Dear Reader,

Yesterday, we looked at a Daily Price Chart of Gilead Sciences, Inc. noting that GILD’s OBV line is sloping up, validating the stock’s recent bullish trend.

For today’s Trade of the Day e-letter we will be looking at a Moving Average Convergence/ Divergence (MACD) chart for The Buckle, Inc. stock symbol: BKE.

Before breaking down BKE’s MACD chart let’s first review what products and services the company offers.

The Buckle, Inc. operates as a retailer of casual apparel, footwear, and accessories for young men and women in the United States. It markets a selection of brand name casual apparel, including denims, other casual bottoms, tops, sportswear, outerwear, accessories, and footwear, as well as private label merchandise primarily comprising BKE, Buckle Black, Salvage, Red by BKE, Daytrip, Gimmicks, Gilded Intent, FITZ + EDDI, Willow & Root, Outpost Makers, Departwest, Reclaim, BKE Vintage, Nova Industries, J.B. Holt, and Veece.

Buy BKE Stock

As long as the 24/52 Day MACD line remains above the 18-Day EMA, the stock is more likely to keep trading at new highs in the coming days and weeks.

Since BKE’s bullish run is likely to continue, the stock should be purchased.

Our initial price target for BKE stock is 49.00 per share.

Profit if BKE is Up, Down or Flat

Now, since BKE’s 24/52 Day MACD is trading above the 18-Day EMA and will likely rally from here, let’s use the Hughes Optioneering calculator to look at the potential returns for a BKE call option spread.

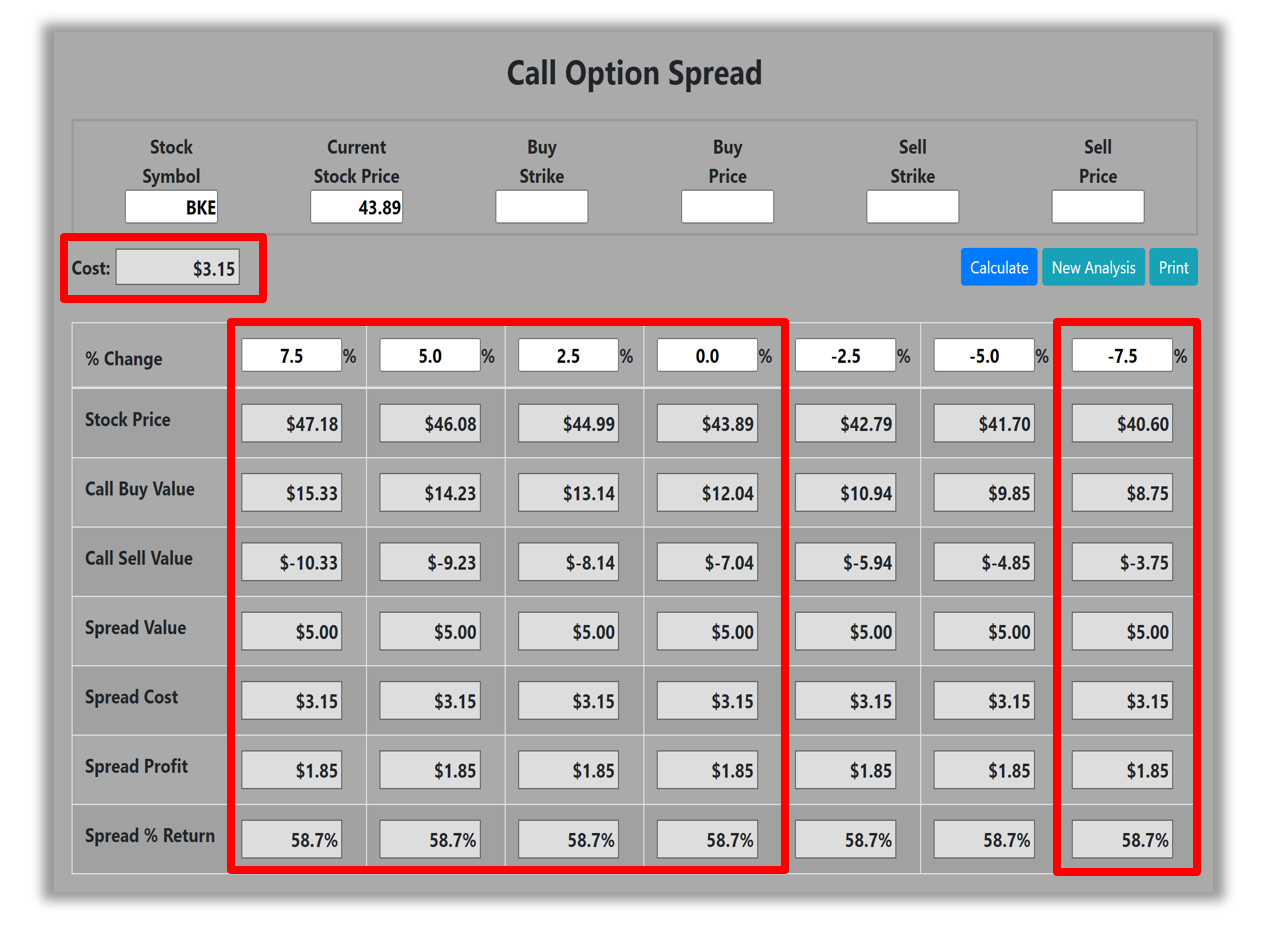

The Call Option Spread Calculator will calculate the profit/loss potential for a call option spread based on the price change of the underlying stock/ETF at option expiration in this example from a 7.5% increase to a 7.5% decrease in BKE stock at option expiration.

The goal of this example is to demonstrate the ‘built in’ profit potential for option spreads and the ability of spreads to profit if the underlying stock is up, down or flat at option expiration. Out of fairness to our paid option service subscribers we don’t list the option strike prices used in the profit/loss calculation.

The prices and returns represented below were calculated based on the current stock and option pricing for BKE on 11/30/2022 before commissions.

Built in Profit Potential

For this option spread, the calculator analysis below reveals the cost of the spread is $315 (circled). The maximum risk for an option spread is the cost of the spread.

The analysis reveals that if BKE stock is flat or up at all at expiration the spread will realize a 58.7% return (circled).

And if BKE stock decreases 7.5% at option expiration, the option spread would make a 58.7% return (circled).

Due to option pricing characteristics, this option spread has a ‘built in’ 58.7% profit potential when the trade was identified*.

Option spread trades can result in a higher percentage of winning trades compared to a directional option trade if you can profit when the underlying stock/ETF is up, down or flat.

A higher percentage of winning trades can give you the discipline needed to become a successful trader.

The Hughes Optioneering Team is here to help you identify profit opportunities just like this one.

Interested in accessing the Optioneering Calculators? Join one of Chuck’s Trading Services for unlimited access! The Optioneering Team has option calculators for six different option strategies that allow you to calculate the profit potential for an option trade before you take the trade.

Trade High Priced Stocks for $350 With Less Risk

One of the big advantages to trading option spreads is that spreads allow you to trade high price stocks like Amazon, Google, or Netflix for as little as $350. With an option spread you can control 100 shares of Netflix for $350. If you were to purchase 100 shares of Netflix at current prices it would cost about $30,000. With the stock purchase you are risking $30,000 but with a Netflix option spread that costs $350 your maximum risk is $350 so your dollar risk is lower with option spreads compared to stock purchases.

Chuck’s $3,000 Trading Scholarship

I don’t want you to miss a single opportunity to potentially reach your goals. That’s why I’d like to offer you a scholarship of the full $3,000 Enrollment Fee of my exclusive Inner Circle Trading Service**.

I want you to follow in my footsteps and succeed beyond your wildest dreams, so please call Brad in my office at 1-866-661-5664 or 1-310-647-5664 and get started today!

You can also CLICK HERE to schedule a call now!

Wishing You the Best in Investing Success,

Chuck Hughes

Editor, Trade of the Day

Have any questions? Email us at dailytrade@chuckstod.com

*Trading incurs risk and some people lose money trading.

** Inner Circle Trading Service program provides training package and specific trade signals for one year. The first 10 people to sign up each day this offer is valid, will get a waiver of the standard fee, which is the price charged to anyone signing up after the first 10 people per day.

Recent Comments