Always keep track of stock splits.

While splits don’t change the value of a stock, they can serve as a positive signal. This can then lead to further liquidity and more investor interest. After all, if an attractive $500 stock were to split 10:1, more investors are likely to jump in.

Plus, according to Morningstar.com, “Splits matter – because these stocks outperform after the announcement, by a lot. Average returns one year later are 25% vs. 12% for the S&P 500 SPX as a whole, say researchers at Bank of America. It’s worth brushing up on stock splits now, for two reasons. Stock splits are picking up again after a decade-long lull.”

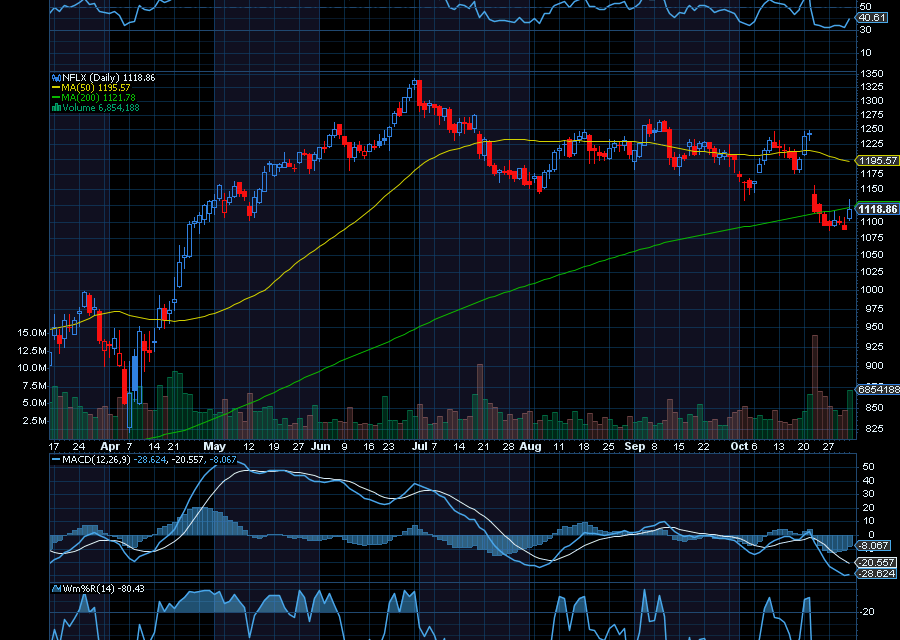

Look at Netflix (NFLX)

Now at $1,113.80, Netflix just announced a 10 for 1 split, which will help make it even more attractive to investors who don’t want to shell out $1,000 for a stock. On November 10, shareholders will receive nine additional shares for every one share owned.

According to the company, it’s doing so to “reset the market price of the Company’s common stock to a range that will be more accessible to employees who participate in the Company’s stock option program.”

Sincerely,

Ian Cooper

Recent Comments