From Keith Harwood, OptionHotline.com

First, I love sharing these articles with you but it is tough to give you all of the info I want to in a small space. I am doing a webinar later today with some great tips for really taking advantage of the current, and very unique, market conditions we are looking at right now. Be sure to sign up and join me this afternoon or sign up to be sure you can access the recording later. Just click here to sign up.

I am always looking for a combination of timing and leverage. Timing is crucial when utilizing options to get into a new idea – it is truly important since options have time-to-expiration as a key factor. If I choose an options trade expiring in 2 weeks but the move happens in 3 weeks, I am left with a loss rather than a gain.

At the same time, I have to see the leverage for the move I am anticipating. I have to see the potential for a major move to really make options work for me. And right now, I see both timing and leverage lining up in the oil sector. While this has been a difficult sector to time for oil companies, the odds and expected value of the trade are certainly on my side right now.

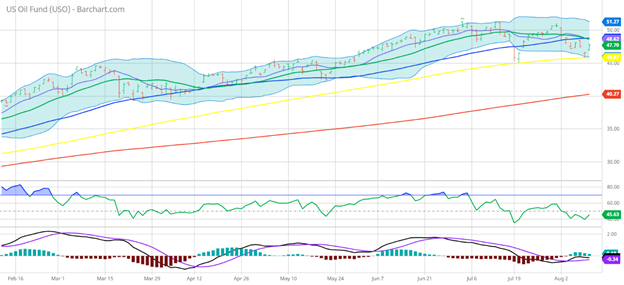

Let’s look at USO:

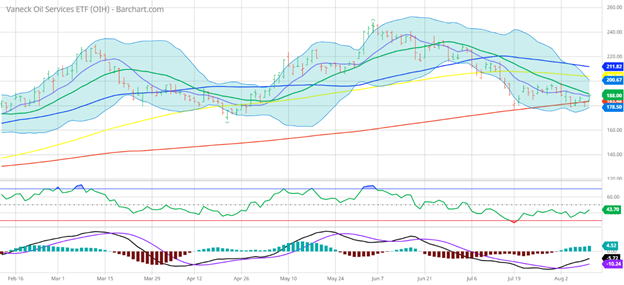

The dips in USO are frequently buying opportunities, and while the dips continue to test lower levels and create some concern, we once again saw that the 100-Day Moving Average was support that held. For now, oil is a buy on the dips, and if that’s going to continue to be the case, then OIH is going to continue to be a buy on even more major dips. Let’s look at the chart:

After flirting with the 200-Day Moving Average and the lows from July, OIH seems to be finding support. This would go hand-in-hand with the support that USO is finding. At the same time, implied volatility in OIH is simply in-line with what it has been for the last few months – so if I think that we can see OIH test the highs of the last few months around $240 and can pair that thesis with an options position like the September 17th $200 calls for $6.40 (which would be worth $40 or more on a move in OIH to $240), one can quickly see that there is truly a great deal of leverage in the options markets TODAY for a trade in the oil sector.

Trading is all about combining timing and leverage, and right now, we certainly have an interesting setup forming in oil that requires our attention.

Please take this chance to review how I apply technical signals to my options trades at https://optionhotline.com and if you have any questions, never hesitate to e-mail me.

Keith Harwood

Keith@optionhotline.com

Recent Comments