by Don Fishback

We’re going to do the same thing that the prudent insurance company would do. And it’s going to shock you how easy it is to do it! The strategy even has a name. The tool we’re going to use that duplicates this insurance/reinsurance business model is called a credit spread. We’re going to collect a premium, and then use a portion of the premium we’ve collected to cap our risk.

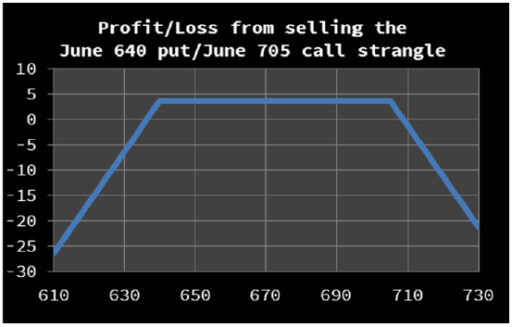

Let’s look at two examples. In the first example, let’s assume that it is May option expiration. We want to sell a strangle that has an 80% probability of profit. The OEX is at 671.76. We want to sell a call that is 5% above the current market price (705.35) and a put that is 5% below the current price (638.17). The call we want to sell is the 705 call, priced at 1.75 ($175). The put we want to sell is the 640, priced at 2, ($200). Our total credit is 3.75 ($375 per spread). Below is a graph of the short strangle.

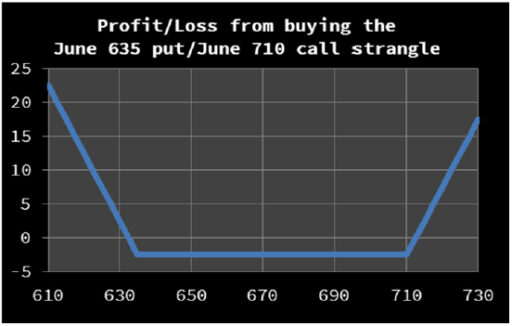

Now let’s look at the trade using credit spreads. It is May option expiration; we are looking for a trade with an 80% probability of profit. We want to sell a call that is 5% above the current market price (with the OEX at 671.76, 5% above is 705.35) and simultaneously buy a call one strike price further out-of-the-money. Also, at the same time that we want to sell a put that is 5% below the current price (638.17), we want to buy one put one strike price further out-of-the-money. The call we want to sell is the 705 call priced at 1.75 ($175). The call we want to buy is the 710, priced at 1.25 ($125). The put we want to sell is the 640 priced at 2 ($200). The put we want to buy is the 635 priced at 1.25 ($125).

We’ve already looked at the options we’d be selling as part of the credit spread combination. Now let’s look at the options we’d be purchasing as part of the total transaction. As noted, we’re buying the 710 call and buying the 635 put for a total of 2.50 ($250). Remember, when you buy an out-of-the-money call and put at the same time, you are long a strangle.

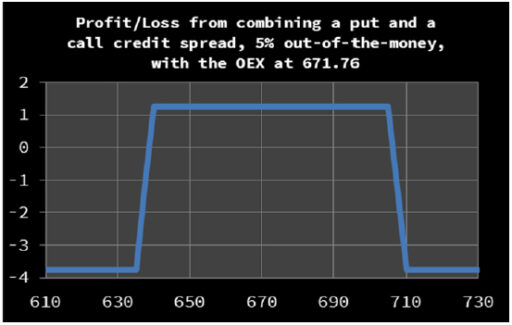

In the credit spread strategy, we are going to combine the long strangle with the short strangle. We are collecting 3.75 ($375) when we sell the strangle. Next, we’re going to turn this position into two credit spreads. We’re going to take a portion of those funds we’ve collected and buy a strangle, the 710 call and the 635 put. Both options are one strike price further out-of-the-money than their put and call counterparts in the short strangle. We will be paying out 2.50 ($250) for the long strangle. The net credit, for the entire strategy is 1.25 ($125)—definitely smaller than $375. The key, however, is that our risk is limited to only $375. That’s because the maximum risk is equal to the difference between the strike prices, minus the net credit received.

Here is a graph of the combined credit spreads:

Here’s why credit spreads are preferable for the risk-averse investor. Note that if the OEX were to go down to 632.5, the loss from selling the strangle would be $375. On the other hand, the loss from selling the credit spread would be only $375. If the market kept dropping, and the OEX fell to 610, the loss from selling the strangle would have been $2,625.00, but the loss from the credit spread would have been only $375—a dramatic improvement. If you’ve implemented five strangles, your losses exceed $13,000.00. If you’ve implemented five credit spreads, your maximum losses are $1,875.

That is one thing you have to be aware of when evaluating credit spreads is they tend to look good only when you are comparing it to the catastrophically improbable.

In other words, if the probable happens, taking on potentially unlimited risk via a short strangle looks great… in hindsight. But if the improbable occurs, you’re out of business.

With credit spreads, the profits are not as great. But if the improbable does happen, you’re not out of business. You won’t win! But the loss won’t be so devastating that it does to your account what Hurricane Andrew did to some insurance companies—wipe them out. You’ll still be around to trade another day.

Recent Comments