Take a look at this example of a trade I just spotted. Finding great bargains that are overbought or oversold doesn’t have to be as hard as it may seem. Let me show you what I noticed on a chart of EOG Resources (EOG).

Be sure to check out the update on a previous trade at the bottom of this message.

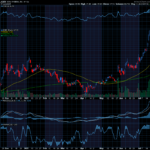

On the chart below, I included the Channel Commodity Index indicator which I use to help me spot powerful reversals that are setting up. If you want more information on the CCI click here.

On the CCI at the bottom of the chart you’ll see highlighted areas that look like fins. These tell us there is a high likelihood that the price is changing directions. When that happens, it creates a great trading opportunity.

In this example we want CCI on EOG to go up to create a clear fin shape. We also want the price to go up to at least $122 before entering a trade. The first target would be $124.

To buy stock shares of EOG today, price would be approximately $121.28. If price went to $124 you would make about $2.72 per share.

That said, option trading offers the potential of a smaller initial investment and higher percentage gain even when price is expected to rise or fall. Let’s take a look.

If you bought one Call option contract covering 100 shares of EOG’s stock with a April 21st expiration date for the 124 strike, premium would be approximately $2.15 today, or a total of $215 per contract. If the stock price rose the expected $2 the premium might increase approximately $1 to $3.15 per share on your 100-share contract. This is a 47% gain over a couple weeks.

Options can offer a win, win, win trade opportunity. They often offer a smaller overall investment, covering more shares of stock, and potentially offer greater profits.

I love to trade, and I love to teach. It is my thing.

Wendy

Past potential trade update:

Last week we discussed buying IBM calls. On 3-30 the April 21st 135 call was $1.39. The premium on 4-3 was $2.24, a 38% profit.

Recent Comments