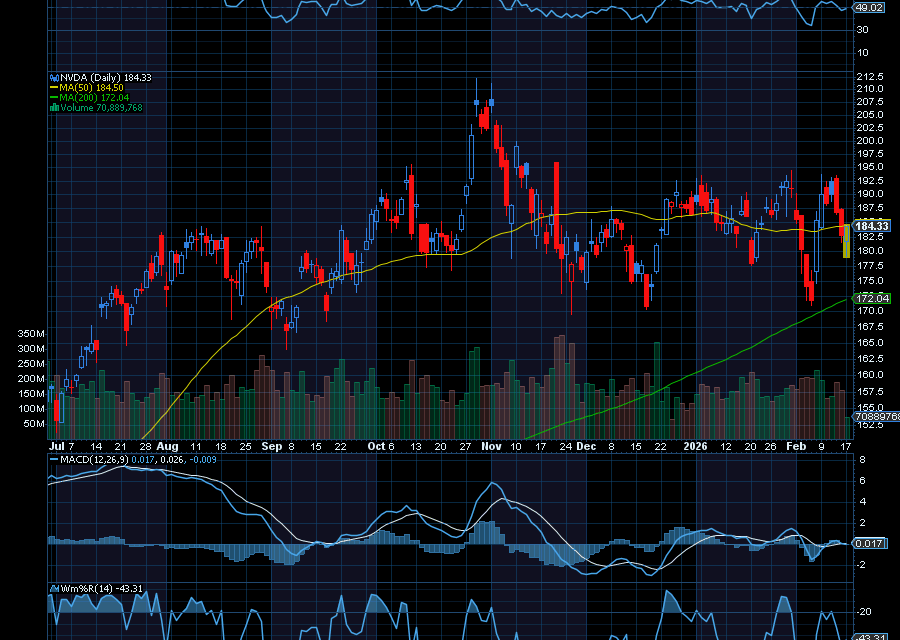

Nvidia (NVDA) is sinking.

But with earnings just days away, we do expect to see explosive upside.

For one, analysts at Citi just reiterated a buy rating on the tech giant. The firm noted that it’s recommending investors add to NVDA, as the valuation looks attractive and the stock is likely to outperform in the second half of 2026.

That’s because its status as an AI leader has made it a key bellwether for all AI stocks. The good news is that big tech companies that operate data centers, or hyper-scalers, are saying they will increase AI capex this year, with a good chunk of that going to AI. We also have to consider that CEO Jensen Huang has said demand for the company’s new Blackwell platform data center products was “off the charts.”

Also, as noted by analysts at Wedbush, “Looking ahead to the remainder of 2026 and into 2027, the focus is already shifting toward NVIDIA’s next milestone: the Rubin (R100) architecture.

Solid earnings, guidance, and anything positive about Rubin could ignite a big rally in Nvidia and the overall tech sector.

Sincerely,

Ian Cooper

P.S. I have been tracking a way to exploit the rising volatility we are seeing and it has been working better than I expected. If you want to see how I am doing it, join me on Wed. Feb 18 at noon EST.

Recent Comments