Tuesday April 24 an interesting and possibly very significant event occurred in the market around 11:15 a.m. EST. The SPX was trying to rally and then suddenly there were just no bids. No huge selling wave, just no bids. It hit an air pocket, and unlike most air pockets which attempt a comeback, this one did not. It figuratively laid there for a few minutes, and the rest of the day was a gradual erosion. The short cover rallies ended the same way, once those bids dried up, there was nothing but air underneath.

This was behavior on an intraday basis I havent seen for a while, It reminded me of stories I had heard from the open outcry pits at the CME. The pits were usually a cacophony of noise, but when a market made a significant top or bottom, there would be a few seconds of dead silence, as the buyers had all bought. There were no bids. Then the first seller started the trend in the new direction.

The level in the SPX that is now important is 4115.00. If that level is not breached on the upside I remain bearish.

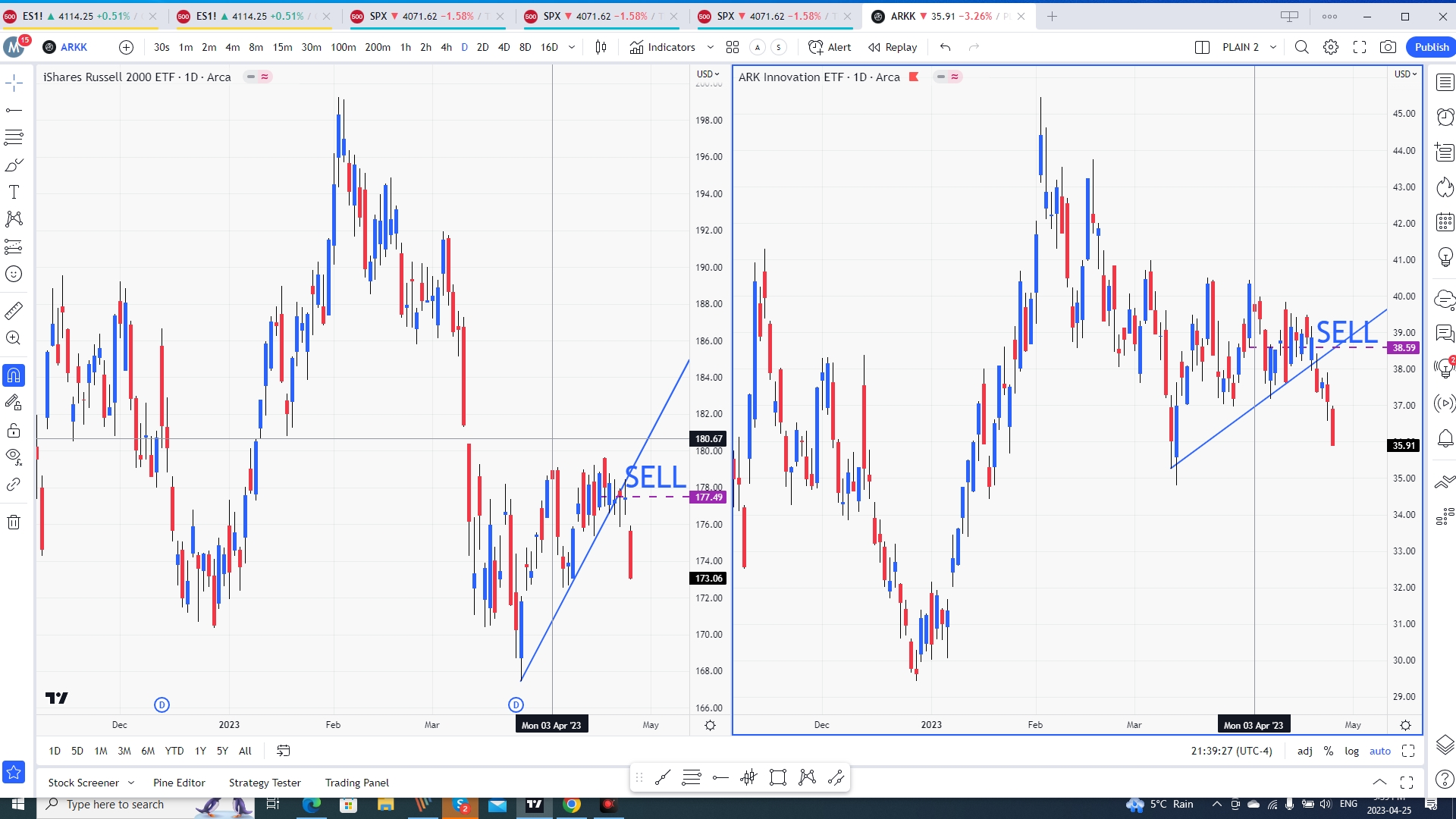

Two of our bearish picks, IWM and AARK have done well. The chart attached shows where we recommended these, and did recommend these more than once as they remained stuck at the levels for a while. Another short trade AAPL is marginally onside. I have a 170-160 put spread here at $4.90 and the close was 164. The 165 is my breakeven. Anything below 160 is a 100% return. For full disclosure I also have SPY put spread that will need a decline to 390 in the next month to be profitable. I certainly haven’t written this one off even though it is underwater right now.

To reiterate, keep an eye on 4115 SPX. If the market stays below there bears have control.

Thanks,

Joe

Recent Comments