With the US government shutdown seemingly approaching an end, there’s a lot of potential for the market to shift into new sectors with exciting upside potential.

As we have seen some risk-off behavior in the tech sector, new buying has emerged on the heels of a rumored resolution to the shutdown, and in that process, new sectors are being bought outside of the AI focus that we have seen in the recent past.

Since it can be tough to find the sectors and stocks that have real money flow going in, I once again am turning to the Forecast Toolbox!

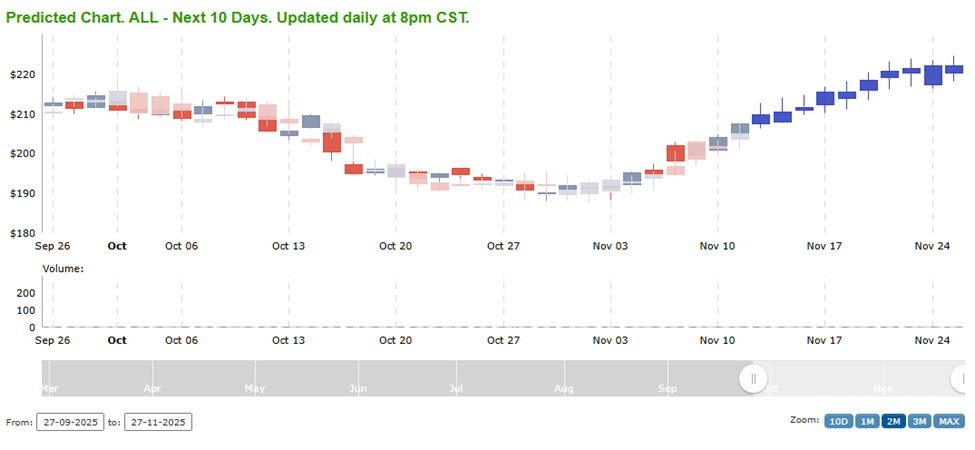

One thing I’ve noticed recently is that many lower volatility stocks are being bought in this part of the rally. There’s a combination of buying in stocks that had been underperforming and those with lower risk associated with slower-moving stocks. One prime example recently has been Allstate (ALL):

As I look at Allstate, there’s a bit of a question for me whether we’ve already run enough or if there’s more buying to come. With positive earnings last week and a recovery from 6-month lows, are we destined for consolidation or do we need to first test 6-month highs (or possibly go even higher)?

While it’s clear what already happened, the Forecast Toolbox is a key element I use to help me identify stocks that look to have continued momentum, and ALL certainly has the necessary characteristics for a bullish trade for me at this point:

With a projection of upside of about 7% in the next 2 weeks, this is a very exciting setup since ALL is traditionally a slower-moving stock. And the great thing about options is that I can leverage smaller moves for a lot less money when the market focuses on what normally happens instead of what could happen.

To get a sense of why this is such an attractive opportunity, and more so than other stocks that could rally 7% with a bit more market risk and higher volatility, I can simply look at the price of the options. ALL stock is trading at about $207 per share, and the December 19th, 2025 $210 calls are trading for $4.50. If it can run to the projected level of $222, those calls would be up in the range of $13 or $14. To get a sense of the relative leverage here, if I look at Palantir (PLTR), a $191 stock, and look at the same $210 strike for December 19th, 2025 call options, they are currently trading for $6.50. PLTR stock is $16 lower, but the $210 call options are $2.00 more expensive. This is because expected volatility (the stock’s movement) is so much higher than ALL. With great potential reward usually comes greater risk, and more expensive options. ALL has a nice setup with lower risk, on average, and a significant potential for upside. And the opportunity is certainly not one I would normally spot without the initial opportunity identified for me by the Toolbox.

If you’d like to get your hands on the Stock Forecast Toolbox and see what it can do for you, you can access a free trial HERE.

And if you have any questions, never hesitate to reach out.

Keith Harwood

Keith@OptionHotline.com

Recent Comments