Pay close attention to buy now, pay later stock Affirm (AFRM).

For one, Americans are taking on substantial amounts of debt.

“All major loan categories tracked in the report saw increases as well. Credit card balances topped $1.2 trillion, rising 7.3% from the fourth quarter of last year and logging the smallest yearly increase since 2021,” reported CNN. “Higher levels of household debt are to be expected as they can reflect factors such as population growth, strong economic conditions, holiday-related spending and the rise of e-commerce.”

Two, more Americans are turning to buy now, pay later borrowing.

In fact, as noted by MarketWatch, shoppers used BNPL to spend about $20 billion between November 1 and December 31, a 9.8% year over year increase.

Better, the global Buy Now Pay Later (BNPL) market is experiencing massive growth, projected to reach between $560 billion and over $900 billion in transaction volume by 2030, driven by surging e-commerce, demand, and flexible payment adoption. In the U.S. alone, the market is expected to reach $198 billion in 2026.

Three, analysts at Needham upgraded the stock to a buy with a $100 price target. The firm added that, “AFRM has submitted an application to establish Affirm Bank, a proposed Nevada-chartered industrial loan company,” as quoted by CNBC.

JMP analysts had also upgraded the AFRM stock to market perform, calling it a “long-term secular winner at the expense primarily of the credit card industry.”

All of which should help drive BNPL stock, like Affirm to higher highs.

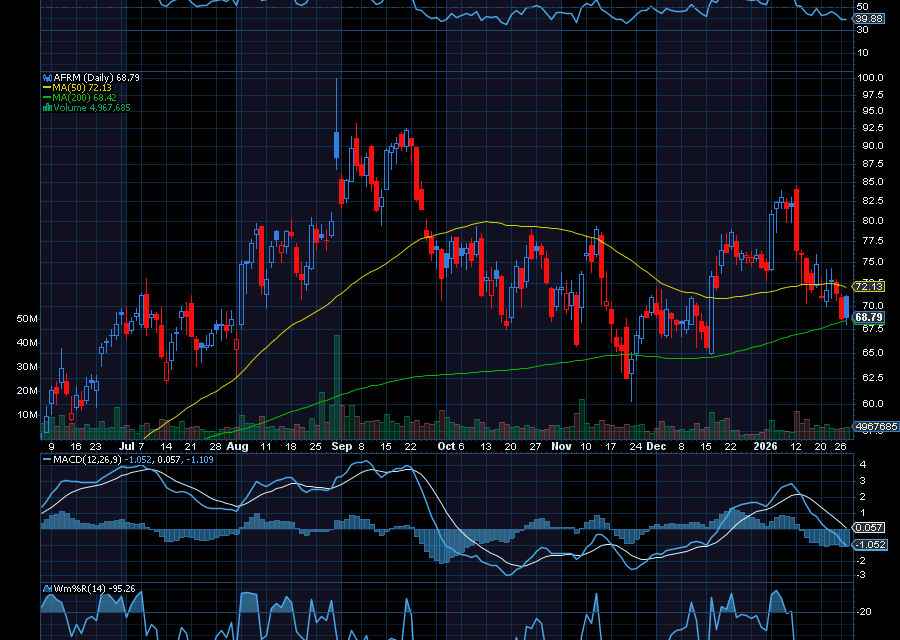

Making it even more attractive, AFRM is technically oversold at its 200-day moving average, which has served as strong support since late November.

Sincerely,

Ian Cooper

Recent Comments