Is now the time to buy the dip in tech? Or is it time to rotate to another sector? Or is holding cash the new king for now?

These questions can all be answered with yes, and all can be answered with no. The key is understanding what type of risk you want to take as a trader and expressing that risk view in the right trade. Adding options into your portfolio can help add leverage when you have conviction and define risk in case you are wrong – the key is understanding how much risk and how much potential reward is present in each of these trades, and that’s why I’ve spent the last 18 years learning the tools of the trade so I can bring that knowledge and understanding to you.

And right now, I’m looking at several sectors for bullish and bearish entries and several sectors that I’m simply not interested in for now. No matter which sector I enter, I plan to enter with options to use the best tool for each trade. That’s the key to trading – every trader must maintain an open mind and express their market view the right way in the right sector with the right trade. Sometimes the right trade is a stock position, but often, there’s a better options trade once a trader’s conviction is set.

That’s why I send out my Outlier Watch List every week – to explain which stocks I have the highest conviction in and how I am willing to express my view with options!

But today, I don’t have a lot of conviction in many sectors (don’t worry, there are a few amazing setups, and I’ll highlight one of those shortly).

First, I showed you all some serious warning signals in QQQ last week. Well, let’s look at it now:

QQQ fell, tried to recover, and seems to want to test the 20-Day Moving Average (or lower) once again. Sometimes, those early warning signs are simply right. And because of the recent fall and lack of clarity in the short-term, I’m simply looking away from QQQ for my next big trade.

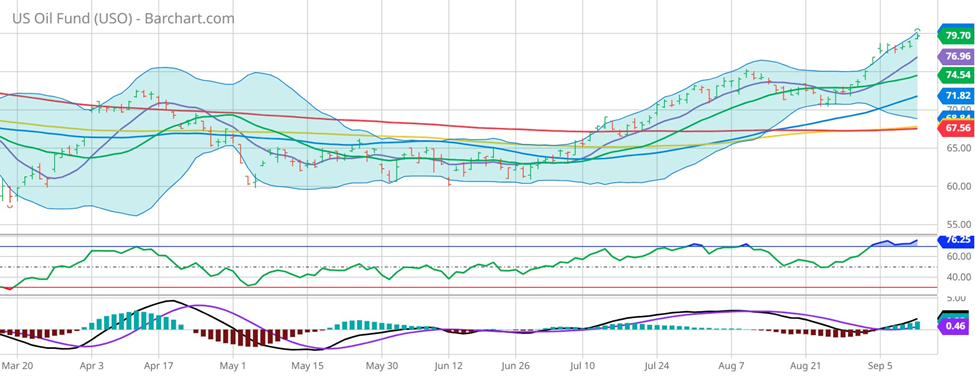

Fortunately, there’s something that just keeps going higher, and that’s oil prices, highlighted by the ETF USO:

USO is making a new high. There’s got to be something that I can buy thanks to this move, right?

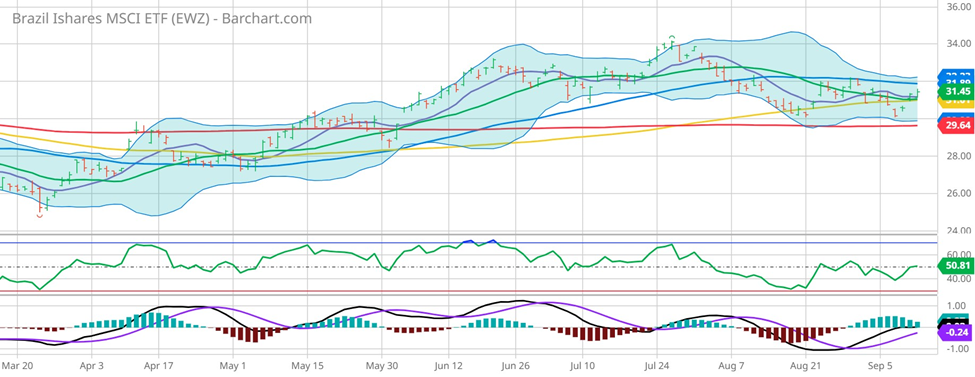

Well, there are many country-based ETFs that tend to perform quite well during oil spikes. After my time spent with a commodities-based hedge fund, the country I think of first is Brazil. So, let’s look at EWZ:

Given the move in oil, this ETF doesn’t look very exciting – shouldn’t it be performing better? Or, perhaps USO is the big leading indicator for this trade and the investment community simply needs to get involved and rotate out of tech and into something that’s more clearly bullish!

Now, you all know by now that I like to find individual stocks when a divergence seems to be occurring. Today is no different. I immediately thought of Petrobras, stock symbol PBR:

Testing highs, but not breaking out like USO is an initial point of interest, this stock looks like a potentially big winner if oil doesn’t collapse. Now that it’s near the highs of June when USO was 15% lower, this stock is at a serious point of interest. And I have an easy technical entry point – a new high, and certainly entered with options. All of this points to a setup that would traditionally make it to my Outlier Watch List!

So please, go to http://optionhotline.com to review how I traditionally apply technical signals, volatility analysis, and probability analysis to my options trades. As always, if you have any questions, never hesitate to reach out.

Keith Harwood

Keith@optionhotline.com

Recent Comments