Let’s take a look at trade examples in the SPY. Our Smart Paycheck Alerts have hit 10 out of 11 winners recently and this is part of how we spot them. We’ll take a look at what is going on this morning, a great indicator that is effective in this situation, and why the SPY is an excellent choice for trading options. At the bottom of this email, I even include an update on a previous example.

SPY, or the SPDR S&P 500 trust was one of the first exchange traded funds and is also one of the most traded ETFs. That volume makes it ideal for great trades. SPY tracks the S&P and makes it possible for individual traders to trade moves in the entire index.

Look at what the S&P did on Wednesday to help us get an idea of what to expect from the SPY this week. The image below is yesterday’s price activity.

This chart image is courtesy of FINVIZ.com a free website and gives a quick view of each day’s movement. Understanding the direction, the S&P was moving on the previous trading day is a great place to start.

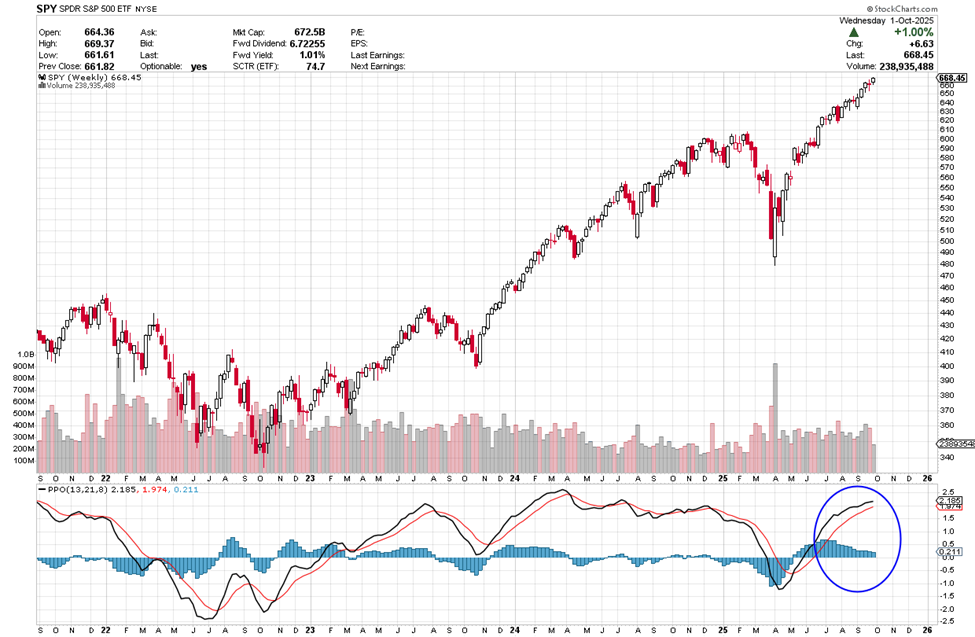

Next, let’s look at chart that includes the Percentage Price Oscillator or PPO indicator. We are specifically looking at the lines in the PPO to cross but you can get more information about this indicator here.

The PPO is showing signs of deceleration, potentially flattening out, though it maintains a modest upward slope. While SPY price action suggests possible consolidation or short-term exhaustion, this example will focus on positioning through long calls.

Potential SPY trade:

In this example, if the price continues to RISE you could consider a CALL trade if it goes ABOVE $669. The short-term target is $675.

Here’s Why an Option Offers A Big Potential Payout

The stock price in this example is $668.45.

If you were trading options and selected a CALL option strike, you would pay a premium of around $3.35 for the Oct 17th 676 expiration. This is an investment of $335 for the 100-share option contract. If the stock price moves to 675 the premium is apt to go up about $3.00. Your premium of $335 plus $300= $635. That is a profit of 90% over a short period of time.

Remember, you can take profit anywhere along the line, you don’t have to wait for the expiration date to sell. It is often wise to take profit when it is earned, especially in a volatile market.

Stay positive and know you can do this. Knowing creates positive results! A part of the abundance process is letting go of anything negative, which creates space to receive.

I wish you the very best,

Wendy

PS-If you want to find out about great opportunities like this, see my articles before they are sent out to the public, and get great updates on the market throughout the day, follow our Telegram channel by clicking here. It make sure you don’t miss any of the great stuff.

Recent Comments