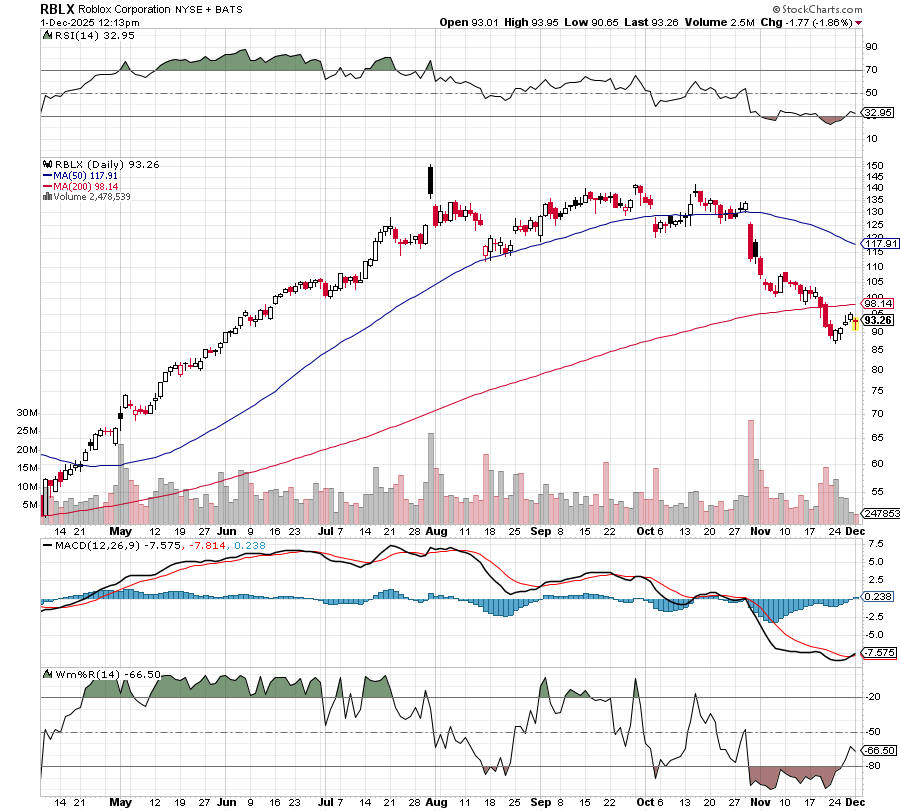

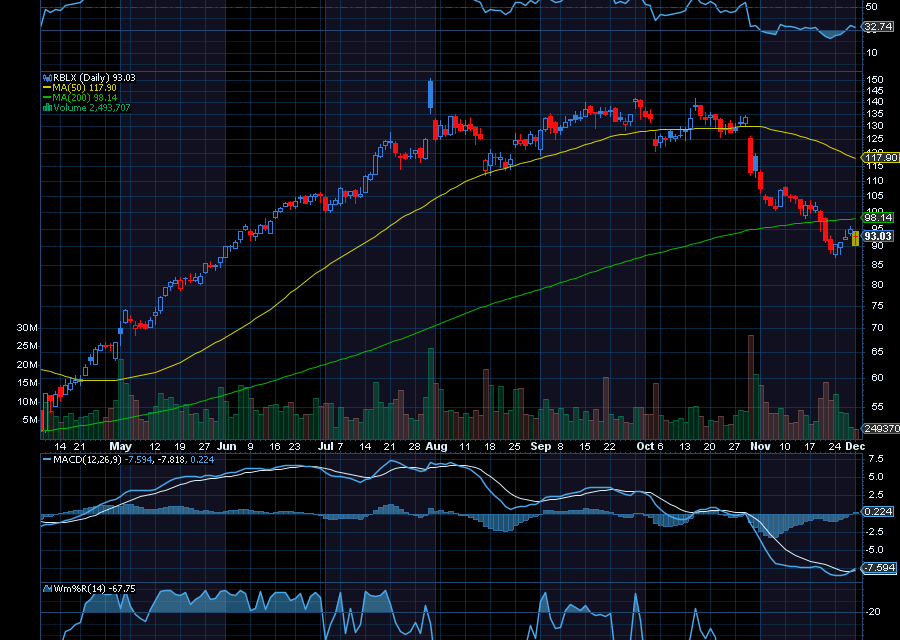

Keep an eye on oversold shares of Roblox (RBLX).

After falling from about $135 to about $87 a share, RBLX is slowly starting to pivot higher. It’s also starting to pivot from over-extensions on RSI, MACD, and Williams’ %R. From its current price of $95.03, we’d like to see RBLX retest $130 again shortly. The last time the stock was this technically oversold in April, it bounced from about $50 to $150.

Not long ago, Goldman Sachs upgraded the RBLX stock to a buy rating.

“The research firm was encouraged by the company’s strength in bookings, revenue, and DAU growth in Q3, and by the management’s commentary expressing a continued and rising sense of optimism surrounding the long-term scaling of the platform and its ecosystem,” as noted by Seeking Alpha. “Looking beyond Q3, Goldman expects Roblox to produce compounded forward bookings growth of 20%+ and a meaningfully higher rate over the next 6-18 months.”

In addition, as noted by Barron’s, “On average, over 150 million users, mostly under 17 years old, were on Roblox daily in the third quarter, which is the seasonal peak of gameplay. That’s the equivalent of the Super Bowl audience—every day. There are millions of games, most of which are made possible by Roblox’s easy-to-use programming tools.”

At its current price, RBLX is severely oversold.

We’d like to see it regain momentum with a retest of $130 again shortly.

Sincerely,

Ian Cooper

Recent Comments