The market is bouncing its way down. Is it possible to grab profit from each swing?

Since January the market has been working its way down with a series of wild bounces. It can be very frustrating if you are constantly getting shaken out as the market drops and then makes turbulent attempts to reverse. If you are looking at these moves and wondering if there is a way to grab the down side and then make the switch to grab gains from the upswings you are not alone. This is the type of holy grail traders have reached for since trading began. To dive into this lets back up and ask a couple questions.

The first question is are you willing to commit the time and tolerate the risk it takes to effectively time the market? Just take a look at the chart of the S&P above. The churn and bounce we saw on the way up pales in comparison to the thrashing we are seeing on the way down. This year we see the S&P basically braiding the moving averages like a rope as it crosses above and below them constantly. The rebound in March is a classic example where we saw classic signs that the trend was reversing with a cross above all three moving averages only to see the bottom fall back out. If you want to time the market you had better be ready for this type contradictory move.

Another question to ask is why? What advantage would there be to putting all of that energy into trying to hit the exact tops and bottoms of each move? The goal is always the same, to make money, right? And for most the second goal is to make good returns that don’t put your hard earned capital at risk on a constant basis.

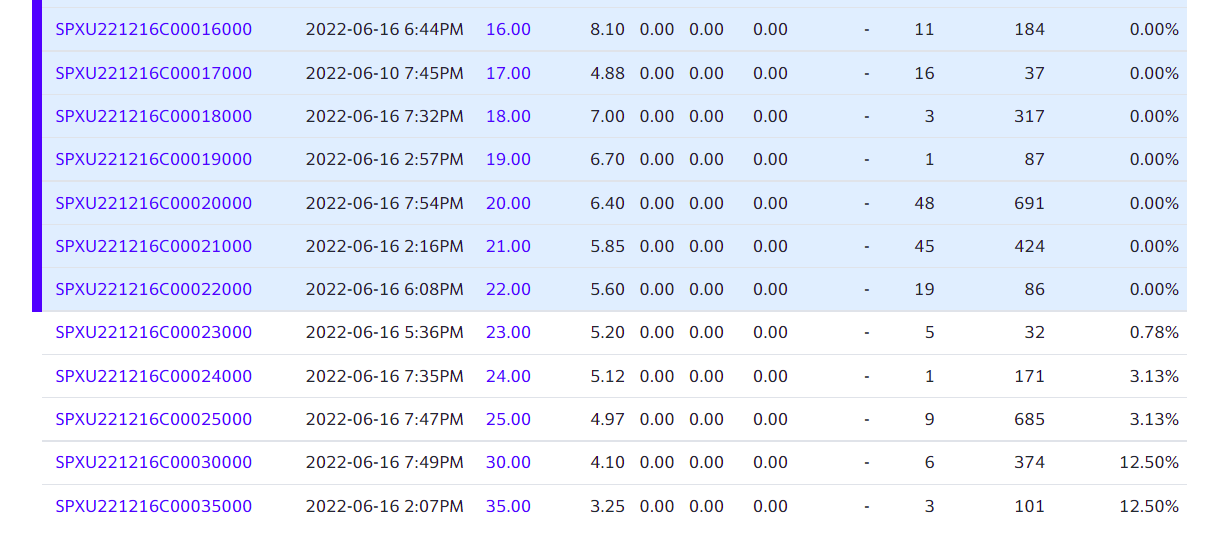

We talked about a number of ways to trade a dropping market recently but one has really proven to be exceptional. Last Friday, using the strategies Andy Chambers outlines in his Market Propulsion guide, we looked at an example that has shot up like a rocket (check it out here). His tools that leverage long term options helped us spot a Dec Call for SPXU. It was at 2.29 when we crawled through the example and it has shot up to 5.60.

This approach doesn’t require you to stay glued to your computer and gives you an extended period of time for the trade to work out. In this case it more than doubled in a week but if that didn’t happen, you could hold it as the bounces we are seeing play out and the trend pulls the market down and makes this trade potentially profitable.

At the end of the day you can find the strategy that works best for you. If calculated risk and more time for a move to play out appeals to your style, trying to time the swings may not be the best approach.

If you want more info on how Andy puts all of these pieces together, just click here.

Keep learning and trade wisely,

John Boyer

Editor

Market Wealth Daily

Recent Comments