Tip #1-Timing is EVERYTHING

The trick is that it isn’t the when of the timing, but more often the how long. Be sure to give yourself enough time for a the move you are anticipating to play out. The market doesn’t wear a watch and it definitely doesn’t care about your deadlines.

The market does not care how much we are losing or making or when we need money. When we set an expectation, we are putting limits on ourselves. We may say we understand that our timeframe of holding a stock, say no more than a week, is just a guideline but the moment we feel like we must hold it longer than that we are vulnerable. That stock could be skyrocketing, and it will be completely normal to second guess that rule we set for ourselves and think we should hold on to it.

Or we can watch it hit our max loss target and start to think that we might want to change that target. As soon as that stock dropped one penny below our target, we are at greater risk of making bad decisions.

(check out a great article on timing and leverage here)

Tip #2-Trust Your Plan and Stick To It

Emotions are a huge part of trading and while you may hear many say you need to keep your emotions out of trading that isn’t entirely true. Emotions are the key to survival. Fear keeps us alive. The key is to listen to your emotions when you are out of the trade. Adjust your plan between trades, not during a trade. Make a note of how you felt and adjust your plan accordingly before entering your next trade.

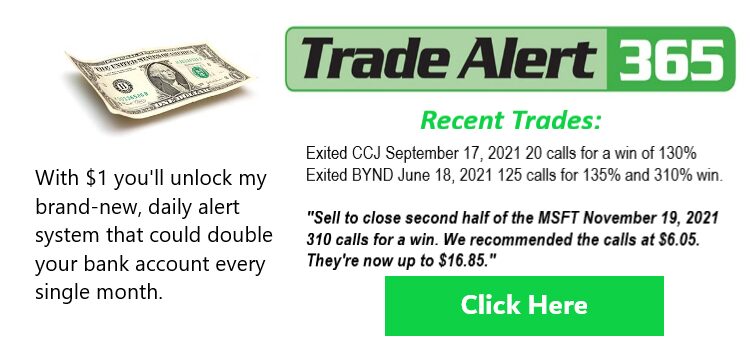

Here is a a great article about a trade you can add to your plan for 2022.

Tip #3-Now Is The Time to Learn To Trade

In fact, it is always time to learn to trade. Smart traders are constantly studying, looking for new ways to see great trades. The best traders are also always looking for new ways to see things they think they already know. It may seem silly to re-read the basics but as an experienced trader, you will see the basics from a completely different perspective.

Take the time to learn. Invest in yourself.

Here’s to a great 2022.

Keep learning and trade wisely,

John Boyer

Editor

Market Wealth Daily

Recent Comments