Wednesday, August 11th, 2021

Happy Wonderful Wednesday!

Last week, the market gave us three bullish days out of five. The three main indices moved sideways with daily swings. The Dow popped above 35,220 and then quickly pulled back. It seems to be stuck just below that resistance level.

To review past equity candidates, scroll down.

For today’s Trade of the Day, we will be looking Walmart Inc. symbol (WMT). Before analyzing WMT’s chart, let’s take a closer look at the stock and its services.

Walmart Inc. engages in the operation of retail, wholesale, and other units worldwide. The company operates through three segments: Walmart U.S., Walmart International, and Sam’s Club. It operates supercenters, supermarkets, hypermarkets, warehouse clubs, cash and carry stores, and discount stores; membership-only warehouse clubs; ecommerce websites, such as walmart.com.

It operates approximately 11,400 stores and various e-commerce websites under 54 banners in 26 countries. The company was formerly known as Wal-Mart Stores, Inc. and changed its name to Walmart Inc. in February 2018. Walmart Inc. was founded in 1945 and is based in Bentonville, Arkansas.

I looked through a lot of charts over the weekend. I zeroed in on WMT because it had a pullback in June and now looks ready to continue heading higher. It is a widely traded stock with lots of volume.

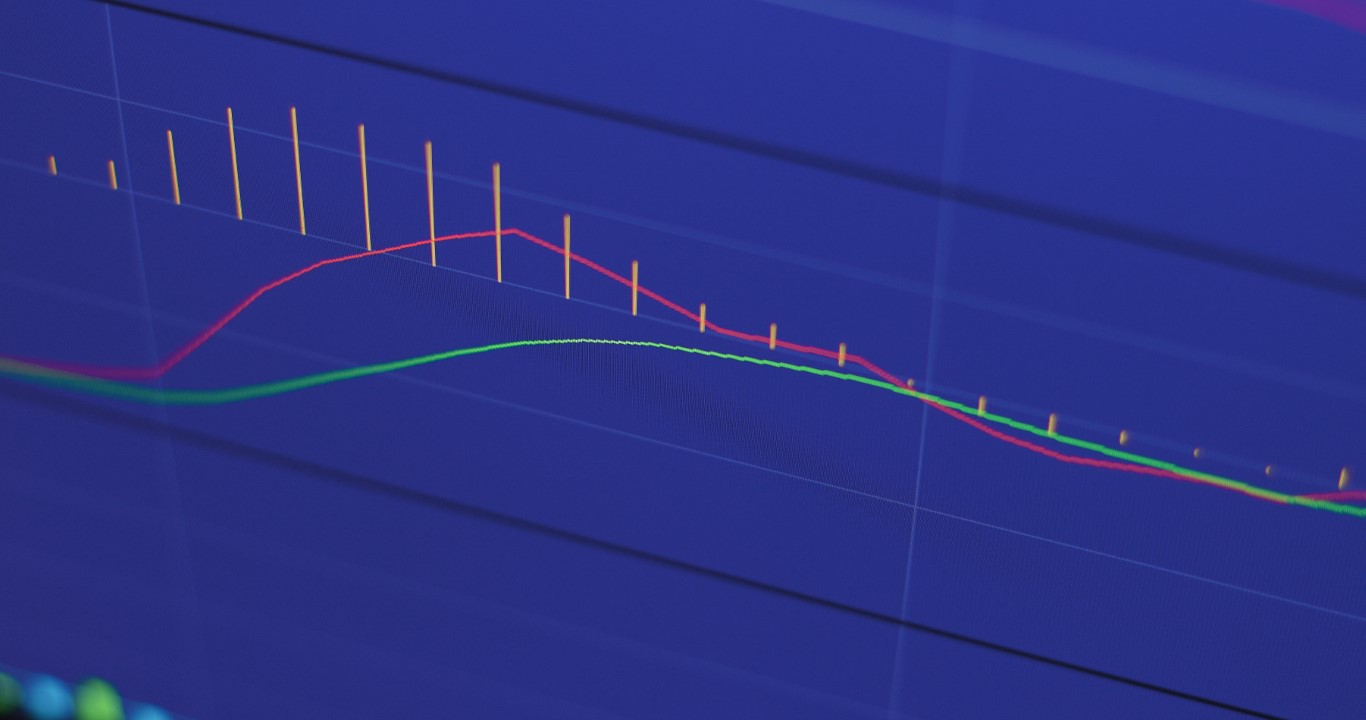

On the ADX indicator below the chart, notice how the green +DI line is on top. Because of that strength, the black line is starting to turn up to show even more growing strength. These are all signals of strength with the thought that it may continue to climb.

For those who want more info on ADX, I give more details in the section below, or scroll down to the trade info.

Average Directional Index (ADX) Points to Direction and Strength

ADX is an easy indicator to interpret. The +DI line (green) is bullish and when it is on top, it suggests price is going to head up. When the -DI line (red) is on top, it suggests price is going to drop.

The black line is the strength line and when it heads up, it is telling you strength is moving into the DI line that is on top and in control. When the ADX line has been heading down, the DI line on top has been weakening and is ready for a change.

When the DI lines swap places and cross up and the ADX heads up, it suggests strength is moving into the new DI direction.

ADX signal = Profit Payout

Each candle on the chart represents price movement of a week. As the + DI heads up and moves above the black line and both remain above the red line, it suggests there is bullish strength that could continue to grow, especially once the black line starts to turn up. If price continues to move up, the ADX line (black) will continue to turn to head up to imply that strength will continue to support the trade. As long as the ADX is heading up, it means it is supporting the bullish- up direction.

I am looking at its chart and possible trade on Monday, but the pattern should hold. You don’t want to consider entry if the current candle doesn’t move above 146 or if it drops below slanted line at 142.50. Think of it as dropping through a floor. If that happened, you would not enter or you would close the trade.

WMT Potential Trade

Please note and remember that I am typing this on Monday, two days before you receive it and the information, I am sharing could change over those two days and is intended to share the opportunities that options offer us.

Walmart (WMT) last eight weeks turned up from its pullback and this week it continued that upward move. It appears to be ready to reclaim recent highs. Its pattern should remain intact if price keeps rising. Notice the + DI is heading up and is well above the -DI line. We want the + DI to remain above the -DI (green above the red) to consider a trade. Green line on top is bullish.

Price is likely to rise further and remain above 146 entry. Its first target is 150 as the +DI (green line) moves up and the ADX (black line) turns up. Its current uptrend should remain intact, and price should continue to rise, perhaps even higher to 155. We will keep an eye on WMT over the next couple weeks.

I am looking at charts on Monday, so prices are apt to change a little by Wednesday.

The short-term price target for WMT is $150, then, perhaps, $155, and higher.

To buy shares of WMT today, price would be approximately 146. If it reaches its near-term target of $150 that would be a rise of $4 or 2% profit in a short period of time. If you bought 5 shares the total cost would be $730, and you would earn $20 total on the five shares.

This said, option trading offers the potential of a smaller initial investment and higher percentage gain even when price is expected to rise. Let’s take a look.

If you bought one Call option contract covering 100 shares of WMT’s stock with an Sept 3rd expiration date (Sept wk 1) for the $150 strike and premium would be approximately $1.72 today or a total of $172. If price increased the expected $4 to $150 target over the next few weeks, the premium might increase approximately $2 to $3.72 per share or $372 on your 100-share contract. This is a gain of $200 on your $172 investment or a 116% gain over a few weeks.

Remember you can close an option trade anywhere along the line before expiration to take gains or stop a loss.

The example above is a comparison of an investment of $730 and a $20 gain versus a $172 investment and $200 profit. Big difference.

Options can offer a win, win, win trade opportunity. They often offer a smaller overall investment, covering more shares of stock and potentially offer greater profits.

If you are having any kind of trouble taking advantage of these trades, I don’t want you to miss out. I have put together programs that help traders just like you access the potential profits that options provide. I write like we are having a conversation, so the information is easy to understand and apply. Be sure to check out the programs shared in this email and we will make it easy for you to get your share.

I love to trade, and I love to teach. It is my thing.

Yours For a Prosperous Future,

Wendy Kirkland

PS-I have created this daily letter to help you see the great potential you can realize by trading options. Being able to recognize these set ups are a key first step in generating wealth with options. Once you are in a trade, there is a huge range of tools that can be used to manage the many possibilities that can present themselves. If you are interested in learning how to apply these tools and increase the potential of each trade, click here to learn more.

Review of Past Candidates:

Two weeks ago, we looked at ConocoPhillips (COP) with an Aug 20 expiration for the 62 strike and a premium of .60. Last week, it started up and now down a little this week. Time value is evaporating as it trades flat.

Last week, we studied Applied Materials (AMAT) August 27th expiration 150 strike for 3.60 Monday. On Weds the 4th, it was probably more like 2.90. Premium went a bit higher and then has slipped to 1.91 with the market’s pullback as I type.

Recent Comments