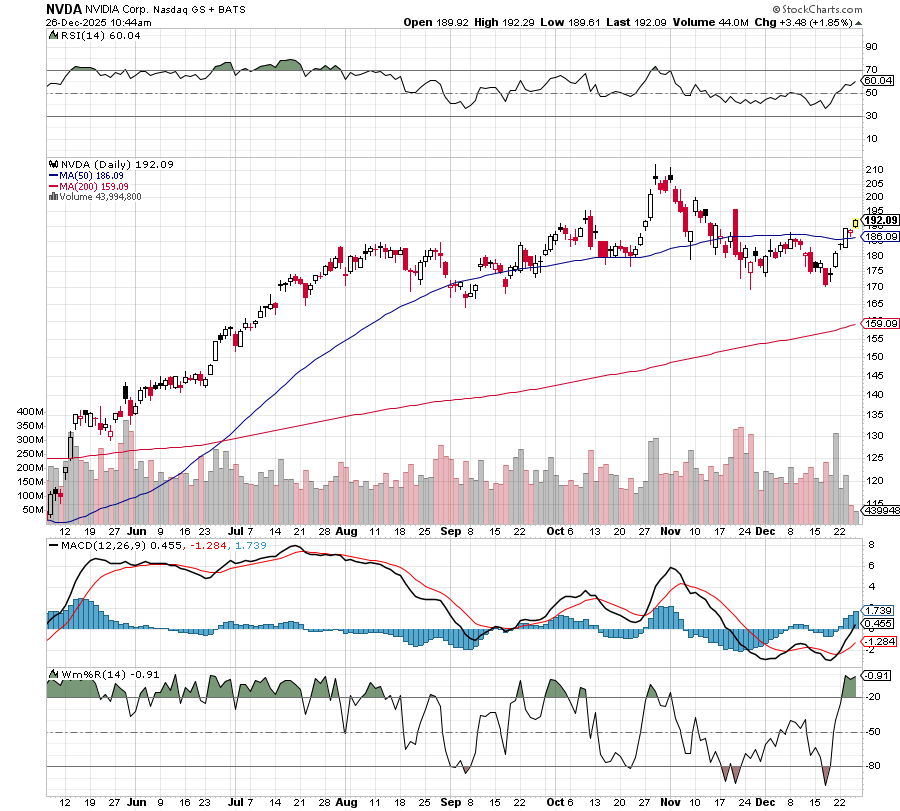

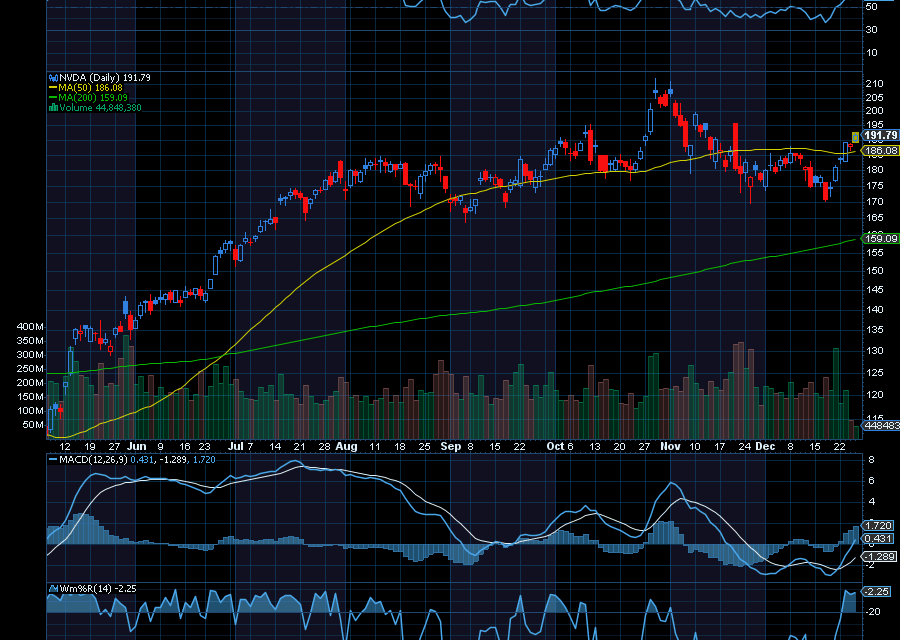

After finding strong support at $170, Nvidia continues to ramp higher.

Last trading at $190 in premarket, NVDA is up on news that it agreed to pay $20 billion to acquire assets from Groq, an AI startup. From here, given the strength of the AI boom, we’d like to see NVDA closer to $200 before the end of the year.

Helping, just days ago, Barclays upgraded NVDA to a buy on stronger AI spending.

“We are OW as the company has long-term sustainable growth led by a large lead in GPUs for AI in DC, with further Edge opportunities (autos, robots, etc.) and a competitive moat around a large portion of the market,” said the firm, as quoted by CNBC.

Even better, Wedbush’s Dan Ives says NVDA could see $250 by the end of 2026. In fact, he argues that the market is still underestimating the critical role NVDA plays in AI.

“The reality is there’s one chip in the world, fueling the AI revolution, and that’s Nvidia. And I think as it plays out, numbers are significantly underestimated. I think 15% to 20% at a minimum going into 2026. You put that together, I think we’re looking at a $250 stock in a base case to end 2026,” said Ives, as quoted by Yahoo Finance.

Sincerely,

Ian Cooper

Recent Comments