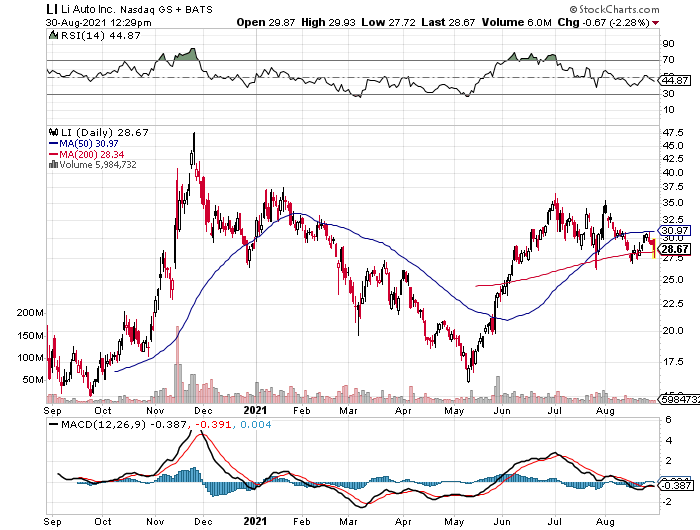

Chart of the Week — Li Auto (LI)

Keep an eye on Chinse electric vehicle stocks, like Li Auto (LI).

At the moment, it’s sitting at triple bottom support, but could soon test a prior high of $34. Not only did the company just beat Q2 estimates, it provided a strong outlook.

For the second quarter, losses narrowed to $10.1 million, as revenues soared 159% year over year to $780.4 million.

For the third quarter, Li Auto, “expects to deliver between 25,000 and 26,000 electric vehicles, which would be an increase of 189%-200% from the third quarter of 2020. It sees revenue reaching RMB 6.98 billion-7.25 billion ($1.08 billion-$1.12 billion), an increase of 178%-189% from a year earlier. That prediction is subject to changes in market conditions, “in particular, the ongoing industry-wide semiconductor shortage due to the global Covid-19 pandemic.”

Going forward, Li Auto expects delivery vehicles to fall in a range of 25,000 and 26,000, which would represent growth of 188.7% to 200.2% year over year. It also expects to see revenues fall in a range of $1.08 billion and $1.12 billion, which would represent growth of 177.8% to 188.9%, year over year, according to the company.

Looking forward to getting started with options, do you offer fee based advice? Just like to get it going