Markets have been volatile again.

With geopolitical tensions, and economic uncertainty, fear is ramping higher again. As a result, some investors are jumping out of the market, which is a terrible idea.

Unfortunately, by jumping out, you’re preventing yourself from making your money back from a resilient market. We have to remember that markets have been through worse pullbacks and bounced. So, instead of jumping out, consider diversifying with yielding ETFs, such as:

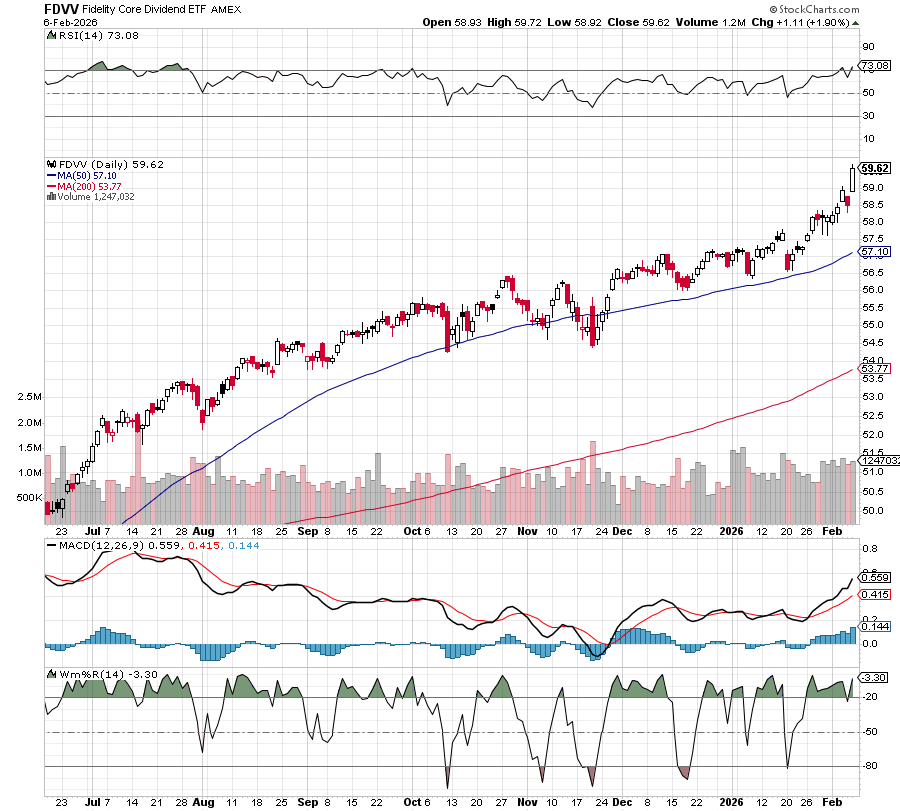

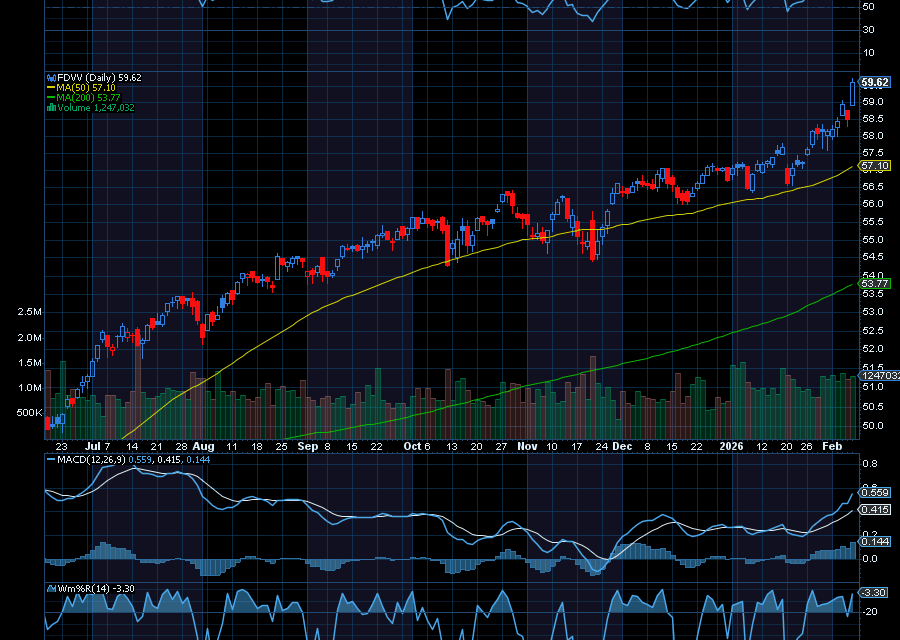

Fidelity High Dividend ETF

We can also look at the Fidelity High Dividend ETF (FDVV).

With an expense ratio of 0.16% and a yield of 3.26%, the FDVV ETF tracks the Fidelity High Dividend Index, which is designed to reflect the performance of stocks of large- and mid-capitalization dividend-paying companies that are expected to continue to grow dividends.

Some of its top holdings include Apple, Microsoft, Nvidia, JPMorgan Chase, Visa, Exxon Mobil, Philip Morris, and Procter & Gamble to name a few.

iShares Core High Dividend ETF

There’s also the iShares Core High Dividend ETF (HDV).

With an expense ratio of 0.08% and a yield of 3.3%, the HDV ETF tracks the investment results of an index composed of relatively high dividend-paying U.S. equities. Some of its 75 holdings include Exxon Mobil, Johnson & Johnson, Progressive Corp., Chevron, AbbVie, Philip Morris, AT&T, and Coca-Cola to name just a few.

JPMorgan Nasdaq Equity Premium Income ETF (JEPQ)

One of the most compelling income-focused ETFs on the market today is the JPMorgan Nasdaq Equity Premium Income ETF (JEPQ).

With a yield of about 10%, JEPQ is designed to deliver high monthly income while maintaining exposure to U.S. large-cap growth stocks.

JEPQ employs a covered-call strategy, generating income by selling options on Nasdaq-linked securities while holding a portfolio of large-cap growth stocks. This strategy allows the fund to collect option premiums, which are then distributed to investors as income.

Sincerely,

Ian Cooper

Recent Comments