The Feds announcement yesterday wasn’t that much of a surprise but it definitely pushed the market down. It seems like this year we have spent a disproportionate amount of time going over bear strategies, but when in Rome… right?

Now we are looking at another bear move and a setup that has been a reliable performer for us just flashed on the chart. SQQQ is the inverse ETF that tracks the NASDAQ but in the opposite direction. That means when the NASDAQ drops, SQQQ goes up. It is a simple way to exploit these dips we have been seeing all year long. Yesterday’s drop pushed SQQQ up and it looks like there is more room for it to move. Take a look:

The blue circles highlighted are tipping us that this move is going to extend. The top circle show the tightening of the trading range that built momentum and then pushed off the 50 day moving average. On top of that we not only see the MACD crossing over to the upside but it is closing a gap that is a clear sign of the power in this move.

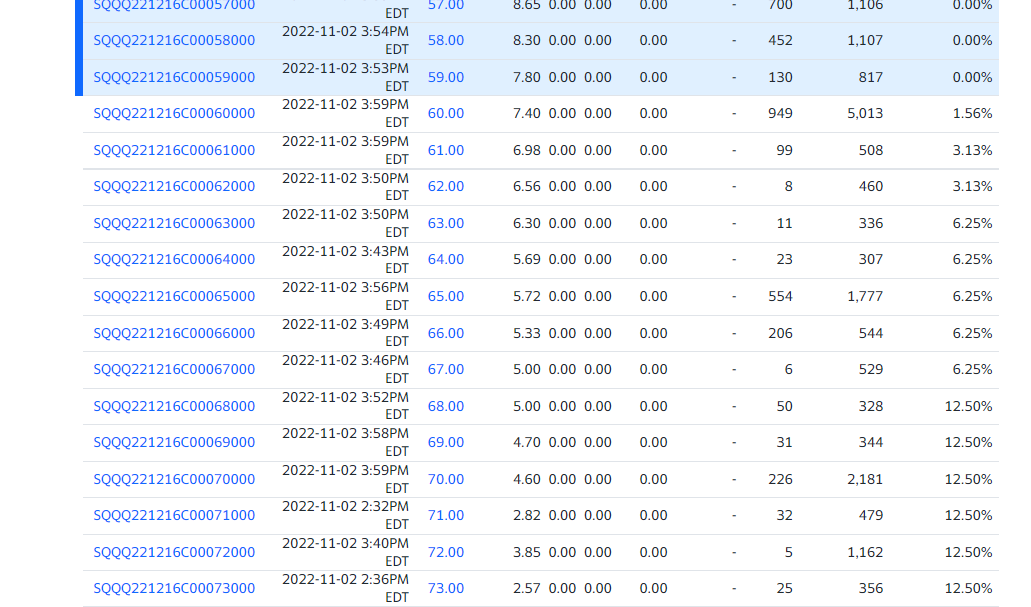

It is pretty realistic to expect the move to reach for that peak we saw near 70. With this momentum and a solid price target, it is a great context to look at a call option on QQQ. If you bought SQQQ at 60 and it moved to the target of 70 that is a nice 16% move. Not shabby at all. Buying 100 shares of SQQ at 60 would cost $6000. The Dec 16 70 Call option is currently at 4.60.

Call options are sold in 100 unit lots so you could buy 100 Call options for $460. While it is very unlikely SQQQ would go to $0 having $460 at risk beats having $6000 at risk. Plus, if this move continues up that to 70 or even towards it, it could move that call up to $6 or possibly $8. Slashing risk by 90% and increasing a potential gain by as much as 10% sounds good to me.

Keep learning and trade wisely,

John Boyer

Editor

Market Wealth Daily

Recent Comments