Happy Thankful Tuesday!

I am excited to share that you don’t need special education or to sit in front of the computer all day to trade options. It can be easily learned if you are interested in spending an hour or so a week earning money in what could be considered “renting” stocks for a short period of time.

This is why I show you the details about an equity’s symbol and pattern each week.

I am typing this on Sunday. The Nasdaq was down 4 out of 5 days.

To read these articles earlier, you can always visit https://www.tradewinsdaily.com/daily-profit-play/

For the updates on previously discussed symbols, including a move that had the power to net you 58% in just a couple days please scroll down.

For today’s Trade of the Day, we will be looking at Airbnb Inc. (ABNB). Read on to see how you can set up a potential 82% grab in a short period of time.

Before analyzing ABNB’s chart, let’s take a closer look at the company and its services.

Airbnb, Inc., together with its subsidiaries, operates a platform for stays and experiences to guests worldwide. The company’s marketplace model connects hosts and guests online or through mobile devices to book spaces and experiences. It primarily offers private rooms and luxury villas. The company was formerly known as AirBed & Breakfast, Inc. and changed its name to Airbnb, Inc. in November 2010. Airbnb, Inc. was founded in 2007 and is headquartered in San Francisco, California.

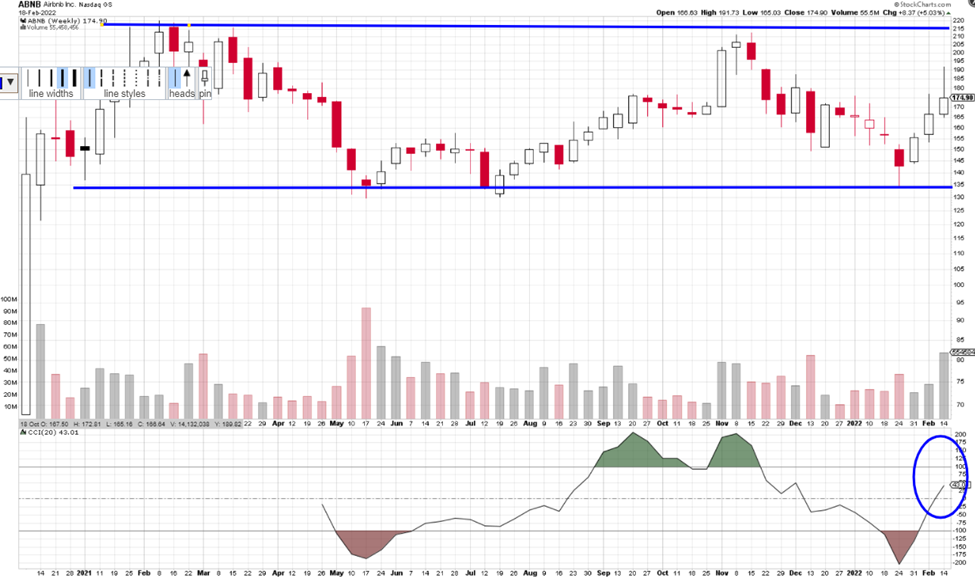

Each candle on the chart represents price movement over a 5-day (week) period. The indicator at the bottom of the chart is a Channel Commodity Index (CCI).

A cross up through the CCI zero or 100 line is bullish, in that it is suggesting price has gone from bullish to even more bullish. A cross up through the zero line and a cross through -100, suggests price is bearish. If you want to learn more about the CCI, you can read through the short section below or you can scroll down to the alert signal.

Channel Commodity Index

A cross up and over the CCI -100 or the zero line can issue an entry signal as it moves from being bearish to bullish. A rise toward 100 is a continuation of that bullishness. Up through the 100 line creates a green fin of bullishness, until it drops back down through the 100-line.

A break below the zero line means it has gone from bullish to bearish and a drop below -100 suggests even more bearishness.

The Commodity Channel Index (CCI) is a versatile indicator that can be used to identify a new trend or warn of extreme conditions. Originally, it was developed to identify cyclical turns in commodities, but the indicator can be successfully applied to indices, ETFs, stocks and other securities. In general, CCI measures the current price level relative to an average price level over a given period. CCI is relatively high when prices are far above their average but is relatively low when prices are far below their average. In this manner, CCI can be used to identify overbought and oversold levels or breaks from one level to another.

Check Out How This Trade Could Pay Out Big Time

ABNB’s is bullish as it rises to the 0 and possibly further near the 100 line. This week’s candle is apt to continue its upward movement. We are looking for a continued move to $175 before considering entry. The short term target is $185 and then higher.

If you find that you like the CCI Indicator as an easy-to-read indicator, it is included in the 5-Star Academy educational program which includes a chatroom where I am during the day to do live teaching sessions on M-W-F and to answer questions during the day. It is an incredibly supportive community.

Potential Profit Play for ABNB

If ABNB’s price continues to move up, you could consider a Call trade. I am writing this on Sunday, if price continues to move to $175 when you receive this on Tuesday, you could consider a call option trade. We are expecting the CCI indicator to continue moving to the 100 line.

These examples are listed as an example to show how options work and the advantages they offer.

To buy shares of Baidu Inc. (ABNB) stock today, it would cost approximately $175 per share. If you bought 5 shares it would cost $875. If price rose to the short term goal of $185 that would be a $50 profit. Not much of a profit on a $875 investment.

Option trading offers the potential of a lower initial investment and higher percentage gain. It is like renting stock versus buying out right. Let’s take a look.

If you bought one Call option contract covering 100 shares of ABNB’s stock with a March 18th (Mar22) expiration date for the 185 strike, the premium would be approximately $6.10 per share or a total of $610 for the contract of 100 shares. If price rose the expected $10 over the next few weeks, the premium would likely increase approximately $5.00 to $11.10 This is a gain of 82% profit. That would be a nice trade over a short period of time!

It is exciting to make money if price rises or falls.

I want to remind you that you can sell to close and take profit any time along the line before the expiration date. You don’t have to hold the contract until expiration.

Options often offer a smaller overall investment, covering more shares of stock and potential for greater profits. This is like renting stocks versus having to pay full price to buy.

This said, if you are having any kind of trouble taking advantage of these trades, we don’t want you to miss out. I have put together programs that help traders just like you access the potential profits that options provide. Be sure to check out the programs (like 5-Star Academy mentioned earlier) shared in this email and we will make it easy for you to get your share.

I love to trade, and I love to teach. It is my thing.

Yours for a prosperous future,

Wendy Kirkland

PS-I have created this daily letter to help you see the great potential you can realize by trading options. Being able to recognize these set ups are a key first step in generating wealth with options. Once you are in a trade, there is a huge range of tools that can be used to manage the many possibilities that can present themselves. If you are interested in learning how to apply these tools and increase the potential of each trade, click here to learn more.

Previous Trade Candidates:

Last week we discussed buying BIDU 180 March 18th Calls. If you bought on Feb 15th the premium was $4.45. The premium did not move much throughout the week. We will continue to monitor this trade.

Two weeks ago we discussed buying JD March 18th 75 Calls. Premium on 2/8 was $5.60. You could have sold on 2/10 for $8.85 or a 58% profit. Last week the premium has fallen. Since there is more time left before expiration, we will continue to watch this trade.

Recent Comments