I just spotted a signal from one of my most reliable indicators. Let me take you through how I spotted it and what it could potentially turn into.

Finding a stock with strong upside momentum can create a winning trade environment. When you know conditions are right for trading, you can set up a trade that fits your personal risk and profit profile. While trading always includes a risk of loss, our goal is to look for trades that help to manage as much of that risk as possible.

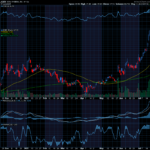

This is why I like the Moving Average Convergence/ Divergence (MACD) indicator and especially when it highlights a pattern like we are seeing in for Eaton Corp. (ETN) is a healthcare stock that you can see on the chart below.

As long as the 24/52 Day MACD line remains above the 18-Day EMA, the stock is more likely to keep trading at new highs in the coming days and weeks.

Since ETN’s bullish run is likely to continue, let’s use the Hughes Optioneering calculator to look at the potential returns for a ETN call option purchase.

Amplify Potential Returns!

The Call Option Calculator will calculate the profit/loss potential for a call option trade based on the price change of the underlying stock/ETF at option expiration in this example from a flat ETN price to a 12.5% increase.

The Optioneering Team uses the 1% Rule to select an option strike price with a higher percentage of winning trades. In the following ETN option example, we used the 1% Rule to select the ETN option strike price but out of fairness to our paid option service subscribers we don’t list the strike price used in the profit/loss calculation.

When you use the 1% Rule to select an ETN in-the-money option strike price, ETN stock only has to increase 1% for the option to breakeven and start profiting! Remember, if you purchase an at-the-money or out-of-the-money call option and the underlying stock closes flat at option expiration it will result in a 100% loss for your option trade! In this example, if ETN stock is flat at 271.12 at option expiration, it will only result in a 3.3% loss for the ETN option compared to a 100% loss for an at-the-money or out-of-the-money call option.

Using the 1% Rule to select an option strike price can result in a higher percentage of winning trades compared to at-the-money or out-of-the-money call options. This higher accuracy can give you the discipline needed to become a successful option trader and can help avoid 100% losses when trading options.

The goal of this example is to demonstrate the powerful profit potential available from trading options compared to stocks.

The prices and returns represented below were calculated based on the current stock and option pricing for ETN on 2/6/2024 before commissions.

When you purchase a call option, there is no limit on the profit potential of the call if the underlying stock continues to move up in price.

For this specific call option, the calculator analysis below reveals if ETN stock increases 5.0% at option expiration to 284.68 (circled), the call option would make 58.7% before commission.

If ETN stock increases 10.0% at option expiration to 298.23 (circled), the call option would make 120.7% before commission and outperform the stock return more than 12 to 1*.

Want Unlimited Access to our Optioneering Calculators?

You can gain unlimited access to our cutting-edge Optioneering Calculators that revolutionize your approach to trading by signing up for our Wealth Creation Alliance Trading Service. Our expert Optioneering Team has meticulously crafted calculators for six distinct option strategies, empowering you to assess the profit potential of your trades. You’ll also receive actionable trade alerts from Chuck as well as additional stock and option training. Join us today!

The leverage provided by call options allows you to maximize potential returns on bullish stocks like ETN.

The Hughes Optioneering Team is here to help you identify profit opportunities just like this one. Stay posted for our next find!

Wishing You the Best in Investing Success,

Recent Comments