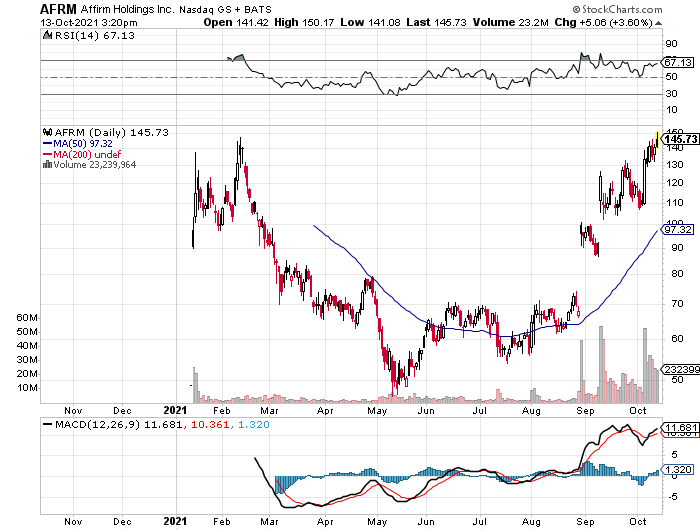

Affirm Holdings (AFRM) could see higher highs.

All as the “Buy Now, Pay Later” boom showing no signs of slowing.

For one, according to Barron’s, “BNPL is gaining popularity given that interest rates are ultralow, reducing costs for consumers. Other fintech apps have entered the market, including Affirm, a pure play on the sector, and PayPal (PYPL). Apple (AAPL) is also developing a BNPL service with Goldman Sachs Group (GS), its credit-card partner.”

Two, according to Bank of America, BNPL apps could grow 10-15x by 2025, and could eventually process $650 billion to $1 trillion in transactions. Three, we’re already seeing a good deal of BNPL acquisitions. Square for example recently bought Afterpay for $29 billion. PayPal announced it would buy Japan’s Paidy for $2.7 billion. Better, Amazon.com plans to make Affirm’s BNPL services more broadly available in the coming months.

AFRM last traded at $146.06, and could be headed to $200 a share, near-term.

Ian Cooper

To follow my Chart of the Week, click here: https://www.tradewinsdaily.com/category/chart-of-the-week/

Recent Comments