The market continues to try to go to new highs, but resistance is strong for the broad market.

This truly is a stock-pickers market with sector and stock rotation selections changing by the day. One day, semiconductors seem to be leading the pack, and then on a day like Tuesday, they pull back while homebuilders take the lead on the back of DR Horton earnings.

For the trader, it’s a noisy market, and I need a tool to help me filter through the noise and find the signals.

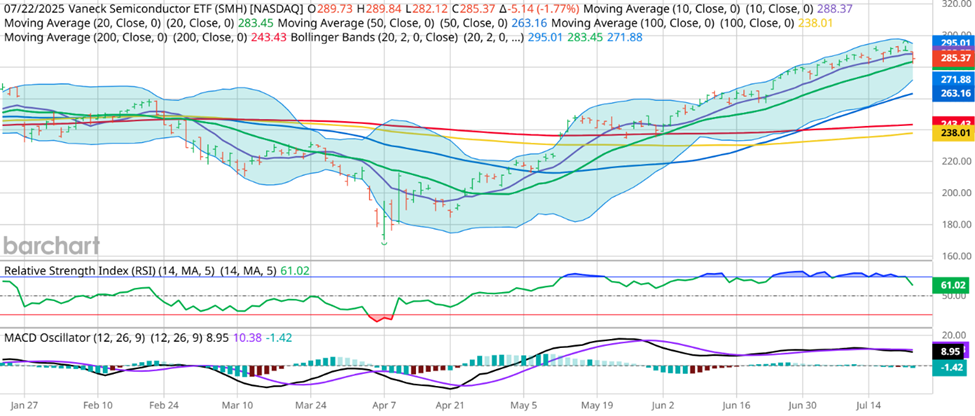

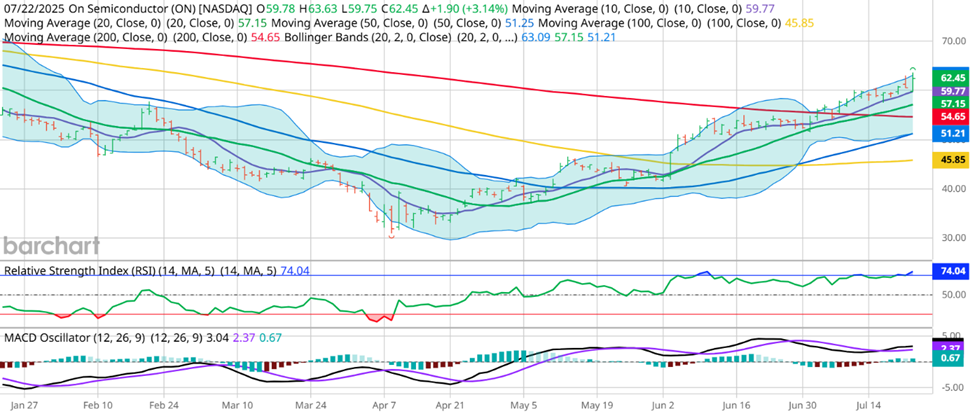

As a prime example of this, I highlighted the potential of ON in last week’s call, where the August 15th $60 Calls were trading just under $4.00. And on Tuesday, the follow-through in ON was strong in spite of broad semiconductor weakness. Let’s take a look at the ETF SMH first:

SMH has been leading the tech market charge to the upside, but in a chopping market that can’t seem to break out, investors felt a little bit of the “what goes up must come down” effect. Perhaps this is ultimately a buying opportunity in semiconductors, or perhaps not. I don’t see a clear signal there for the coming few days, but what I can say is that ON’s idea from last week was a strong performer:

ON August 15th $60 calls increased in value to about $5.40, a roughly 35% increase in value for the week. And while some may be looking for more, I’m looking for something else.

Why not run with this wave of bullishness? Well, to put it simply, we are getting into tech earnings now and the correlations of earnings in other tech names can shift the technical signals in many of these tech names.

So, instead, I want to look at a stock within a sector that’s broadly done with earnings, and that means I’m going back to the financial sector.

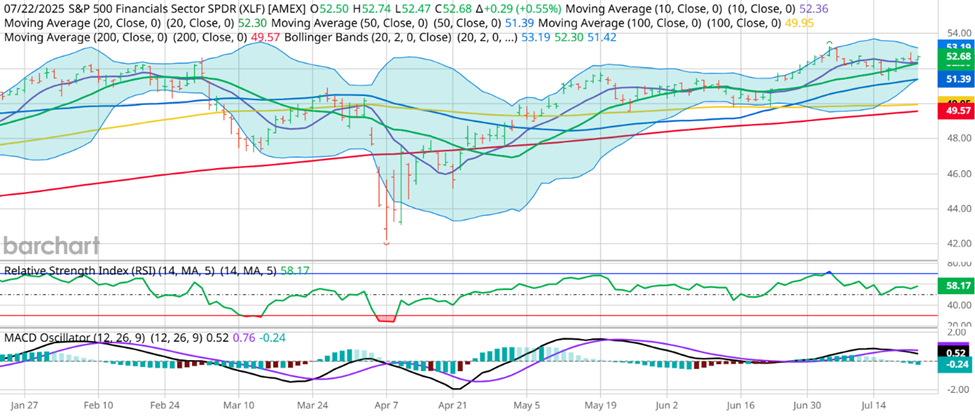

Let’s start with XLF:

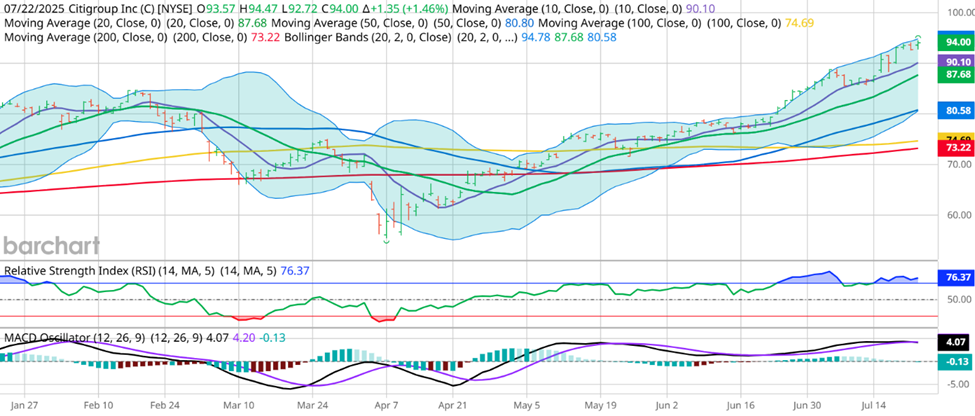

Pressing against the July 3rd, 2025 highs, XLF looks prime for a breakout. So, I’m looking for a candidate within the sector that looks particularly attractive to the AI models in the Stock Forecast Toolbox. When I think through the best performance in the financials sector based upon earnings, I go right to Citigroup:

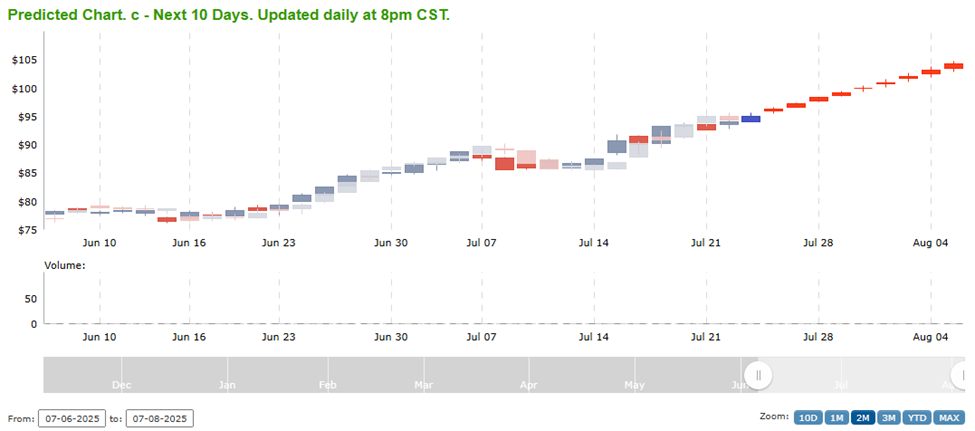

Citigroup had a nice rally on earnings and after a slower consolidation period, is trading at new highs again. And the Stock Forecast Toolbox is even more bullish than I am given the moneyflow going into Citigroup after stellar earnings:

(to take the Stock Forecast Toolbox for a test drive, click here)

With a projection of a 5-6% rally in the coming week, I can already see some great potential here by leveraging the trade and defining my risk with options. In this case, the August 15th $95 Calls are currently trading for about $1.65. If the stock rallies to $99 as the Stock Forecast Toolbox projects, it’s a homerun. If it falls short and only gets half way there to $96.50 in the coming week, it’s still a big return.

The key is knowing when to enter, when to exit, and when to change the structure of the trade. For me, this is a great setup for a week, exiting prior to the FOMC decision and any potential unknown volatility that it could cause. And if I can achieve a big 100%+ win in the process (if the Forecast Toolbox projection hits), even better!

If you’d like to get your hands on the Stock Forecast Toolbox and see what it can do for you, you can access a free trial HERE.

And as always, please go to http://optionhotline.com to review how I traditionally apply artificial intelligence, technical signals, volatility analysis, and probability analysis to my options trades. And check out http://tradespoon.com to learn more about the artificial intelligence systems that Vlad Karpel created and I have been working on with him to find great trading opportunities in any market condition

If you have any questions, never hesitate to reach out.

Keith Harwood

Keith@OptionHotline.com

Recent Comments