With the 2025 holiday season is just around the corner, investors may want to consider investing in Amazon (AMZN). That’s because, according to Adobe Analytics, online spending is expected to jump about 5.3% this year to $253.4 billion.

- U.S. online sales for the 2025 holiday season (November 1 to December 31) are forecast to be $253.4 billion, a 5.3% growth compared to the previous year.

- Cyber Monday sales are expected to come in around $14.2 billion.

- Black Friday sales are expected to be about $11.7 billion.

- And Cyber Week is expected to account for $43.7 billion in sales.

In most years, Amazon is a no-brainer stock to buy and hold for the holiday rush. In fact, with the exception of 2022, the ecommerce giant has historically pushed higher heading into the holidays, which we expect to happen again this year.

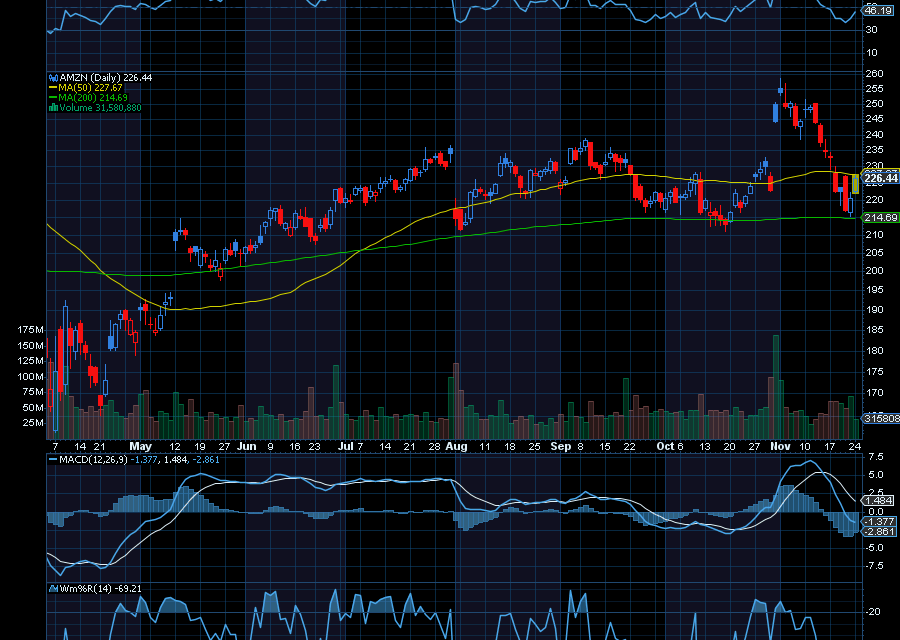

AMZN also just caught strong support at its 200-day moving average and is just starting to pivot higher. It’s also pivoting from overextensions on RSI, MACD, and Williams’ %R. We’d like to see AMZN retest $240 initially heading into the holiday season.

From here, we’d like to see the ecommerce giant challenge its prior high at around $238.85 near term. Longer term, we’d like to see AMZN at $250 a share. Goldman Sachs also reiterated its buy rating on Amazon, noting that it’s well-positioned for the holidays.

Sincerely,

Ian Cooper

Recent Comments