Lithium remains one of the most strategically important commodities for the global shift to electrification, clean energy, and energy storage. Demand for lithium is only rising, as supply continues to dwindle thanks to lower mine activity.

In fact, lithium is shifting from oversupply to a tight deficit again.

As noted by Seeking Alpha, “Industry forecasts continue to point to lithium demand more than doubling by the end of the decade, with 2026 shaping up as a key inflection year where demand growth clearly outpaces new supply.”

“Several higher-cost producers have slowed production or paused expansions, while permitting timelines and capital discipline are keeping new mines from coming online as quickly as once expected. As a result, analysts increasingly expect the lithium market to move from surplus toward deficit starting in 2026,” they added.

That being said, investors may want to jump into related lithium stocks and ETFs such as:

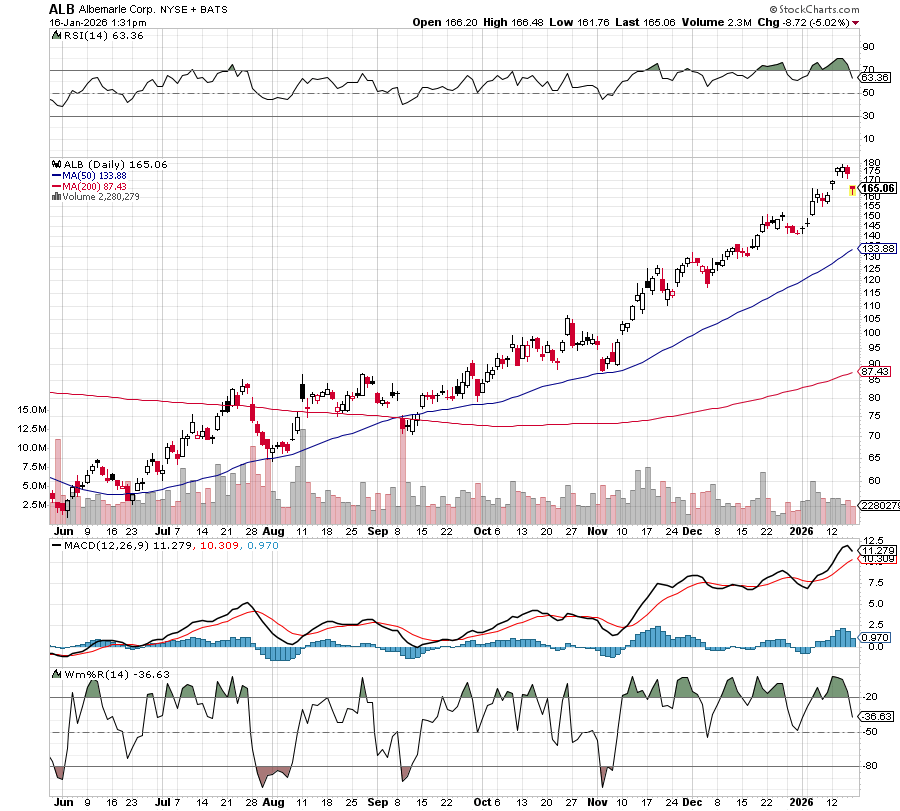

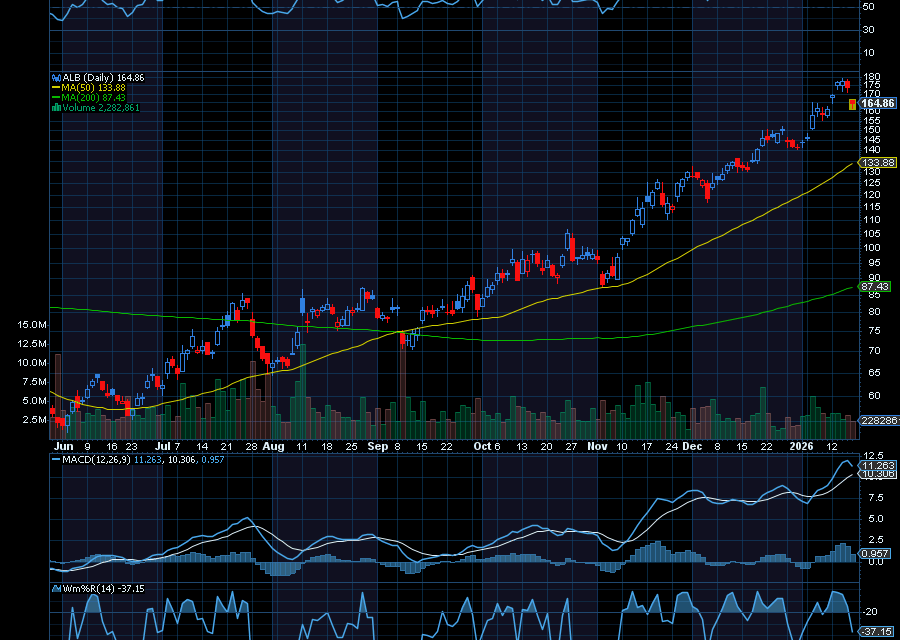

Albemarle Corporation (ALB)

Albemarle remains a cornerstone for lithium exposure and continues to attract analyst attention. Several major banks have recently raised price targets and ratings on ALB, reflecting optimism about supply constraints and stronger lithium pricing. Deutsche Bank, for example, upgraded ALB to a buy rating with a $185 price target.

Analysts at Baird also upgraded ALB to a buy with a price target of $210.

“We are incrementally positive given the recent increase in lithium prices… and our view that demand strength stemming from stationary storage will continue to propel ALB higher,” Baird analysts wrote, as noted by Seeking Alpha.

Sincerely,

Ian Cooper

Recent Comments