Weakness may be an opportunity for Spotify (SPOT).

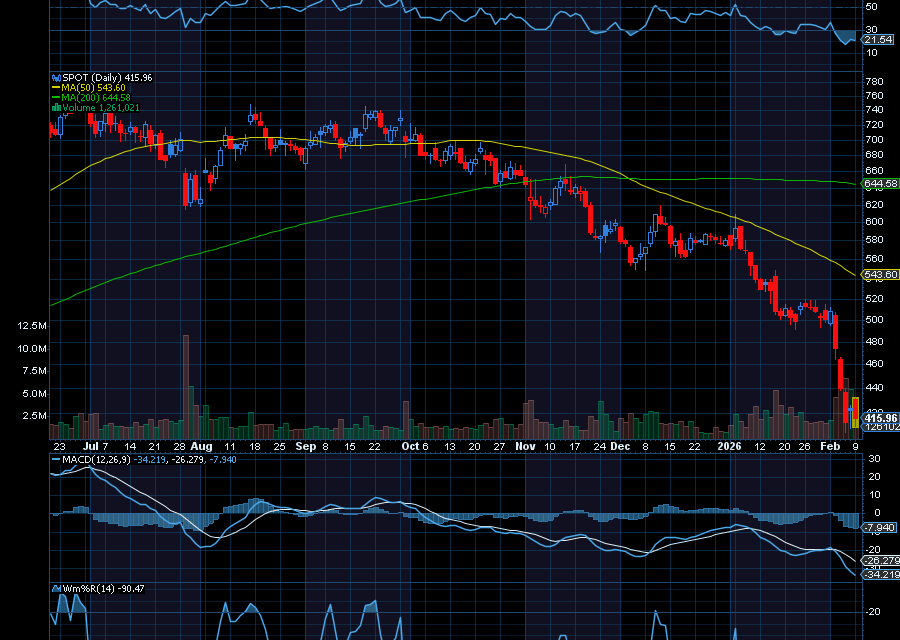

Since peaking in September, SPOT is down about 43%.

But that’ll happen with weaker than expected guidance and news it would part ways with its longtime CEO, who will still remain involved as Executive Chairman.

In its last report, EPS of 3.28 euros crushed estimates of 1.97 euros. That was also higher than the 1.45 euros posted year over year. Revenue of 4.27 billion euros was also better than estimates for 4.23 billion euros. It also saw its monthly active users jump by 11% to 713 million. Premium subscribers jumped 12% to 281 million, in line with expectations.

However, we should point out two key negatives with the report.

As reported by the company, its gross margin of 31.6% was 50 basis points ahead of guidance because of “rights holder liabilities.” If that were to be excluded, Spotify’s gross margins would have only been “modestly ahead of guidance die to content cost favorability,” as noted by Founder and Executive Chairman, Daniel Ek in Q3 2025 earnings commentary.

Not helping, SPOT forecast fourth quarter revenue of 4.5 billion euros, which is below expectations for 4.56 billion euros. It also said it expects for total premium subscribers to reach 289 million, short of estimates for 291.1 million.

However, weakness may be an opportunity.

With a good deal of negativity now priced into the stock, we’re seeing opportunity. Two, analysts at Oppenheimer said SPOT’s recent $1 monthly price hike could help the stock get on track again. Also, analysts at Goldman Sachs has a buy rating on the stock, noting that investors should take advantage of the drop in SPOT shares. The firm also has a price target of $700.

Sincerely,

Ian Cooper

Recent Comments