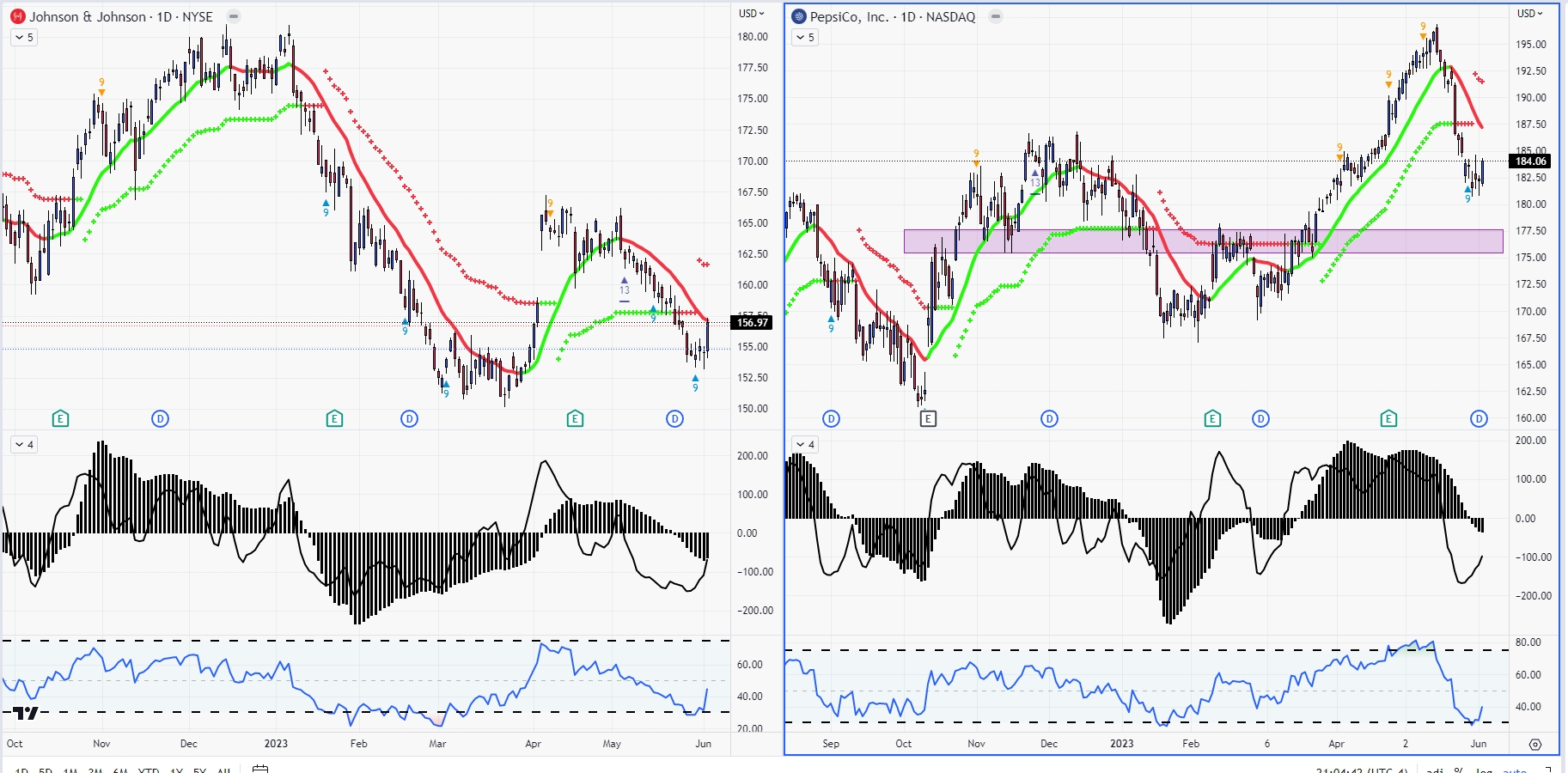

Last week I was watching Shopify for a bit more weakness below $55 to entertain a long position, which thus far hasn’t happened. Still like the set up tho … bigger picture uptrend, positive earnings surprise last quarter, and orderly consolidation that is very likely to see another test higher. Still like buying under $55. Two more stocks to watch are JNJ and PEP. Johnson and Johnson looks very close to turning the trend positive in the attached chart.

There is “Demark 9” a numerical calculation of oversold and overbought based on the pattern of highs and lows and closes. It has tested the breakout level and made a higher lower. JNJ looks to move up imminently and dips Monday in the 156’s would look attractive to buy with a stop loss under 143. Pepsi also has a Demark 9 count. however it is further from turning its trend positive, and further from the support box as highlighted in the chart. So adding PEP to the watch list to see how it plays out this week.

There are unlikely to be any home runs this week. See profit, take profit. Don’t look for big wins right now.

Thanks,

Joe

Recent Comments