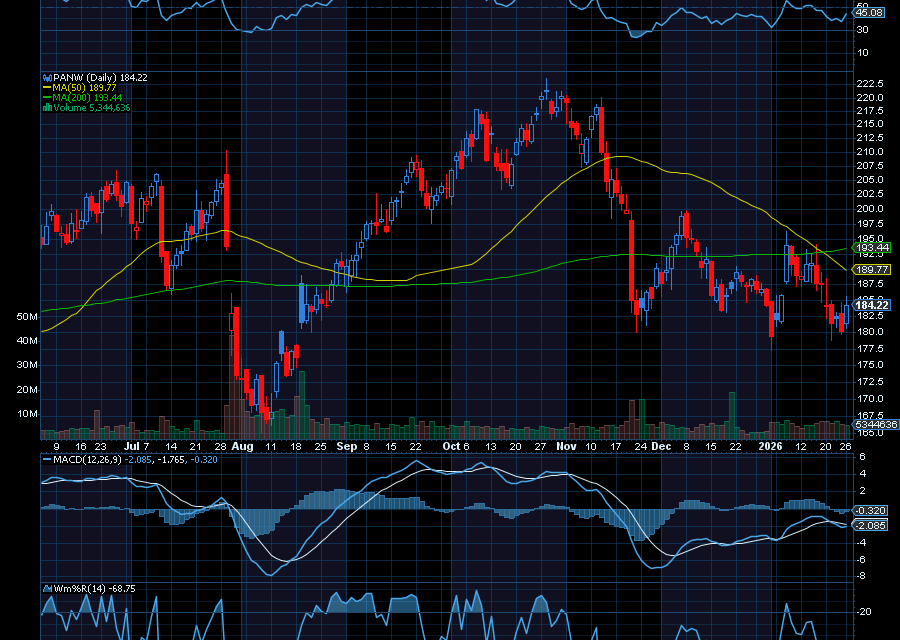

Trading at $180.18, Palo Alto Networks is oversold at triple bottom support dating back to late November 2025. It’s also oversold on RSI, Full Stochastics, and Williams’ %R.

In fact, the last few times it was this oversold using those technical pivot points, the stock bounced back from about $144.15 in April to 200; from $165 in August to $220; and from $180.18 in November to a high of about $200. Nowadays, it’s just as oversold.

Helping, analysts at JPMorgan recently raised their price target on PANW to $235 with an overweight rating. The firm added that PANW has “established the most comprehensive end-to-end platform of Security Software within our coverage universe,” adding that the company is “well positioned as a long-term share consolidator,” as quoted by CNBC.From its current price of4 $180.18, we’d like to see PANW closer to $194 initially.

Sincerely,

Ian Cooper

Recent Comments