Markets ended last week on a downturn and all signs are pointing to the decline to continue. While earning season is chugging along, inflation concerns are taking control while new spike in COVID cases are popping up.

This type of momentum shift will often occur as new economic data doesn’t match markets’ expectation. Sentiment is not where traders hoped it would be as we continue to figure out what a post pandemic world will look like and it is creating enough fear to pull the markets lower.

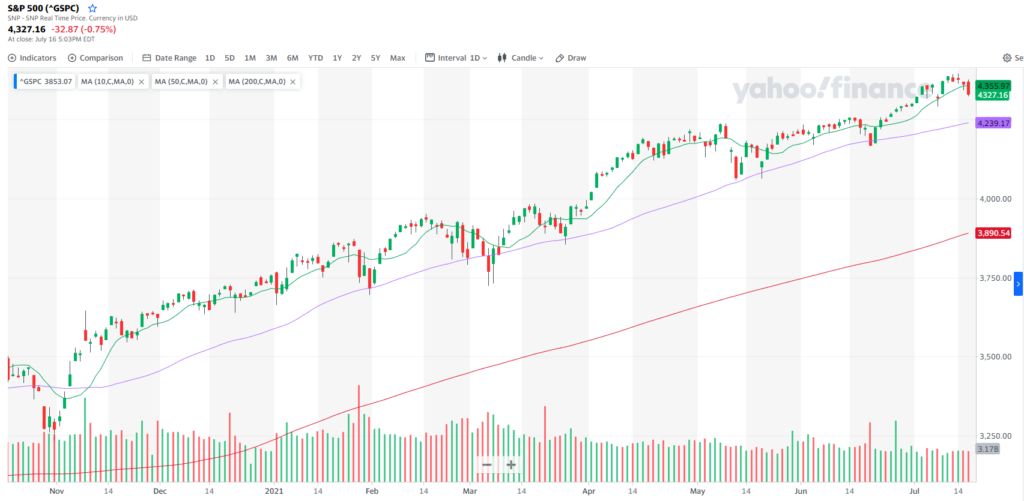

All three indexes ended last week below their 10 day moving average, an early sign of a reversal. Now we are going to look for confirmation of the trend as we open up a new week. The charts show what we have to keep an eye on as the market chooses a direction. Take a look:

(chart below)

As we talked about last week (read the article here) we noted that the S&P has consistently pulled down to its 50 day moving average and found support. This is a very likely next move. At the very least we should expect to use the 50 day as a target. If it gets down to that price, we can can look at other momentum indicators to see if the trend down will continue.

Joe Duffy assembled a concise and extremely effective collection of momentum setups and it is a must read guide for situations just like this.

You can grab your copy here.

Keep learning and trade wisely,

John Boyer

Editor

Market Wealth Daily

Recent Comments