Let’s start the week out by looking at trade examples in the SPY. We’ll take a look at what is going on this morning, a great indicator that is effective in this situation, and why the SPY is an excellent choice for trading options. At the bottom of this email, I even include an update on a previous example.

SPY, or the SPDR S&P 500 trust was one of the first exchange traded funds and is also one of the most traded ETFs. That volume makes it ideal for great trades. SPY tracks the S&P and makes it possible for individual traders to trade moves in the entire index.

Look at what the S&P did on Friday to help us get an idea of what to expect from the SPY this week. The image below is Friday’s price activity.

This chart image is courtesy of FINVIZ.com a free website and gives a quick view of each day’s movement. Understanding the direction, the S&P was moving on the previous trading day is a great place to start.

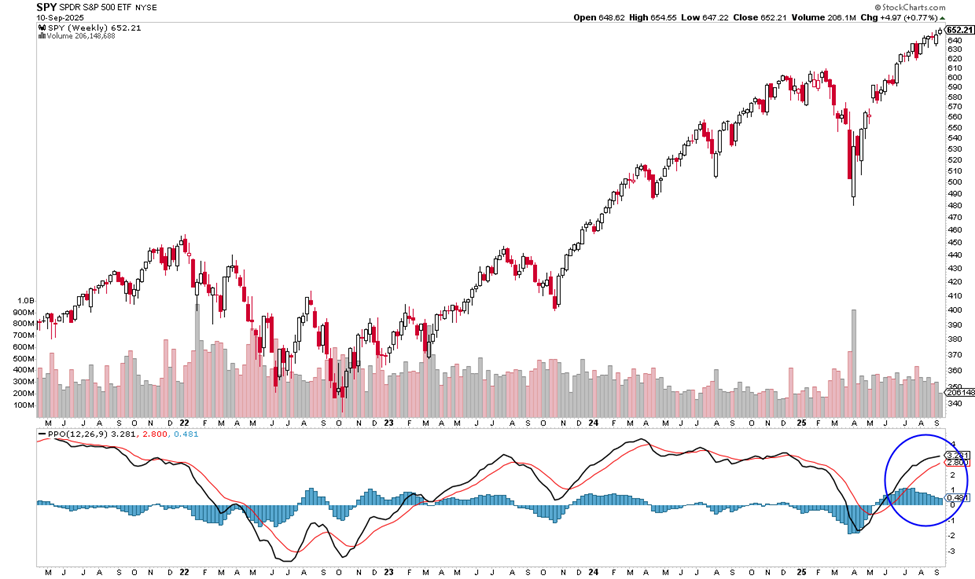

Next, let’s look at chart that includes the Percentage Price Oscillator or PPO indicator. We are specifically looking at the lines in the PPO to cross but you can get more information about this indicator here.

The PPO is exhibiting a slight downward curl, which may signal emerging bearish momentum. However, the indicator is currently lacking strong directional conviction and could continue to drift marginally in either direction. Given the indecisiveness, it would be prudent to wait for further confirmation before initiating a trade. For the purpose of this analysis, we’ll look at a potential put option setup.

Potential SPY trade:

In this example, if the price continues to FALL you could consider a PUT trade if it goes BELOW $652. The short-term target is $645.

Here’s Why an Option Offers A Big Potential Payout

The stock price in this example is $652.21.

If you were trading options and selected a PUT option strike, you would pay a premium of around $7.34 for the Oct 17th 645 expiration. This is an investment of $734 for the 100-share option contract. If the stock price moves to 645 the premium is apt to go up about $3.50. Your premium of $734 plus $350= $1084. That is a profit of 48% over a short period of time.

Remember, you can take profit anywhere along the line, you don’t have to wait for the expiration date to sell. It is often wise to take profit when it is earned, especially in a volatile market.

Stay positive and know you can do this. Knowing creates positive results! A part of the abundance process is letting go of anything negative, which creates space to receive.

I wish you the very best,

Wendy

Previous Trades:

Last week we discussed buying SPY puts. It did not reach our target entry price.

Recent Comments