by Peter McKenna

For many years, full-service brokerages had it easy. They charged individual investors hefty commissions for recommending stocks and executing trades. The bull market put an end to their dominance as discounters entered the fray. The discounters did not offer stock recommendations, but they offered executions at a fraction of the commissions charged by the full-service brokerages.

Managed Accounts

Today, full-service brokerages are in a dogfight with the discounters. To justify their higher commissions, they have promoted the concept of the managed account, also called the wrap-fee account. Instead of individual commissions, brokerages are now charging a yearly fee based on the amount of money an investor puts into an account. If you open an account with $500,000, for example, you will pay the brokerage about $5,000 per year to “manage” your money.

To draw clients into this concept, full-service brokerages must convince investors that only Wall Street professionals have the wisdom and experience to make their dreams come true. You can see this marketing strategy in action every time you watch a television commercial for a full-service brokerage. The pitch goes something like the following: “Do you want to retire early to a chateau in the South of France? If so, let us manage your money. We will develop an investment plan specifically suited to your retirement dreams. Why? Because we care about you.”

How do brokerages convince the public to believe in this pipe dream? First, they must convince investors that only Wall Street professionals can successfully manage money. They do this by continually singing the virtues of following investment strategies, as proof of their wisdom and conservative philosophy:

1. Diversify your holdings.

2. Let professionals plan your financial future.

3. Follow the buy-and-hold strategy religiously.

Let’s take a closer look at these strategies.

Diversify Your Holdings

This certainly sounds like a responsible strategy. Brokerages recommend that investors buy a few tech stocks, a few blue-chips and some bonds and mutual funds, with the lion’s share of the money put into stocks. The idea is that your money is safer if it’s spread across several different types of investment.

Here’s the problem with this strategy. On any given day, nine out of the 10 stocks will move in the same direction. If the market goes way up, most stocks will go up with it. If it goes way down, most stocks will go down with it. If the market goes down over many years, your stocks will likely also go down, no matter how diversified your portfolio. The best way to buy individual stocks is to buy companies with good products, good management, a strong position in their particular industry and, most important, strong earnings potential over the long run.

The argument that you must diversify sounds logical, but in reality it is a marketing tool that makes brokerages seem wise and experienced.

Let Us Plan Your Financial Future

Brokerage ads give you the impression that a Wall Street professional can plan out your financial future and make your dreams come true. They show brokers planning a portfolio so a man and his wife can be wealthy enough to volunteer his services to a poor country.

This sounds terrific, but its rubbish. Your broker will send you a ring-binder full of colorful charts and graphs that show you how your money will grow if you diversify and follow the buy-and-hold strategy. Do you want a vacation home, a small business or even your own island? Turn to page 39 and see how it’s done.

Here’s the truth: Your retirement dreams will come true only if the market goes up over the long term. Your stock account, no matter how well diversified or how long you hold it, will go up only if the market goes up. And there is simply no guarantee that the market will go up over the long term. The TV ads and fancy charts are little more than marketing tools to justify high commissions. Brokerages must make you think they can turn your life around with a little planning.

Buy-And-Hold

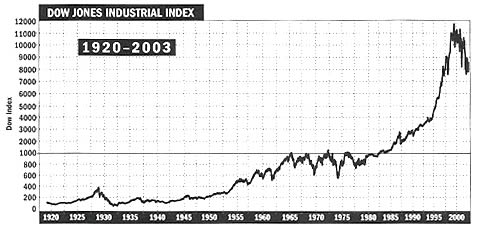

The chart below is the most widely used marketing tool on Wall Street. It shows the remarkable, spectacular rise of the DOW over the last 83 years. It is truly remarkable, a visual representation of the stunning success of the U.S. stock market. The line appears to go steadily up. Your broker will use this chart as proof that the buy-and-hold theory is superior to all other strategies. And looking at the chart, it would be hard to argue with this assertion.

But take a closer look at the chart. It shows the DOW’s progress over more than 80 years. Now take an even closer look. There is no doubt that the DOW has gone from a low of about 200 to more than 11,000 at its peak. But there were periods in-between, sometimes decades or more, when the DOW lost ground or stayed relatively the same. Suppose you entered the market during one of these periods? What would happen to your investments if you bought during one of these periods? The answer is that you would be sitting on dead money.

The buy-and-hold theory is only half true. It works only if you are lucky enough to buy at a market low and wise enough to ignore your broker’s admonition to hold forever and sell at a high point. It’s really the luck of the draw. Our success depends on when you were born, when you accumulated enough money to invest in stocks, and how the market unfolds during your investing years. Small investors usually begin putting substantial amounts of money into stocks at about age 30 to 35. This is after they have attended college, started a career and a family and put money aside to invest.

Recent Comments