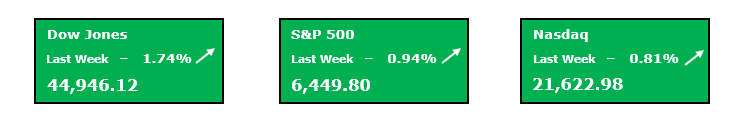

This Bull market continued to decisively push higher in last week’s trading as each of the three major indexes each leaped to fresh all-time highs throughout the week. The significant upside movement did not come easy, however. The battery of market news from last week was mostly positive, but not completely positive. The good news was seeing July CPI come in a touch cooler than expected and also seeing July’s retail sales report meet expectations. The bad, however, was that the PPI inflation report for July posted a result that was significantly higher than the market was expecting. The fallout from the PPI report was that U.S. Treasury yields had a quick & notable move higher and the market’s rate cut predictions for September were tamped down. When looking at the CME’s FedWatch tool early last week, it showed the probability of a Fed rate cut in September at 100%. Furthermore, it even went as far as to show that some were entertaining the idea of a 50bps cut (double cut) in September. Most felt this was a bit of a stretch, yet it is what the market began to price in prior to the PPI report. However, once we got the PPI results, this quickly normalized with markets now pricing in only a 25bps cut in September, which had been the market’s consensus. The result, the S&P 500 & Nasdaq made their new highs roughly mid-week before giving back some of that ground in the back-half of the week. The Dow, however, finally made a new intra-day high in Friday’s trading, its first since Dec ’24. The new highs on the Dow were largely a function of the index’s high priced laggards (UNH), rallying strongly late in the week. Regardless of the cause, seeing a new high in one of the major indexes is encouraging. Also, even though some of the ground that was gained last week was given up during Thursday and Friday’s trading, stocks are still only marginally off of their all-time highs, and this is positive for investors. Despite the disappointing PPI data, investors weighed that against the balance of other data we’ve recently gotten, and all signs still point toward to September cut, albeit a 25bps cut. As displayed by the market’s price action for the week, this was still an acceptable outcome for investors. Earnings have been good, rate cuts are seemingly on the way and market technicals are strong; investors like this mix and it’s why stocks are still sitting near those all-time highs.

Following a week that featured numerous all-time highs across the major indexes, and the first S&P closes above 6400, of course the technicals behind this market at the index level are strong. With that said, I do want to look under the surface to see what the internals would suggest about this market that is continuing to hit new highs at a relentless pace. We did see some notable improvements in market breadth last week with the number of S&P 500 stocks trading above their 50-day moving average briefly topping 65%. We saw a similar recovery in the number of stocks trading above their 200-day moving average. When looking at the S&P 500 sector ETFs, over the past month of trading we have begun to see better performance from some of the laggards. Of the 11 sectors, 10 of them now have a positive return over the past month with the only decline being in the Energy sector. The top performer over the past month has been the Comm Services sector. Seeing the positive performance across most sectors in recent trading is a good sign but we still would like to see the sectors trade into a more durable long-term uptrend. All this said, overall, the S&P, along with the other two major indexes, are in confirmed long-term uptrends. Even though the leadership in the market remains fairly narrow, the technicals are rock solid. Additionally, despite the S&P 500 making numerous new all-time highs in the past month, the index does not look overstretched. At present the index is trading about 8.8% above its 200-day, this is indicative of a strong bull trend, but far from technically overstretched. Furthermore, the key oscillators that I follow confirm the reading that the market is not technically stretched at these levels. I do still think that in the next month we could be in for some choppy rangebound trading as uncertainties mount, however, for now it seems clear that the bulls are still in charge of this market as equity indexes continue to hit new highs.

⚡ Special Promo: First Month Access for Only 1$⚡

Have you joined my Weekly Profit Opportunity newsletter yet? If not, then you just missed out on a recent trade alert I sent to members that has risen 117.4% in just a few weeks! While past results do not guarantee future returns, this newsletter features my top trade pick each week!

Key Events to Watch For

- Major Retail Q2 Earnings

- Fed Back in Focus

Headed into the second half of August, the majority of Q2 earnings season is behind us and it has turned out to be quite a strong reporting season. This week we will hear from a key group of companies that carry a major weight in the real economy. The theme of this week’s earnings report is the retail sector as many of the companies in this space are on deck to report their Q2 results. Some of the key names we are watching this week are WMT, HD, LOW, TGT, & TJX. While several of these stocks are certainly not the most ‘important’ stocks when it comes to overall index performance, what is occurring in their business is a key read on the domestic economy which is a primary concern of the market. Each of these companies is amongst the largest retailers in the country and in some cases the entire world. Tariffs and their effects are still an ongoing concern for investors. This block of companies are at the forefront of where tariff-impacts will show up first. Investors will be closely watching these reports for any signs of business weakness as a result of tariffs. With the current backdrop featuring concerns about a cooling job market, slowing economy, and low yet stubborn inflation, these reports carry a heavier importance this reporting season than they otherwise would. A major surprise from this block of earnings has the potential to be a market catalyst this week.

Although the Federal Reserve’s FOMC does not have a policy meeting this month, the Fed will be back in focus this week in a pretty crucial way. Up first, on Wednesday, the ‘Minutes’ from the FOMC’s July meeting will be released. Since this meeting featured the first Fed Governor dissents on a policy decision since 1993, these transcripts could provide some interesting insights into what the committee is thinking. Additionally, this week will feature the Fed’s annual Jackson Hole “Economic Policy Symposium”, or more commonly referred to as, the Fed’s Jackson Hole meeting. While this meeting does not feature an update on monetary policy, in the past it has proved to be a major market-moving catalyst on several occasions. Fed Chair Powell has used this meeting as an opportunity to telegraph to markets if there is a ‘policy shift’ upcoming for the FOMC. Fed Chair Powell’s scheduled speech is set for Friday morning and this is what traders will be anxiously waiting for. As markets are looking toward the September meeting and hoping for this to be the beginning of a series of rate cuts, if Powell provides any hints that they may indeed be coming, expect the market to react positively. However, if Powell strikes strong Hawkish tone, contrary to what the market wants, this speech could put stocks under pressure. Needless to say, this Friday morning speech to close out the week has the makings of a high-stakes market event.

Thank you for reading this week’s edition of the Weekly Market Periscope Newsletter, I hope you enjoyed it. Please lookout out for the next edition of the newsletter as we will give you a preview of the upcoming week’s important market events.

Thanks,

Blane Markham

Author, Weekly Market Periscope

Hughes Optioneering Team

Recent Comments