Where is the market trend?

When I look at the broad market, it’s difficult to see a clear trend in the broad market. Every rally seems to be followed by a sell-off. Every sell-off seems to be followed by a rally.

This is what they call a stock-picker’s market. Finding the hidden gems is crucial when the market doesn’t have an overall trend. Let’s look at SPY to start:

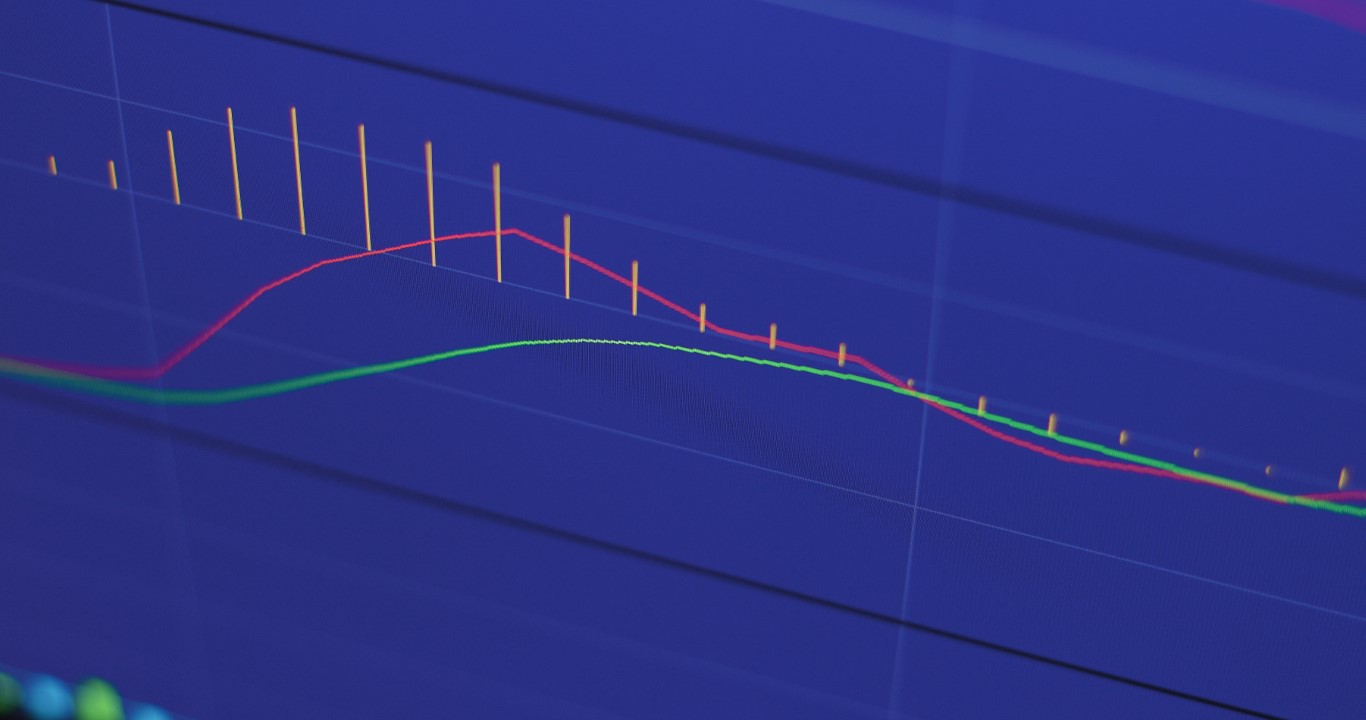

As you can see, SPY is drifting higher over time, but showing some question marks here as it tests the 20-Day Moving Average. This could be the top, or it could be a short-term consolidation period. For me, to be bullish the market, I need a new high, and to be bearish, I need to see a failure of support, and likely a breach of the 50-Day Moving Average to show some momentum. In other words, I see nothing great today, but perhaps I will see something there tomorrow.

How about tech? Let’s look at QQQ:

Tech is similar to the S&P 500, but with a bit of relative weakness as it has tested the 50-Day Moving Average repeatedly in the last week. This, again, is illustrating a need for a new high to be bullish or a breach of the 50-Day Moving Average to be bearish.

But there’s always a trade if you dig deep enough. One that I’m looking at right now is in biotech, so let’s look at XBI:

After pulling back to the area of consolidation formed in January and early February, XBI seems to have found support. There’s a higher high, there’s support at the 100-Day Moving Average, and there’s a target at the prior high around $102. With just over 10% of upside, there’s certain to be some interesting potential here in the biotech space to look for names to add to by Outlier Watch List.

With that, I’ll be diving deep into the component stocks of XBI to find more interesting technical setups that have attractive options volatility, as well. And just like that, I’m starting to pick my stocks in this stock-pickers market.

As always, please go to http://optionhotline.com to review how I traditionally apply technical signals, volatility analysis, and probability analysis to my options trades. And if you have any questions, never hesitate to reach out.

Keith Harwood

Keith@optionhotline.com

Recent Comments