From Ian Cooper, Author Trigger Point Trade Alerts

Use Weakness in Uber and Lyft is an Opportunity

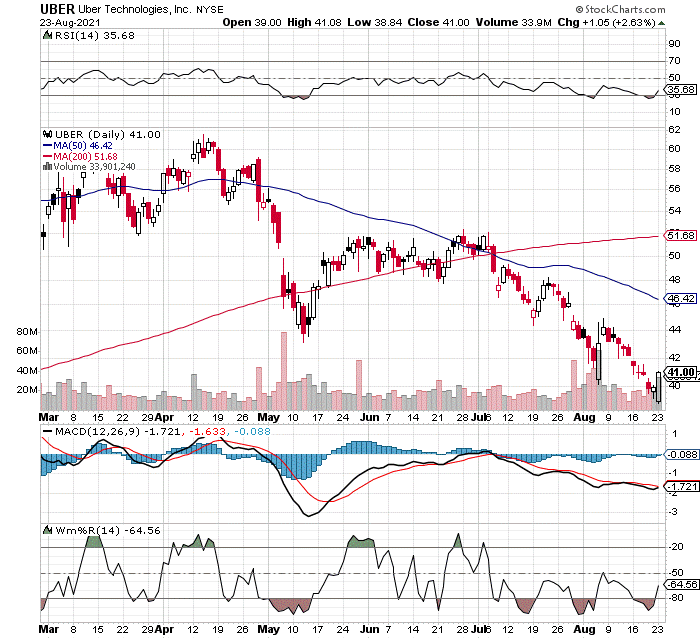

Investors may want to pay close attention to ride-hailing stocks, like Uber and Lyft.

Over the last few days, a California court struck down a measure that exempted them from a law requiring drivers to be classified as employees to receive benefits.

Temporarily, that’s not great news for the companies.

However, crisis may lead to opportunity here. For one, according to The Wall Street Journal, “The companies don’t need to immediately change their way of doing business, but Friday’s ruling adds a wrinkle in their efforts to preserve their independent-worker models and serves as a setback in their years-long fight against the California law at the heart of the ruling.”

Two, analysts are telling investors to buy on weakness.

Mizuho analyst James Lee says the appeal process could take up to a year. He also says Prop 22 will remain in effect, for example. He also just reiterated a buy on Uber with a $72 price target.

Bank of America’s Justin Post also reiterated a buy on Lyft. He also has a buy rating on Uber with a price target of $64 a share. “With Prop 22 winning in the 2020 election by a wide margin (5 9%/41%) and legal challenges to ballot initiatives in CA being fairly common, we expect many investors to see a solid basis for winning an appeal,” said Post, as quoted by Street Insider.

Ian Cooper

PS-To see some of my previous picks, click here

Recent Comments