I really want to buy the market, but I’m looking for a reason, and I can’t seem to quite see it.

Don’t get me wrong, I don’t think the market needs to collapse from a technical perspective, but I don’t think it needs to go back to highs. At least, I don’t think it needs to go back to highs, yet.

Let me explain a bit further. I’m always looking for a leading indicator for the markets to go higher. For years, that market leader has been the technology sector. Well, when the market (the S&P 500) was at recent highs, the tech sector (the NASDAQ 100) was lagging the move. And people could understand it, because interest rates were projected to rise due to inflation and so money wasn’t as cheap which meant investment in tech companies was more expensive, so tech lagged a bit. It made sense.

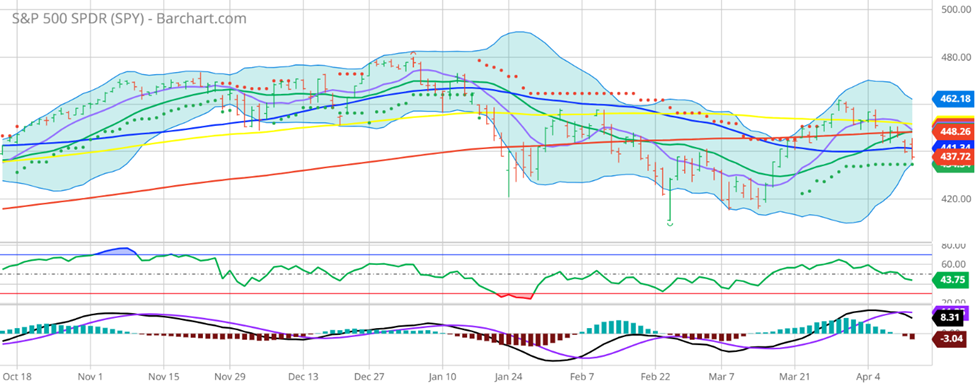

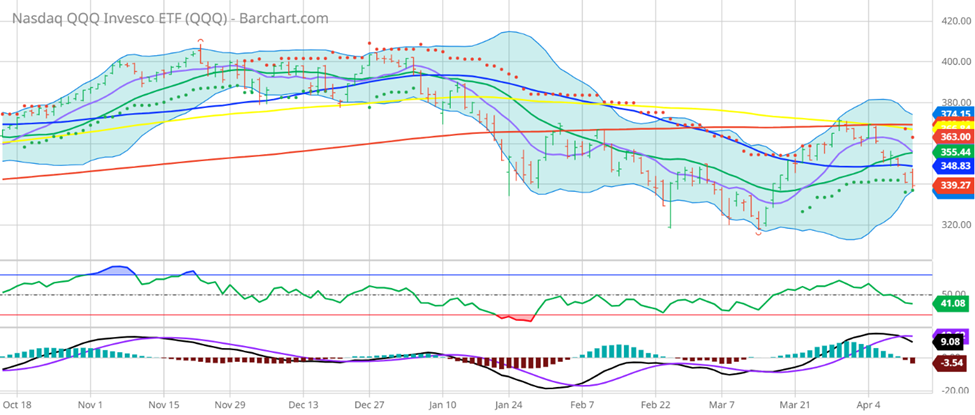

Let’s look at the charts for the S&P 500 and NASDAQ 100 now:

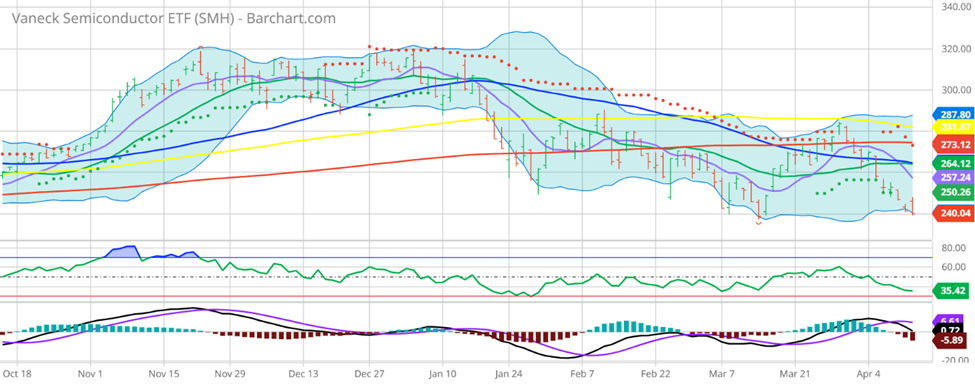

So, we saw the lag on the way up. Then, we saw both the broad market and the tech sector try to hold at the 50-Day Moving Average and fail. That’s a bit tough to justify buying. But, even more alarming, is that the leading indicator for tech is failing much worse. Semiconductors have traditionally been the leader for tech, and they are falling to 6-month lows as we speak, as we see the semiconductor ETF test the lows from March 14th:

Given this, I’m struggling to justify buying the market. When I see semiconductors find their footing, I’ll have an easier time buying. Maybe this is a double-bottom, and it’s time to buy. If we see a higher high and higher low today, that could be the start of something. But for now, it’s better for me to wait for a signal than to try to catch that proverbial falling knife.

While the VIX isn’t necessarily in panic mode, and neither tech nor the broad market are in panic mode, there’s some dangerous red flags coming from the semiconductor sector right now that mean I need to either look for some bearish bets if semiconductors make a new low or simply hold off on the buy side, at least for now.

So, please go to http://optionhotline.com to review how I traditionally apply technical signals and probability analysis to my options trades. As always, if you have any questions, never hesitate to reach out.

Keith Harwood

Keith@optionhotline.com

Recent Comments