break down the monthly chart for TXT stock.

Below is a 10-Month Simple Moving Average chart for Textron, Inc.

Buy TXT Stock

As the chart shows, in July, the TXT 1-Month Price, crossed above the 10-Month simple moving average (SMA).

This crossover indicated the buying pressure for TXT stock exceeded the selling pressure. For this kind of crossover to occur, a stock has to be in a strong bullish uptrend.

Now, as you can see, the 1-Month Price is still above the 10-Month SMA. That means the bullish trend is still in play!

As long as the 1-Month price remains above the 10-Month SMA, the stock is more likely to keep trading at new highs and should be purchased.

Our initial price target for TXT is 97.15 per share.

90.9% Profit Potential for TXT Option

Now, since TXT’s 1-Month Price is trading above the 10-Month SMA this means the stock’s bullish rally will likely continue. Let’s use the Hughes Optioneering calculator to look at the potential returns for a TXT call option purchase.

The Call Option Calculator will calculate the profit/loss potential for a call option trade based on the price change of the underlying stock/ETF at option expiration in this example from a flat TXT price to a 12.5% increase.

The Optioneering Team uses the 1% Rule to select an option strike price with a higher percentage of winning trades. In the following TXT option example, we used the 1% Rule to select the TXT option strike price but out of fairness to our paid option service subscribers we don’t list the strike price used in the profit/loss calculation.

Trade with Higher Accuracy

When you use the 1% Rule to select a TXT in-the-money option strike price, TXT stock only has to increase 1% for the option to breakeven and start profiting! Remember, if you purchase an at-the-money or out-of-the-money call option and the underlying stock closes flat at option expiration it will result in a 100% loss for your option trade! In this example, if TXT stock is flat at 94.37 at option expiration, it will only result in a 4.9% loss for the TXT option compared to a 100% loss for an at-the-money or out-of-the-money call option.

Using the 1% Rule to select an option strike price can result in a higher percentage of winning trades compared to at-the-money or out-of-the-money call options. This higher accuracy can give you the discipline needed to become a successful option trader and can help avoid 100% losses when trading options.

The goal of this example is to demonstrate the powerful profit potential available from trading options compared to stocks.

The prices and returns represented below were calculated based on the current stock and option pricing for TXT on 4/22/2024 before commissions.

When you purchase a call option, there is no limit on the profit potential of the call if the underlying stock continues to move up in price.

For this specific call option, the calculator analysis below reveals if TXT stock increases 5.0% at option expiration to 99.09 (circled), the call option would make 43.0% before commission.

If TXT stock increases 10.0% at option expiration to 103.81 (circled), the call option would make 90.9% before commission and outperform the stock return more than 9 to 1*.

The leverage provided by call options allows you to maximize potential returns on bullish stocks.

The Hughes Optioneering Team is here to help you identify profit opportunities just like this one.

Want more trade highlights like this one, except with actionable option trade recommendations? Click here to check out my Weekly Optioneering Newsletter. Right now, the first month costs just $1, a fraction of the normal $39 monthly subscription fee.

Short-Term Program from Chuck!

Chuck Hughes has just launched his exciting new trading service program, Lightning Trade Alerts. This new service focuses on low-cost & short-term options trade.

Members will receive hand-picked options trades from the 10-Time Trading Champion, Chuck Hughes.

Call our team at 1-866-661-5664 or 1-310-647-5664 to join or CLICK HERE to schedule a call!

Wishing You the Best in Investing Success,

Chuck Hughes

Editor, Trade of the Day

Have any questions? Email us at dailytrade@chuckstod.com

*Trading incurs risk and some people lose money trading.

Recent Comments