If you’re looking for opportunity in this crazed market, look for solid stocks down on temporary weakness. If you also want to earn yield, see if you can indirectly invest in those same solid stocks through yielding ETFs. In fact, here’s one to consider.

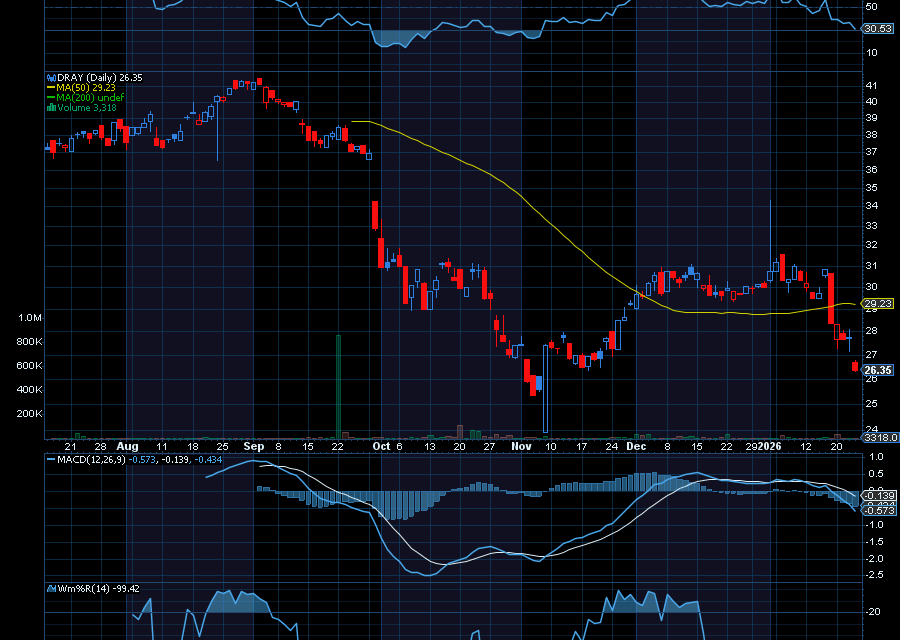

YieldMax DKNG Option Income Strategy ETF (DRAY)

With an expense ratio of 0.99%, a 30-day yield of just over 2.2%, and a distribution date of 47.19%, the YieldMax DKNG Option Income Strategy ETF (DRAY) providing the potential for weekly income through a covered call option strategy on the DraftKings (DKNG) stock.

The fund does not directly invest in DKNG.

Most recently, DRAY paid a dividend of just over 25 cents on January 23. Before that, it paid out just over 17 cents on January 16. And before that, it paid out a dividend of just over 29 cents.

A key catalyst for DKNG is the Super Bowl and March Madness.

After all, Americans love to bet on sports.

Look at the Super Bowl, for example.

According to the American Gaming Association, $7.61 billion was bet on the Super Bowl in 2021. In 2022, the AGA estimated that more than $8 billion would be wagered. In 2023, $16 billion was wagered. In 2024, about $23.1 billion. In 2025, nearly $30 billion. With the 2026 Super Bowl set for early February, we expect to see another round of big numbers.

As for March Madness, about $3.1 billion was bet in 2025. About $2.7 billion was bet un 2024.

So, it comes as no real surprise they have such an impact on sports betting stocks, like DKNG.

Historically, DraftKings’ stock saw a bump ahead of the Super Bowl over the last few years. In 2024, DKNG ran from a January low of about $32 to a high of $45.62 after the game. In early January 2025, DKNG ran from about $17.60 to $20.88.

Helping, analysts at Needham just reiterated a buy rating on DKNG with a price target of $52. The firm cited DKNG’s core online sports betting and iGaming products, which have contributed to DKNG’S 18.5% revenue growth over the last year. Analysts at Wells Fargo upgraded DKNG to an overweight rating with a price target of $49 a share.

Sincerely,

Ian Cooper

Recent Comments