With all of the chaos in the markets, it’s a good idea to protect your portfolio and generate income with high-yielding stocks.

Look at real estate investment trusts (REIT), for example.

For one, most are a great hedge against inflation. After all, when inflation rises, so do a lot of rents. Two, we’re seeing a recovery in demand for offices, apartment buildings, warehouses, hospitals, shopping centers and hotels. We’re also seeing bigger demand for e-commerce, logistics and warehouse demands, as noted by JPMorgan.

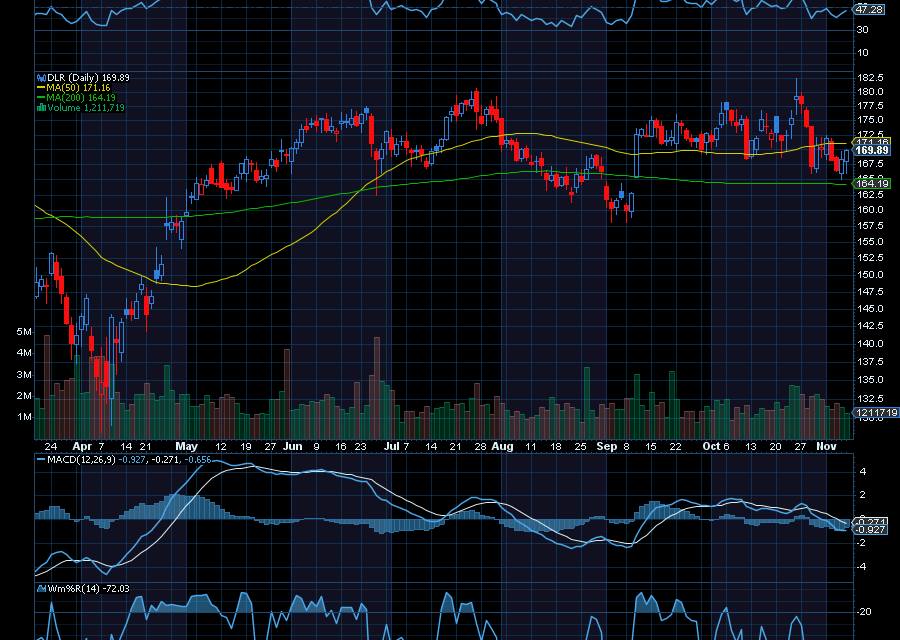

Look at Digital Realty Trust (DLR)

With a yield of 2.91%, Digital Realty Trust (DLR) has more than 300 data centers and has now become one of the biggest REITs in the U.S. with a market cap of $57.71 billion. DLR also declared a quarterly dividend of $1.22, which will be paid on January 16, 2026 to shareholders of record as of December 15, 2025.

Helping, future growth is being fueled by the artificial intelligence data center boom.Thanks to artificial intelligence, data center demand is expected to rise at a 15% CAGR until 2030, according to Goldman Sachs. Plus, according to analysts at HSBC, data center demand has far outweighed supply thanks to AI demand and constrained supply in key markets. They also expect DLR to see further, strong momentum as we get into 2025.

Sincerely,

Ian Cooper

PS – I have been seeing a very interesting pattern in the charts and it has been very lucrative in the past. I want to show you what I am seeing and how to trade it. I’ll be live this Wednesday at 1PM ET to walk through it. Grab a spot here.

Recent Comments