Tis is a busy week. NVDA earnings tomorrow could be the tipping point for the market, or fuel it to the next record. The economy is showing more signs of pain and Wall Street is on a hair trigger, ready to scramble. When we have been in a steady trend for so long it is easy to forget the tools we can use to navigate a choppy and erratic market.

Tech has been the tip of the spear for this long run and it is still a driving force. As we look to see what to do next, let’s take a look at how tech is doing.

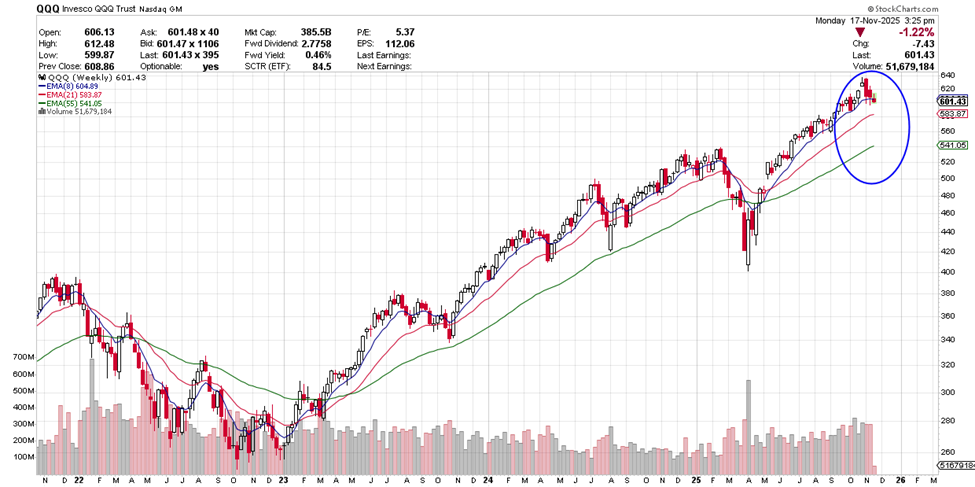

Here is a chart of QQQ, the tech ETF, and I am specifically looking at the EMAs. The EMAs on the chart below are represented by the colored lines:

In this example, you see that the EMA’s are in the correct order however there is the slightest curl down and red candles. This may indicate a change in direction. During times like this it’s okay to wait for a more solid indication of direction. We will wait until next week to see which direction QQQ goes.

Not suffering a big loss can be just as good as scoring a win. By waiting for more info on this chart our money is safe and we are ready for a more certain set up that can be our next pay out.

I try hard to share what I have learned so you can reap the benefits I have been blessed with and avoid the mistakes I have had to learn from.

I wish you the very best.

Wendy

Recent Comments